Pharmacy Blog

Understanding Trust Reporting Rules for Pharmacists

Pharmacy owners and pharmacists who have or are impacted by trusts should be aware of new trust reporting rules that have become effective as of December 30th, 2023. These changes introduce added responsibilities for trusts and filing T3 Trust Income Tax and...

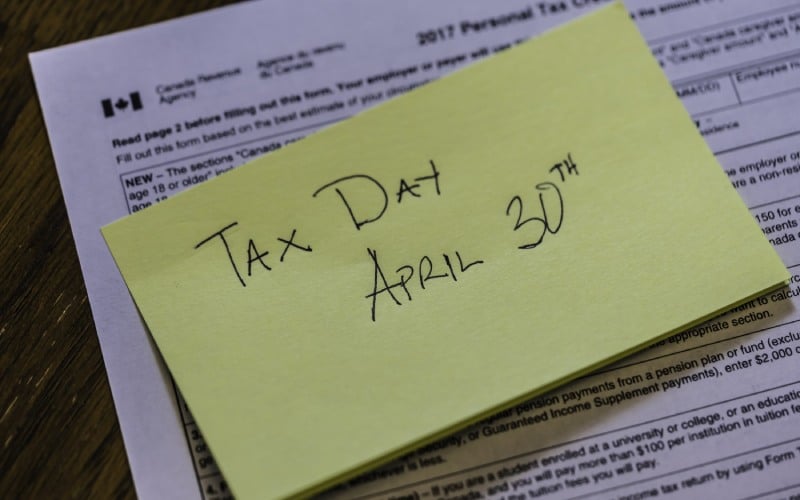

Navigating Tax Season: A Guide for Pharmacists

Tax time is stressful - especially for pharmacy owners who are juggling both personal and business taxes, or self-employed pharmacists who have a complex relationship between the personal and business-related elements in their taxes. However, understanding the...

A Comprehensive Guide to the New CPP Rules

As of 2024, a new second tier of earnings ceiling has been added for the CPP program. If your earnings fall within this tier, meaning that you are making more than the set threshold amount, your CPP deductions will be higher, as additional payroll deductions will...

Follow us on Social Media

Do you want to start saving thousands in tax every year?

Do you want to start saving thousands in tax every year?