Are you about to buy a house or renew your mortgage?

Think twice about selecting ‘yes’ on your bank’s mortgage application to buy their mortgage insurance.

For most people, when the bank representative proposes adding mortgage insurance, it’s a five second decision – at the very end of a long mortgage process.

“Pays off my mortgage in the event of death, disability, or critical illness? And all I have to do is answer a few quick questions?” – seems like a no brainer, right?

But here’s what no one thinks about: “the bank asked me literally everything possible just trying to get a mortgage, why don’t they do the same about my health for their mortgage insurance?”

After all, they’re on the hook for hundreds of thousands of dollars if you die.

The banks make this process way too easy and in this article, you’ll understand why.

Here are 8 reasons why you should never buy mortgage life insurance at your bank.

Coverage Usually Is Not Sufficient

Each bank sets a limit as to how much insurance coverage they will provide.

- TD Bank covers up to $500,000

- National Bank covers up to $500,000

- BMO covers up to $600,000

- Scotia Bank covers up to $750,000

- RBC covers up to $750,000

- CIBC covers up to $750,000

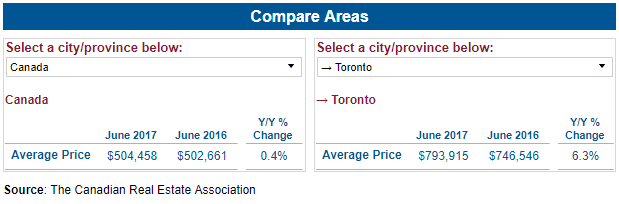

Given housing prices in Canada, you might not be fully covered.

This is especially true if you live in big metropolitan areas like Toronto, Montreal, or Vancouver where the average price is typically greater than $750,000.

Don’t waste your time getting partial coverage. You deserve to be fully covered.

It is a Group Policy, You Don’t Own It

That’s right – the bank owns the insurance policy, not you.

Which means that the bank can change the terms or cancel your coverage at any time.

You buy insurance for peace of mind that your family will be protected in case something happens to you, wouldn’t you agree?

Don’t leave yourself exposed to the bank cancelling your coverage or changing the terms.

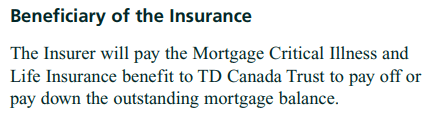

The Beneficiary is the Bank, Not Your Family

With bank mortgage insurance, the bank is the beneficiary and there is nothing you can do about that.

You bought mortgage insurance to protect your family, not the bank.

Not only do you want to cover the mortgage at death, you also want to leave something extra to cover funeral expenses and income replacement for your family.

You can’t do that with bank mortgage insurance.

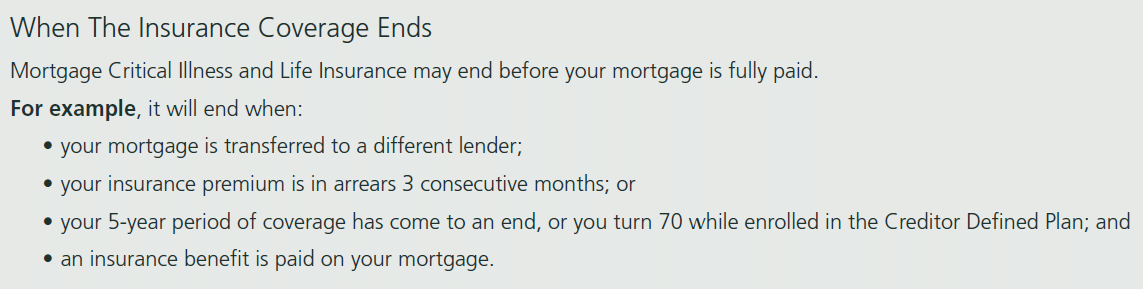

Rates Go Up at Renewal and You Cannot Transfer

Banks love to tie mortgage insurance into your mortgage agreement.

Why does that matter?

Because when it’s time to renew your mortgage (every 5 years typically), you’ll need to renew the mortgage insurance policy as well.

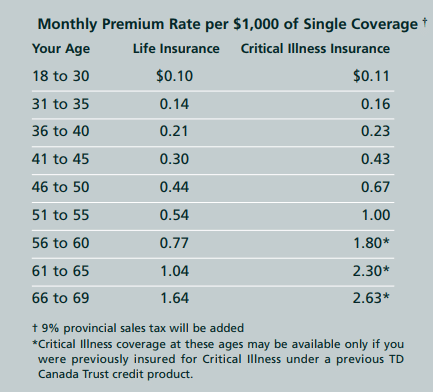

Your new premium will be based on your outstanding mortgage balance, which is smaller than before, but doesn’t mean you’ll be paying less. Because you’re older, your premium will likely go up.

And if you take your mortgage to another company, you can’t transfer the policy. You will lose your existing mortgage insurance and have to re-qualify for new coverage.

So while rates for bank mortgage insurance are cheaper when you’re young, they get extremely expensive as you get older.

Everyone Pays the Same Rates

Because bank mortgage life insurance is a group policy, everyone pays the same rate.

It doesn’t matter if you’re doing everything you can to be healthy, you’ll be paying the same rate as a smoker.

Definitely not the best deal in town – if you are healthy, you should be paying cheaper rates.

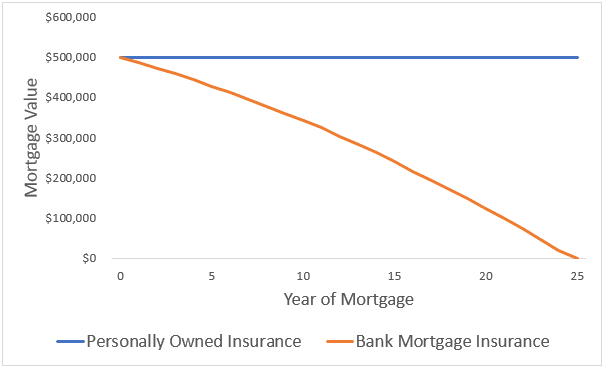

The Coverage Declines Over Time

You started with a mortgage of $500,000, so you pay premiums based on this $500,000 amount.

Makes sense.

However, if you die and your mortgage balance is $400,000, the bank will only pay $400,000 even though you have been paying premiums for $500,000 of coverage.

The bank’s mortgage life insurance benefit value declines as you pay down your mortgage. So, the banks will only pay whatever is left owing on the mortgage even though you are paying premiums for a higher benefit amount.

Doesn’t sound fair, right?

The Banks Don’t Want to Pay For a Medical

Typically, an insurance company requests for you to get a medical (blood and urine test) done and does its homework by contacting your doctor to assess your health.

This whole process is called underwriting and is done to decide whether you qualify for coverage.

Here is the problem with bank mortgage insurance – banks don’t want to pay for medicals and instead shift the responsibility onto you to determine if you are eligible to begin with.

How do you know if you are eligible?

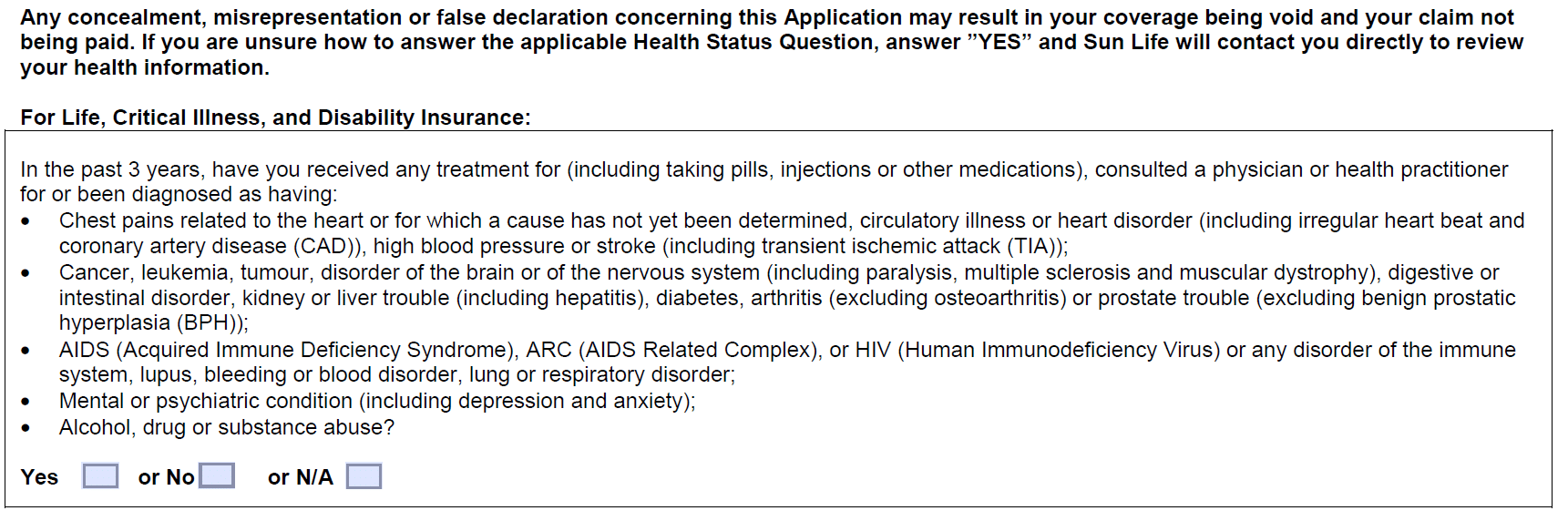

The application form bundles about 30 questions into one single question and will only request a medical if you selected ‘yes’ to the question.

Look how long the question is! It’s too easy to misunderstand or misinterpret the question.

Most people check off ‘No’ as a result.

How are you supposed to answer past 3 years of medical history in only a few minutes?

Remember the time you saw your doctor because you had the flu and were vomiting? Or because of stomach pains or cramps? Or because of bronchitis?

Oops, forgot about that! You checked off ‘no’ but should have checked ‘yes.’

If you answer the question incorrectly, the banks see this as fraud and won’t pay at time of claim.

You would think the bank representative would help you out here, right? Try going to see one and going through the process yourself.

These reps aren’t trained to inquire about your health and if you ask a question, you’ll get “please consult with your doctor” responses and still be pressured to sign the application before you leave.

The banks train their staff for sales, not for understanding your health.

You Could Be Deemed Ineligible Years Later

It’s natural to think that once you submit the application, if the bank doesn’t say anything and you start paying premiums, that you qualify for the insurance and have nothing to worry about.

Think again.

Called “post-claim underwriting” – this is the biggest pitfall to bank mortgage life insurance.

Personal insurance policies get underwriting done in the beginning before issuing the insurance policy.

Banks do this at the end, after a claim is submitted.

Why is this bad?

The banks may very well find that something in your particular situation violate the insurance contract, which means they don’t pay.

Or, for the medical question on the application, you checked off ‘no’ but should have checked ‘yes’ – oops.

You can go years of paying premiums and if a claim is made, the bank can reject the claim and not pay because you weren’t eligible to begin with.

The whole point of the insurance is to feel safe knowing that your mortgage will be paid if you die or get sick.

So why bother paying the bank premiums if you aren’t even sure if they will pay?

Conclusion

Since bank mortgage insurance is a group policy that only assesses if you are eligible for coverage at time of claim (by that time it’s too late), many people are denied payment.

All this despite the fact they have been paying premiums for years and the bank never said anything.

Don’t let this happen to you and your family. It can potentially ruin your family financially.

An alternative is to get a personally owned insurance policy, for the following reasons:

- No coverage limit

- Cheaper premiums

- The beneficiary can be whoever you want

- Benefit value does not decline over time

- The terms cannot be changed or cancelled on you

- Doesn’t matter if you change banks at mortgage renewal

- Eligibility is assessed by insurance company (not you) before policy is issued

- Payout is guaranteed at time of claim (unless you intentionally lied about something)

Want to learn more? Schedule a free consultation and we’ll come see you.

Do you know someone with bank mortgage insurance and was denied payment?

Ricardo Ardiles

CIM | Partner

Ricardo is a founding partner of Pharma Tax and focuses on providing tax planning strategies to health care professionals. His goal is to provide simplicity and convenience to clients by coordinating all areas of personal wealth management so that his clients don’t have to. This means working with external professionals on: investments, insurance, business planning, retirement planning, and estate planning.

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020