"Should I setup a corporation? What are the benefits?"

These are questions I get every week from relief/locum pharmacists.

I also get these questions from staff pharmacists who are on payroll simply because they don't know how to invoice pharmacies.

If you're working at more than one pharmacy, you could be saving thousands in taxes this year and every year going forward.

But there are also additional legal, accounting, and administration costs of setting up and maintaining a corporation that you should know about.

So a cost/benefit analysis tailored to your situation should always be done when considering if a corporation is right for you.

Here are 5 questions to ask yourself in assessing whether or not incorporation is right for you.

More...

What is the difference between Sole Proprietor vs Corporation?

There are two main ways that relief pharmacists will operate:

- Sole proprietor

- Corporation

Regardless of the structure you select, you are now considered "self employed" in the eyes of the CRA.

Your business is offering relief services to pharmacies in exchange for compensation.

Sole Proprietorship

This is the simplest and most common business structure that reliefs start with.

One person (you) owns the business and you are solely responsible for all the decisions, profits, debts, and obligations of your business.

Advantages

- Ability to make all decisions

- Entitled to all profits

- Simple to establish and cost effective

- Business losses & expenses reduce personal income tax

Disadvantages

- All the income is taxable at your marginal tax rate (typically 43% for most pharmacists)

- Personally responsible for all debts - unlimited liability

- Limited ability to raise third party capital

- Need to be a generalist; no partners with unique skills

- Attracting high caliber employees may be difficult

Corporation

Unlike sole proprietorship, the law considers a corporation as a separate entity from its owners, who are the shareholders.

To setup a corporation, there are initial setup costs:

- Incorporation by a Lawyer (typically $2,500+HST)

- Government of Ontario fee ($300+HST)

- Registration with the Ontario college of pharmacists ($1,250+HST)

And every year, there are annual costs to maintain:

- Ontario college of pharmacists renewal ($375+HST)

- Accounting (typically $2,000+HST)

- Legal fees (typically $250+HST)

However, most provinces allow you to operate under a provincial corporation instead of a pharmacy corporation, saving you the annual College registration fees.

For example, the Ontario College of Pharmacists does not require reliefs who operate under an Ontario Corporation to register, saving you the initial $1,250 fee and the $375 fee going forward.

Advantages

- Lower tax rate (typically 12.5%-15% depending on province)

- You can defer income to future years, saving you taxes

- Limited liability

- Easier to raise capital

- Possible tax savings at death

Disadvantages

- Extra costs to start and maintain

- If multiple shareholders, possible conflicts can restrict decision making

- Directors may be held responsible for corporate activities

- Personal guarantees (if any) can undermine limited liability

So, When (if ever) Should I Incorporate?

There are the five factors to consider whether to incorporate and continue practicing under a corporation.

The answer depends on your personal situation, there is no cookie cutter solution for everyone:

- How many pharmacies do you work at?

- Do you need all the income that you earn?

- Do you have adult family members in a lower tax bracket?

- Do you not have group medical benefits?

- Do you want to start investing?

1. How Many Pharmacies Do You Work At?

Typically, reliefs work at more than one pharmacy.

But if you work at only one pharmacy, you could be subject to "Personal Services Business" (PSB) rules.

These rules suggest that the CRA could deem you an employee of the pharmacy instead of a relief contractor.

So, even if you incorporate, the tax benefits available to corporations would not be available to you.

As long as you work at more than one pharmacy, you will resemble the client-contractor situation and not employer-employee situation that the CRA is looking for.

SUMMARY

Are you providing relief services at more than one pharmacy?

- If yes, incorporation may be right for you

- If no, remain as a staff pharmacist on payroll

2. Do You Need all the Income You Earn?

If you need all the income that you earn to pay for your regular living expenses, then incorporation is NOT right for you.

Simply because the added costs of a setting up and maintaining a corporation will outweigh any benefit you receive.

But if you don't need every dime to live, a corporation can save you a significant amount of taxes every year.

Update: Ontario changed the small business tax rate starting January 1, 2019 to 12.5%. Read more...

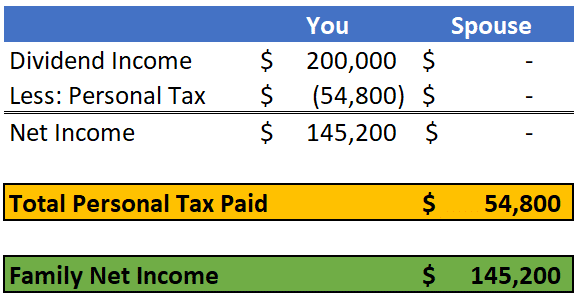

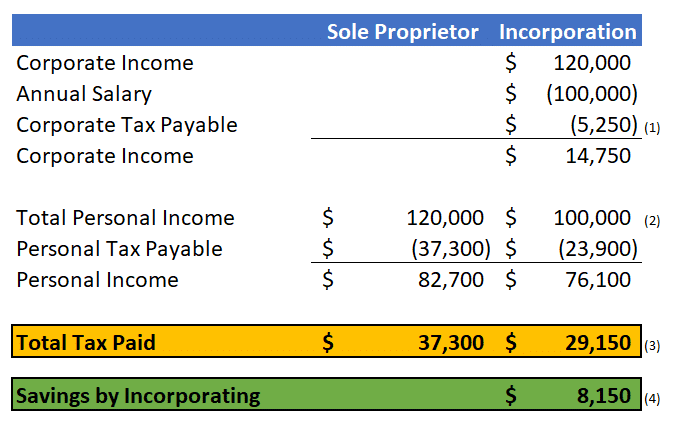

Example

Holly is a relief pharmacist in Ontario.

In 2019, she will earn $120,000 of income from working at 3 pharmacies.

Holly only needs about $100,000 per year to live.

Should she incorporate?

1) Total Federal & Ontario small business rate = 12.5% on net business income + Employer CPP = $2,750 | 3) Corporate Tax Payable + Personal Tax Payable |

2) Pay yourself an annual salary of $100,000 | 4) Difference in total tax paid under each scenario |

What's the outcome?

A corporation is better for Holly vs operating as a sole proprietor.

Holly is better off by $8,150 this year and every year going forward because of the lower tax rate of corporations.

Would you rather pay 12.5% corporate tax rate or personal marginal tax rate of 43%?

But why would someone leave money inside their corporation?

This leftover can be used for many options, including but not limited to:

- Saving to purchase or start your own pharmacy

- Funding your medical expenses

- Splitting income with family

- Starting to invest your money

- As a safety cushion in case of a bad year

SUMMARY

Ask yourself, do I need every penny that I make to fund my life?

- If yes, incorporation is not right for you

- If no, incorporation may help you pay less tax

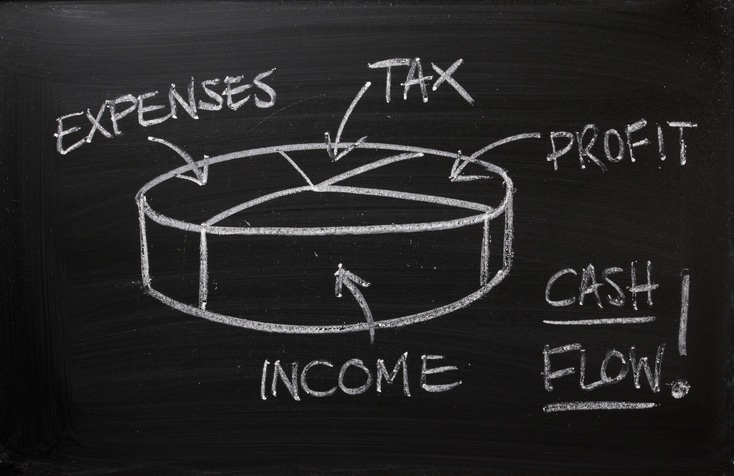

3. Do You Have Adult Family Members in a Lower Tax Bracket?

Sole proprietorship and corporations both allow you to pay a reasonable amount of income to family members who work for you.

If your spouse, common-law partner, or adult children are in a lower tax bracket than you, splitting income can help you save on taxes.

Example

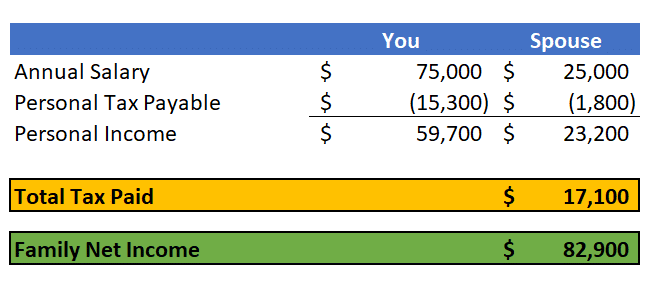

Continuing from the prior example.

Holly needs $100,000 per year to live.

However, her spouse helps throughout the year as an assistant and doesn't work anywhere else.

Can she split income?

Option 1: Holly pays herself the full $100,000.

Option 2: Holly would like to utilize her spouse, who is in a lower tax bracket than she is. Will Holly be better off by splitting a reasonable income?

The result?

Income splitting does help Holly pay less tax overall as a family.

Holly and her spouse are better off by $6,800 this year and every year going forward.

The split income does need to reasonable and justified for the level of responsibilities done.

SUMMARY

Do you have an adult family member who is in a lower tax bracket than you are?

If yes, you may benefit from splitting income.

4. Do You Not Have Group Medical Benefits?

Relief pharmacists don't get group benefit coverage at the pharmacies they work at because they aren't employees.

So any medical expense comes directly out of your own pocket.

You receive a medical expense tax credit if your medical expenses are more than 3% of your annual income.

Good but not great...

With a corporation, you can expense 100% of your medical expenses and pay less tax.

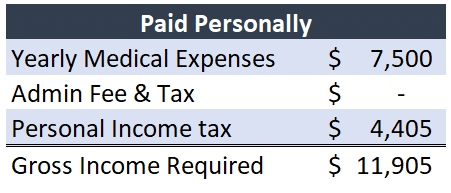

Example

Holly visits her dentist every year and likes going for massages every once and a while.

She also needs braces for her daughter this year.

Should Holly pay for these expenses personally or through her relief corporation?

If Holly pays for these expenses personally, how much income does she have to earn to pay for everything?

Assumes 43% marginal tax rate and medical expense tax credit included

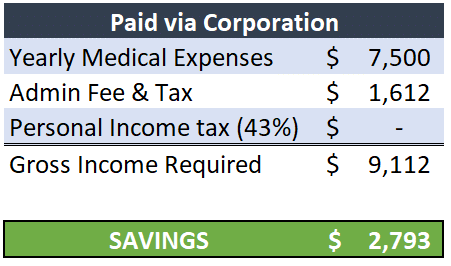

By setting up her own Health Spending Account in her corporation, her corporation can pay 100% of these expenses.

Admin fee & tax of Health Spending Account

So it is cheaper to fund Holly's medical expenses though her corporation instead of paying for them personally.

Holly is better off by $2,793, money she can use for more massages if she wants to.

Even if your spouse has group benefits, you can still use a Health Spending Account to pay for whatever doesn't get covered.

Group benefit plan limits are often very low, so even if you have benefits, you probably still pay out of pocket for some things.

Especially for big ticket items like braces, lasik, etc.

SUMMARY

Do you have group benefit plan coverage?

If not, a corporation can fund 100% of your medical expenses through a Health Spending Account and save you money.

5. Do You Want To Invest?

There are certain tax planning and investment strategies available only to those who have a corporation.

While the strategies are outside the scope of this article, you can potentially save thousands in taxes by investing using your corporation vs investing personally.

How to Save $1 Million Dollars in 10 Years Using by Creating Your Own Individual Pension Plan. Read more

Conclusion

At some point in your career as a relief, you will ask yourself: should I incorporate?

The answer depends on these two questions first:

Am I providing relief services at more than one pharmacy?

Can I afford to save money or do I need every dime to live?

If the answer is yes to both questions, you may have a solid case for incorporation.

While a corporation provides many benefits, it does have extra costs so a cost/benefit analysis needs to be done, tailored to your situation.

That's something we can do for you so that you make a decision that's in your best interest.

To see if this strategy is right for you, schedule your free strategy session here.

Ricardo Ardiles

Co-Founder of Pharma Tax

Ricardo helps pharmacists like you pay less tax, start/grow a pharmacy, and take your wealth to the next level.

Prior to starting Pharma Tax, Ricardo worked at another accounting & wealth management firm focused on dentists. Pharmacists were coming on as referrals and all said the same thing: what you guys are doing for dentists, we need that specialist for pharmacy.

Hence, Pharma Tax was born.

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020