John Smith [real name changed], is 48 years old and is a staff pharmacist who has worked at a banner store for the last 10 years.

His wife, Kelly, also 48, stays at home taking care of their two young children, Lindsey, 13, and Lucas, 10.

John is wondering if there are any tax planning strategies involving Kelly that can help him pay less tax and free up some cash flow.

Here is one way to help John and Kelly – a spousal RRSP.

Challenges

- John’s salary is $125,000 and contributes regularly to his RRSP

- Kelly does not earn an income and has no RRSP

- Primary goals: to manage their cash flow, pay down debt, and save

Recommendations

- Setup a spousal RRSP with Kelly as the owner and John as the contributor

- John maximizes his RRSP contribution: 18% of his salary, or $22,500 per year

- Use the tax refund to pay off mortgage and/or personal debt

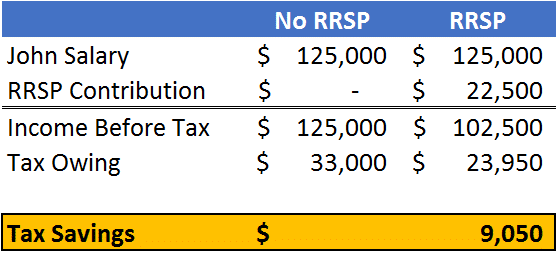

If John elected not to contribute to an RRSP, he would owe approximately $33,000 per year in tax and still has to worry about how to manage the leftover cash flow and how much to save.

By maximizing his RRSP contribution, John lowers his tax bill by approximately $9,000 and meets his goals: he is able to save, pay less tax, and use the leftover cash flow for lifestyle purposes.

Results:

- Save $22,500 per year towards retirement at age 65

- Remaining income used to fund lifestyle as they wish

- Annual tax refund of approximately $9,000, used to pay down debt faster

By age 65, John and Kelly will have saved over $382,000 inside the Spousal RRSP (excluding market growth) and paid an additional $153,000 in mortgage payments and/or personal debt – money that would have otherwise gone towards tax.

Why a Spousal RRSP?

Spousal RRSPs are one of the ways that married and common law partners can split income.

Withdrawals from the spousal RRSP are taxed in Kelly’s name, who benefits from a lower tax bracket.

With proper tax planning, you can equalize John and Kelly’s income in retirement to lower the overall family tax bill.

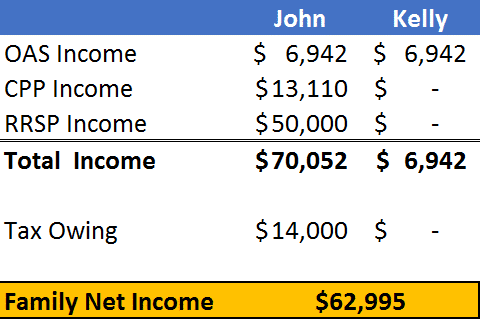

Scenario 1: No spousal RRSP setup, majority of retirement income taxed in John’s name

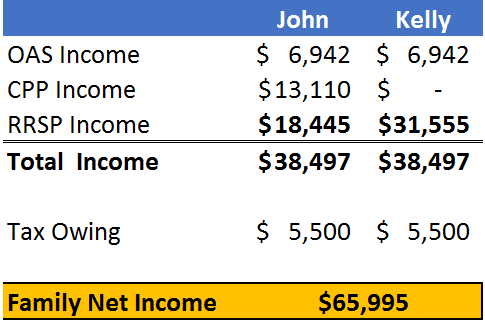

Scenario 2: Spousal RRSP setup, retirement income is equalized between John and Kelly

In retirement, the Spousal RRSP allows John to take advantage of Kelly’s lower tax bracket by being able to split retirement income. As a result, they pay $3,000 less in tax each year.

Conclusion

- Spousal RRSP can be used to split income between spouses

- At retirement, income will be equalized resulting in less tax paid overall

To learn more about income splitting and other tax planning strategies for Pharmacists, contact us for a free consultation. If you are not ready for a consultation, please join our newsletter to receive tax planning tips for Pharmacists just like this.

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020

Nice site guys

Congrats

Keep up the great work