- Cleanings at the dentist

- Vision (contacts or new glasses)

- Prescription drugs

- Massages

- Chiropractic sessions

- Physiotherapy

Dental Bill for Braces

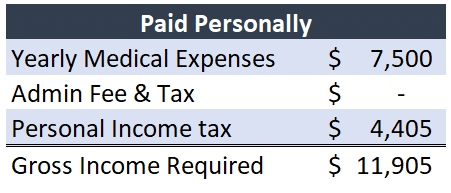

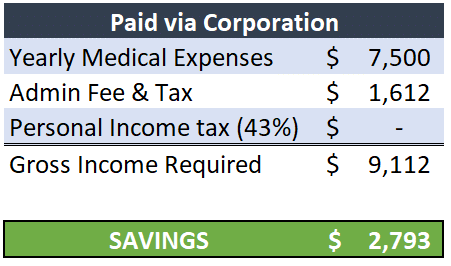

Our client Sandy had to pay for her daughter’s braces this year, which cost $7,500.

Sandy has group benefits through her husband’s work but the plan doesn’t cover orthodontics, so she’s stuck with 100% of the bill.

Typically, group benefits will only cover $1,000 to $1,500 for major dental anyway, not nearly enough.

Sandy makes about $120,000 per year, so she’s in the 43% tax bracket.

Had she paid for this dental bill with personal dollars, the real cost after income tax and tax credits would have been about $11,905.

Routine Medical Bills

While braces don’t happen every year, common things like dental cleanings, vision expenses, prescription drugs, massages, and chiropractic sessions do happen every year. Here’s what we commonly see:

- Dental cleanings at $150 each visit, 2x per year, husband and wife = $600 per year

- Massages, physio, and/or chiropractor = $500 per year

- Total = $1,100 per year

If that’s you, then you can be saving about $372 every single year by using a Health Spending Account instead of paying for medical expenses personally.

Do you have kids? Then you’re likely spending about $2,000 to $3,000 per year or more in medical.

Do you like to take care of yourself? Then you’re likely spending on a massage every month, cosmetic services, naturopath, etc.

Here are a few more illustrations of potential savings by using an HSA:

- $2,000 medical bills every year = $745 in savings every year

- $3,000 medical bills every year = $1,117 in savings every year

- $4,000 medical bills every year = $1,489 in savings every year

Are you getting lasik done this year? That’s around a $5,000 bill and with a HSA you can save about $1,862.

So as you can see, the savings start to add up.

Multiply those savings over the next 5, 10, 20 years and we’re talking tens of thousands in saved money.

What is a Health Spending Account?

It’s just a fancy term for a health insurance plan for your corporation.

However, it’s drastically different from a group benefit plan.

With group benefits, you pay a fixed monthly premium and whether or not you use the benefits is up to you.

With the right HSA, other than an initial setup fee of about $300, you only pay when you use it.

So if you don’t have any medical expenses in one year, then you don’t pay anything.

For an owner like yourself, cash flow flexibility like that is priceless.

What are the limits?

By CRA guidelines, your limit for an HSA is up to a maximum of 20% of your total annual compensation.

So if you make $120,000 pear year, your HSA limit can be set to no higher than $24,000 per year, which is more than plenty for most people.

Most of our clients typically set their limit to $10,000 per year.

You can increase or decrease your limit at anytime without having to show any proof of income.

And if you don’t use all of your limit in one year, you can roll that forward 1 year.

You don’t get that flexibility with group benefit plans!

Are there restrictions on practitioners?

No, there is no practitioner limit with an HSA.

This is the biggest difference between a group benefit plan and a HSA.

With group benefits, typically you’re capped at $300 or $500 per year for massage, chiropractor, physio etc.

With a HSA, there is no practitioner limit, meaning if you want to spend $10,000 on massages, go right ahead!

As long as it’s from a licensed practitioner, you’re good to go.

For massages, that means RMT or NHPC.

And for vision, no need to worry about glasses every 2 years like what most group benefit plans offer.

If a pair breaks or you lose one, you can claim through the HSA and not have to worry about time limits.

Where a HSA really comes in handy is when you have big ticket items such as:

- Lasik ($5,000 on average)

- Braces ($5,000 to $8,000 on average)

- Periodontal work ($5,000 to $10,000 on average)

- Dental implants ($3,000 to $10,000 on average)

An HSA will cover all of these expenses for you no problem whereas most group benefit plans cap the coverage to $1,500 or don’t offer coverage at all.

There are also travel emergency & medical packages that you can add-on to the plan as well that will cover you for medical expenses while out of the country.

Who is covered?

If you setup a HSA, who is covered?

- Yourself

- Your spouse (common law or married)

- Dependents under age 21 or under age 25 if enrolled in post-secondary education

How about your employees?

CRA rules state that if you have full-time employees, you should offer them coverage as well.

It isn’t mandatory to offer coverage to part-time or relief pharmacists on contract but you can if you want to.

Typically, most of my clients set coverage for employees at 3% to 5% of what each employee makes.

Or a flat dollar limit such as $500 per year for singles, $1,000 per year for family.

It’s a great way to retain employees and show them you care!

Group Benefits or Health Spending Account?

If you’re a relief pharmacist, go with a health spending account; if you have group benefits, you’re likely paying more premiums than you’re actually using in benefits, so a health spending account is more advantageous to you.

If you’re a pharmacy owner and have less than 5 full-time staff (including you), then a Health Spending account will likely be a better option for you. For the same reasons above.

If you have 5 or more full-time staff, then we need to crunch some numbers and see how much your employees are claiming.

For lots of claims, it might make more sense to have a group benefit plans AND a health spending account to complement and provide coverage for claims that the group benefit plan doesn’t cover (like orthodontics for example).

We can help you make that analysis.

Conclusion

A Health Spending Account is a great way for you to save money every year on routine medical expenses.

A HSA can complement your existing group benefit plan or can replace it all together.

The flexibility of a HSA gives peace of mind to my clients knowing that they have coverage if they need it but aren’t stuck having to pay a fixed monthly premium every month, which really helps cash flow.

A HSA covers yourself and your entire family but it can also extend to your staff.

By extending coverage to your full-time employees, it is a great way to retain key members of your team and show them how much you care about them.

Not all HSAs are created equal but we’ve already done our research to see which ones are the best ones out there for pharmacists.

If you’d like to learn more about a Health Spending Account or to set one up for your pharmacy, complete our contact form here and I’ll get in touch with you or schedule a time to talk with me here.

All the best!

Ricardo Ardiles

Follow Pharma Tax on Social Media

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020