If you’re a pharmacy owner and over 40, you should stop contributing to RRSPs.

There are far better and faster ways to save for retirement than an RRSP.

Do you want to pay less tax every year?

Do you want up to 65% more of a retirement nest egg compared to a personal RRSP?

Do you like the idea of your corporation funding 100% of your retirement?

Do you want a creditor proof solution?

Do you not want to worry about whether the amount of your retirement savings will be enough to last the rest of your life?

Welcome to the Individual Pension Plan (IPP).

Here are 8 reasons why, if you’re a pharmacy owner, you should consider not contributing to an RRSP anymore but, instead, to your own pension plan.

Retire in Your 50’s Without Having to Sell Your Pharmacy

We talk to pharmacy owners everyday and we hear this a lot:

“I don’t think I’ll ever stop working but I definitely want to cut back at some point in my 50’s to work 2-3 days at most. I don’t want to sell my pharmacy yet either”

Let’s get you to this level!

Problem is: if you’re like most pharmacy owners, most of your wealth is tied up in your pharmacy and little savings elsewhere.

So if you aren’t going to sell, with what money will you fund your retirement?

Here’s one solution: Individual Pension Plan (IPP), which can help you save $1M+ in 10 years or less.

You can save FASTER and MORE compared to an RRSP.

An IPP is a defined benefit pension plan, much like what government employees have.

With defined benefit pension plans, the goal is to provide you a specific amount of retirement income that is payable for life.

For example: John Smith

- John is 42, owns 1 pharmacy

- Pays himself $148,000 per year

- Wants to cut down to 2-3 days per week but doesn’t know when, at some point in his 50’s

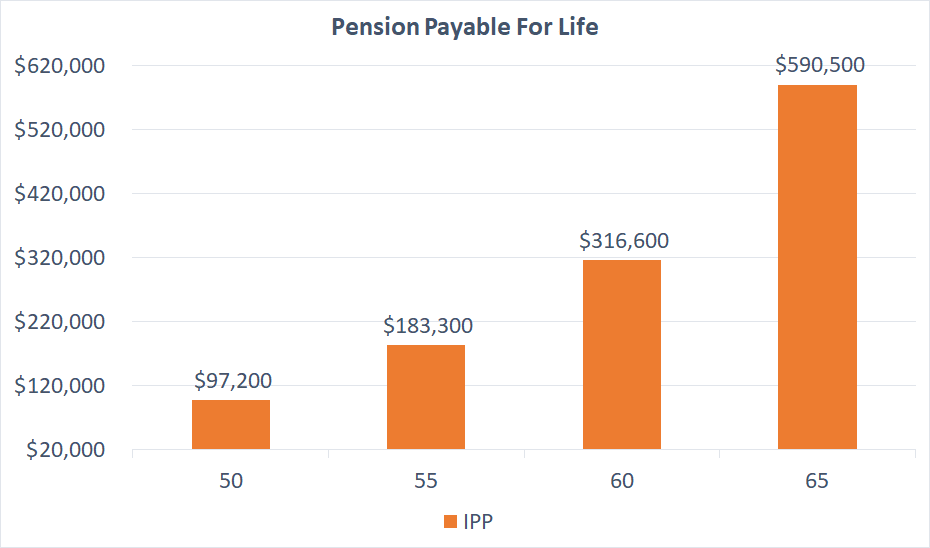

Here is how much pension income he can get for life at different retirement ages.

If John semi-retires at age 50, he can receive $97,200 payable for life; at age 55, he can receive $183,300 payable for life, and so on.

The 2-3 days he works at the pharmacy will add another $40,000-$60,000 per year, so replacing his current income of $148,000 per year won’t be an issue in retirement.

The longer you wait, the higher your annual pension income becomes.

Save up to 65% more vs an RRSP

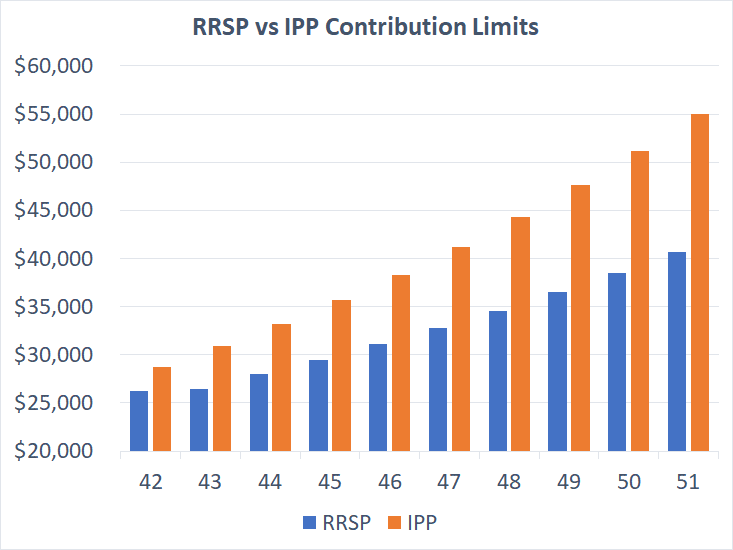

Why can you save up to 65% more vs an RRSP?

With defined benefit pension plans, the goal is to provide you a specific amount of retirement income that is payable for life.

For example: retire at age 55 with $183,000 in annual retirement income

The closer you are to retirement, the less time you have to reach this goal, so contribution limits increase so that you can reach your goal on time.

With RRSPs, you aren’t guaranteed any amount of retirement income.

RRSP contribution limits are capped to the lesser of:

- 18% of your annual earned income

- RRSP limit for the year ($26,230 for 2018; $26,500 for 2019)

The amount of retirement income will depend on the level of contributions and rate of return on these contributions.

Whether or not the RRSP income will last for a lifetime is uncertain.

So the key difference here is: IPP is customized to you and based on your goals; RRSP is a cookie cutter approach with no goal set.

As a result, you can save up to 65% more inside an IPP compared to a personal RRSP.

Large differences in contribution rooms start at around age 40 and the difference increases as you get closer to retirement.

If you’re under 40, continue with RRSPs for now then you can flip over to an IPP at anytime once you hit 40.

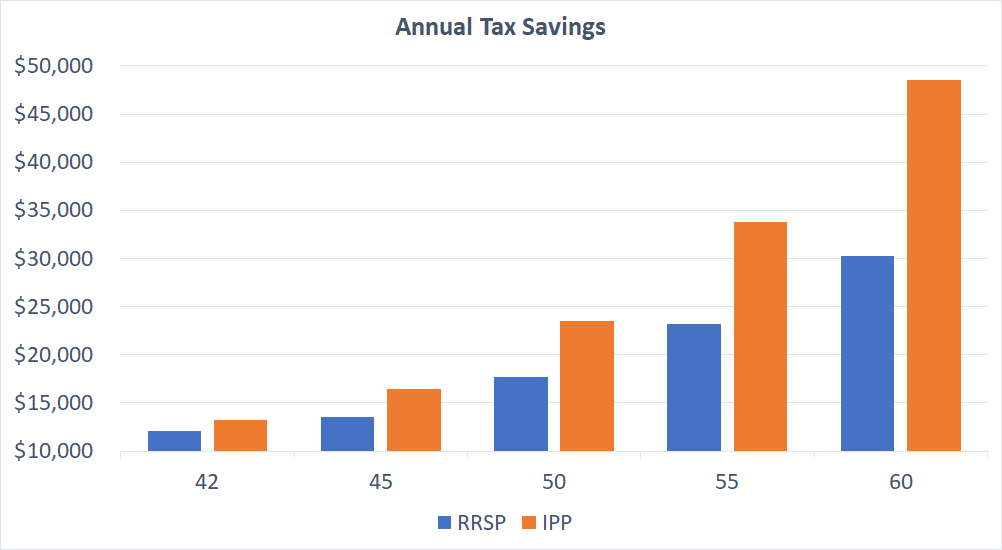

Save thousands more in tax

IPPs work in the same way as RRSPs in that they are a tax deferral.

You don’t pay tax on your contributions, you get to defer tax until you start withdrawing in retirement.

Over the years, your contributions grow tax sheltered and the compounding really makes a big difference.

Especially for most pharmacists, who are in the 43% to 46% tax bracket.

With higher IPP contribution limits, you can save even more tax vs an RRSP.

Contributions are funded via your corporation

IPP contributions are funded directly from your corporation and each contribution is a tax deduction.

With RRSPs, you have to contribute with after-tax income, which is terrible.

Let’s say you want to contribute $10,000 in your RRSP.

That means you have to pay yourself approximately $18,518 first and, after 46% tax, you’re left with $10,000 to contribute to the RRSP.

With an IPP, $10,000 goes directly from your corporation into the IPP, helping free up cash flow for other things.

IPPs are customized to you

IPPs are fully customized and flexible.

With defined benefit pension plans, the goal is to provide you a very specific amount of retirement income that is payable for life.

For example: retire at age 55 with $183,000 in annual retirement income.

This amount is calculated via actuaries based on how long you have worked, how much you pay yourself, and time left until retirement.

RRSPs are setup with a cookie cutter approach: everyone in Canada has the same contribution rules.

What if you can’t contribute one year because you don’t have the money?

No problem, contributions are not mandatory in any year.

Contribution room carries forward just like RRSPs.

What are you waiting for?

Schedule a free strategy session to see if this strategy is right for you.

Transfer money tax-free to family

If you pass away, the money inside your pension plan can be transferred to your spouse tax-free just like an RRSP.

However, an IPP has an added benefit.

Let’s say you have family who works in your pharmacy, you can add these family members to your IPP.

If children are members of your IPP and both you and your spouse pass away, the money inside the pension plan can transfer tax free to your children.

With RRSPs, proceeds to children are not tax free.

Let’s say your RRSP is worth $1,000,000 at death, that will be subject to approximately 53% tax (in Ontario) before passing on to your children.

That means approximately $530,000 in tax and your children will split the remaining $470,000.

That’s a large chunk of change that is wasted in tax instead of passing to your children tax free.

Don’t stress about money running out

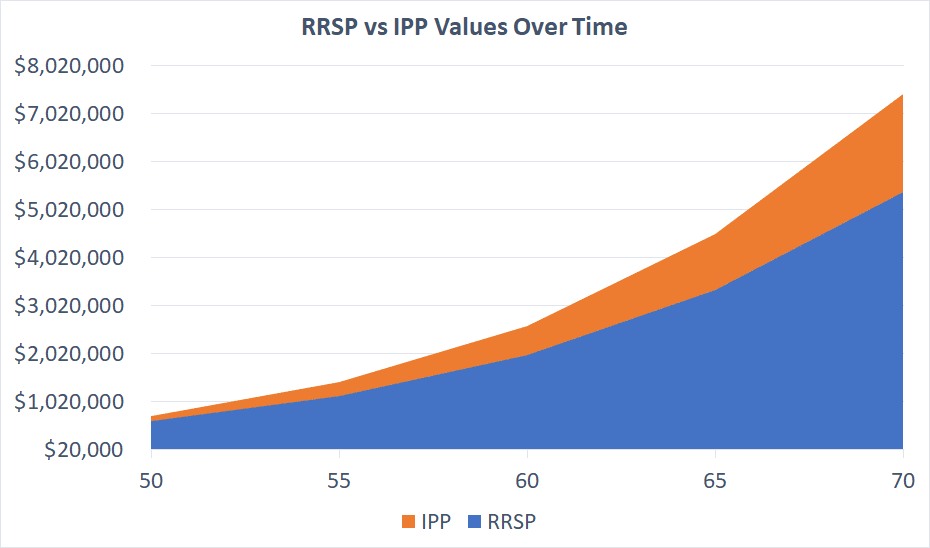

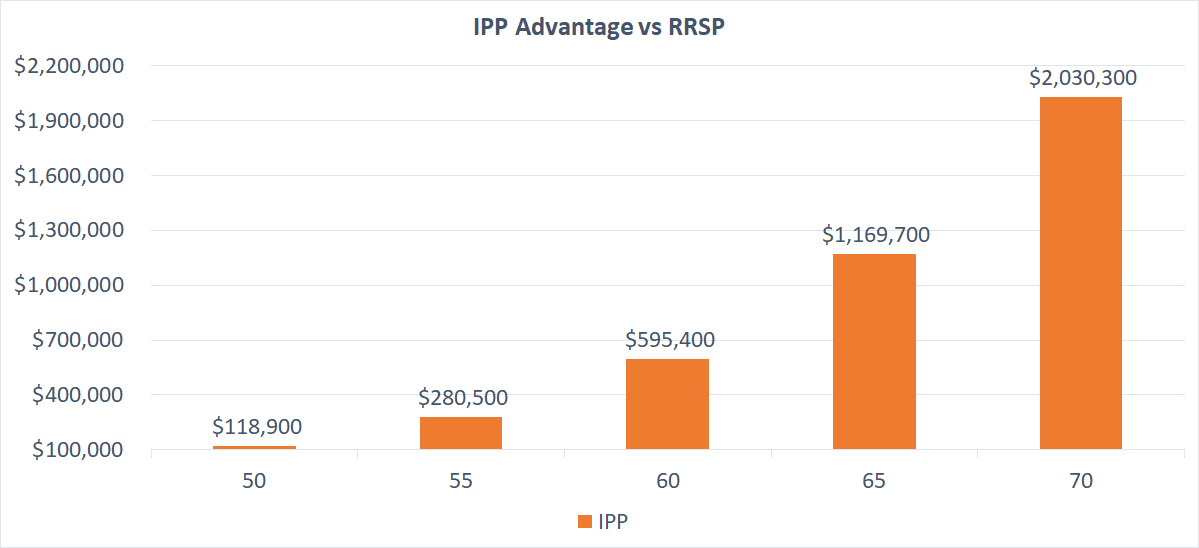

Do you want an extra $118,900 by age 50 for retirement?

Or how about an extra $1,169,700 by age 65?

The difference is huge.

Conclusion

The IPP advantage over an RRSP is clear.

Not only can you save thousands more in tax every year, you can have up to 65% more for retirement, and take comfort knowing it’s income for life.

If you’re like most pharmacy owners, you want to semi-retire without having to sell your pharmacy.

However, with most of your wealth tied up in your pharmacy where will that retirement income come from?

2-3 days working won’t be enough to cover your living expenses.

An IPP is a FASTER and BETTER way to save for retirement compared to an RRSP.

If you’re a pharmacy owner and are over 40, consider NOT contributing to your RRSP anymore and instead start an IPP.

You can literally save $1,000,000 or more within 10 years or less.

And potentially receive $183,000 per year for life starting age 55.

Ready to supercharge your retirement savings? Contact us to see if an IPP is right for you.

Ricardo Ardiles

About the Author

Ricardo helps pharmacists like you pay less tax, grow your pharmacy, and grow your wealth.

Prior to starting Pharma Tax, Ricardo worked at another accounting & wealth management firm focused on dentists. Pharmacists were coming on as referrals and all said the same thing: what you guys are doing for dentists, we need that specialist for pharmacy. Hence, Pharma Tax was born.

Follow Pharma Tax on Social Media

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020