Whether you’re purchasing your first home or 2nd, 3rd, it’s become very difficult for Canadians to save for a down payment.

Saving for a $100K down payment seems almost impossible for a lot of pharmacists because almost half of what you make goes to tax already and you spend the rest, so where is this money going to come from?

Here’s a real life case study how two of our clients went from $0 to saving $165,377 in two years of working with us.

Use this real life scenario as motivation that, with proper planning and discipline when it comes to your finances, you too can do the same.

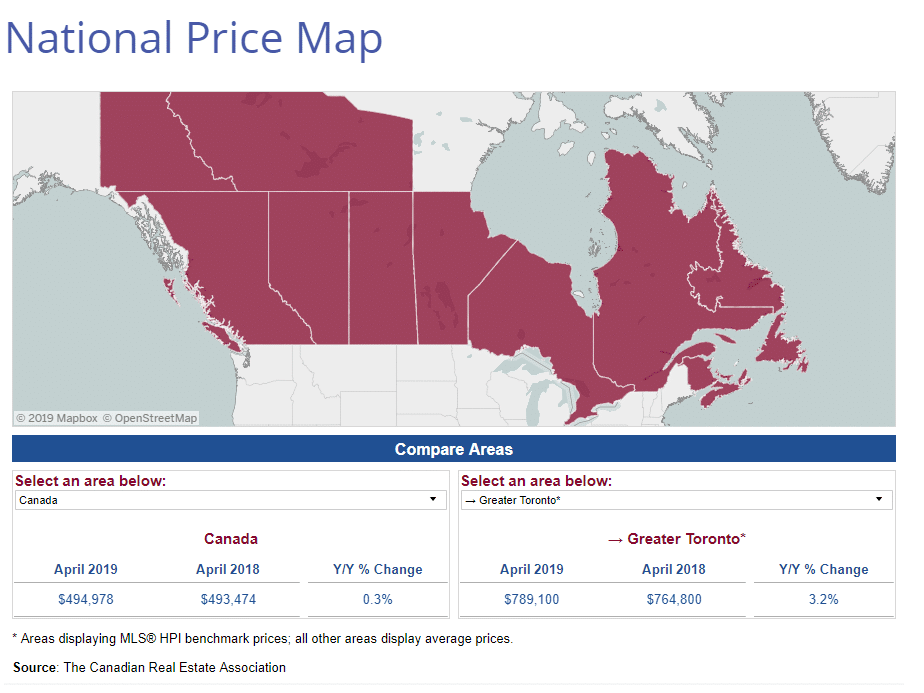

Home Prices and How Much Down Payment You Will Need

According to the Canadian Real Estate Association, as of April 2019, the average price for a home in Canada is around $494,978.

In the Greater Toronto Area, that price climbs to about $789,100.

Let’s use the Greater Toronto area as an example going forward, with the average purchase price of about $789,100.

Banks will typically ask you for 20% down payment, so about $158,000.

Not many have that kind of money saved up!

It’s no wonder why so many people can only afford a lower down payment.

The minimum down payment required is:

- 5% of the first $500,000, so $25,000; plus

- 10% on the remainder, so about $29,000

For a total minimum down payment of $54,000.

Anything less than 20% down payment and you have to pay a Canada Mortgage & Housing Corporation insurance which protects the lender (the bank, not you) in case you can’t make your payments.

This amount typically varies from 0.60% to 4.50% and is calculated as a percentage of the loan and the size of your down payment.

We won’t get into details in this article, just know that it’s an added cost that will get tagged onto your mortgage.

Note: for any homes greater than $1M, this insurance isn’t available; you’ll likely end up paying a higher rate of interest.

How to Get Up To $70,000 Tax Free For Your Down Payment

Your RRSP is your best friend when buying a home for two reasons:

- Each contribution is a tax deduction, so you pay less tax

- You and your spouse can each withdraw up to $35,000 tax free to purchase your home through the Home Buyers Plan

So that’s $70,000 you can withdraw from your RRSPs to purchase your home.

Spouse by definition includes married or common-law spouse.

The 2019 Federal budget increased the Home Buyers Plan from $25,000 to $35,000 thankfully.

While it’s still not enough of an increase in our opinion, it’s better than no increase.

How do you qualify for the Home Buyers Plan?

- This is your first home purchase in Canada

- This is not your first home and you have not owned a home for at least 4 years since you sold your last home

There are a few additional conditions that need to be met but generally you qualify if you can meet any of the two conditions above.

You do have to repay this Home Buyers Plan back to your RRSP over time.

For example, if you purchase a home this year 2019, you have to start paying it back in 2022.

You pay it back over 15 years, or about $2,333 per year if you take out the full $35,000 for the home buyers plan.

How to Save $165,377 in 2 Years

In our experience, a lot of pharmacists earn more than their spouses.

Yet, many are missing out on this savings strategy that can help you get the $70,000 tax free withdrawals from the Home Buyers Plan.

And many aren’t fully maximizing on employer sponsored group RRSP programs.

So if you’re part of Walmart, Shoppers Drug Mart, Rexall, or any other pharmacy that provides benefits, you may be leaving FREE money on the table.

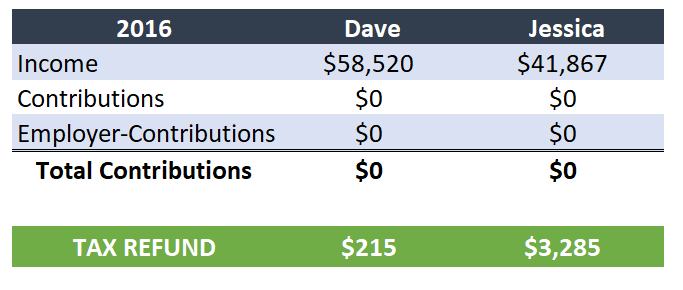

Our two clients, call them Dave and Jessica, came to Canada in late 2015 and literally started with $0 in savings because all their money was being invested into updating their licensing, education, and living expenses.

In 2016, their first year of working in Canada, Dave started working in another job while getting re-licensed and Jessica worked, as well as started post-secondary education because her degree wasn’t being recognized here.

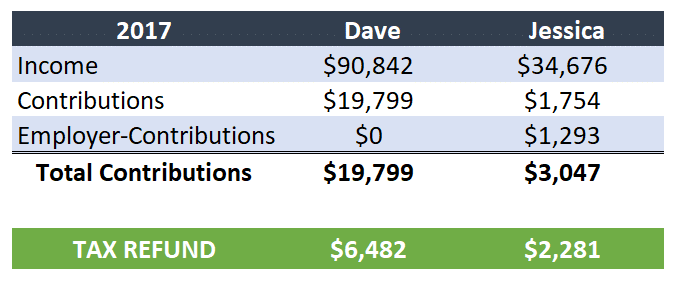

In 2017, Dave changed positions after getting licensed while Jessica started going to school full-time and working part-time.

Dave contacted us to help them manage their finances.

We opened an RRSP account in Dave’s name and contributed $19,799 there so that he can save tax and start building up his RRSP.

Jessica’s group benefits kicked in, which includes a Group RRSP, so we reviewed the options and maximized the amounts she can get from her employer for FREE.

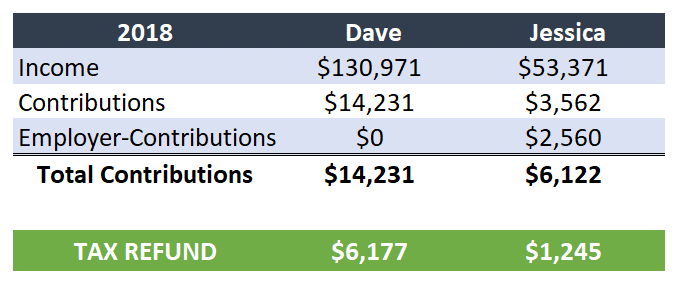

In 2018, Dave now earned similar to what most pharmacists make on average, which is about $120K per year.

Since Dave earns much more than Jessica, we opened a spousal RRSP in Jessica’s name.

While Jessica is the owner of the Spousal RRSP, Dave can make contributions and get the tax deduction.

Why this strategy?

Jessica doesn’t have enough money to put in her RRSP to maximize her $35,000 Home Buyers Plan limit.

So we leverage the ability of Dave to contribute to her RRSP and get the tax deduction.

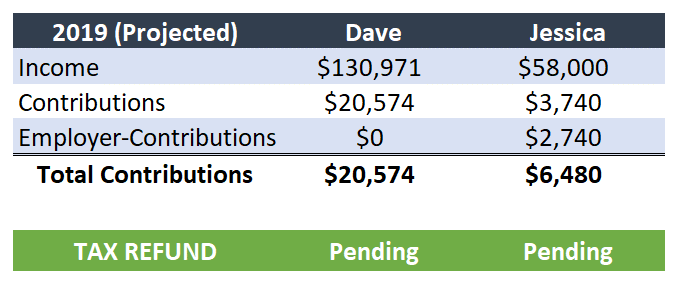

Now in 2019, Dave has contributed an additional $20,574, which we split the contribution between his RRSP and Jessica’s Spousal RRSP.

At this point, they each have about $35,000 across their RRSP accounts.

So now they can withdraw $70,000 tax free under the Home Buyers Plan when they have found the home they want to buy.

And they were able to achieve this goal in 2 years! Summer 2017 – Spring 2019.

What about the balance to make up the $165,377?

Dave and Jessica haven’t been spending every dollar they make, so whatever was leftover, including tax refunds, have been saved into each of their TFSA accounts.

TFSA accounts are great because anything inside a TFSA can be withdrawn tax free.

As of June, 2019 here are their balances including growth in their investments:

- Dave RRSP = $34,958

- Dave TFSA = $60,312

- Jessica RRSP = $25,755

- Jessica TFSA = $33,112

- Jessica Group RRSP = $11,240

- Total = $165,377

How Did They Do It? Did They Live A Terrible Lifestyle?

It’s all about the decisions you make in spending your money.

You might think, Dave and Jessica don’t do anything, they live a boring life.

That’s in the eyes of the beholder but they are actually very happy.

We taught them how to establish a budget, gave them the tools to monitor monthly, and how to adjust as things change.

Note, we aren’t telling them how to spend their money.

This is very key.

We teach you how to save first, spend last and how to track it every month.

The rest is up to you!

Now, they don’t have any kids.

They currently rent, spending $1,800 per month

Vacation budget = $10,000 per year (they take 2-3 trips per year)

Spend $500 per month in restaurants.

Spend $300 per month on entertainment.

Spend $200 per month on personal gifts.

How many of you are doing all of that and still saving $165,377 in 2 years?

Truth is, you can too. It’s not impossible.

You just need to be taught how to save first, then play with whatever is left.

They don’t teach this in pharmacy school.

Life is all about the decisions we make and the same comes to your finances.

I have heard this saying “death by a thousand cuts”

What does that even mean?

We make a lot of small expenditures that seem insignificant but when you add them all up, many don’t have anything leftover to save.

$5 for coffee every day.

$12 for lunch every day.

$250 gucci belt.

$300 shoes.

$1,000 purse.

$500 on concert tickets.

$750 per month for your car.

It adds up.

So rather than saving what’s leftover, let’s help you spend what’s leftover after saving.

Is This Strategy Right For You?

Schedule your free strategy session and reach your goals FASTER.

Conclusion

Most pharmacists make about $120,000 per year, on average based on our clients and experience working with pharmacists.

So you can achieve these results, too.

How much you save for down payment comes down to the choices you make when it comes to your finances.

By developing a “save first and spend the rest” mentality, you can save $165,377 in just 2 years with proper planning and discipline.

If you earn more than your spouse, consider opening a Spousal RRSP.

This way, each of you can potentially withdraw $70,000 tax free from your RRSPs to purchase your home.

This is a strategy that most pharmacists don’t know about and can help you save FASTER for your down payment.

Also, leverage each of your TFSA accounts so that you don’t have to pay any tax when you withdraw money.

These are things they don’t teach you in pharmacy school.

Yet, most pharmacists don’t seek professional help because they don’t have the time or don’t want to look “stupid” when it comes to their personal finances.

We are here to help you pay less tax and with those savings, help you reach your financial goals FASTER.

No question is silly to us.

Schedule your FREE strategy session where we can chat if this strategy makes sense for you.

Ricardo Ardiles

About the Author

Ricardo helps pharmacists like you pay less tax, grow your pharmacy, and grow your wealth.

Prior to starting Pharma Tax, Ricardo worked at another accounting & wealth management firm focused on dentists. Pharmacists were coming on as referrals and all said the same thing: what you guys are doing for dentists, we need that specialist for pharmacy. Hence, Pharma Tax was born.

Follow Pharma Tax on Social Media

Please seek professional advice before implementing any strategies discussed in this article. Tax & accounting solutions are provided by Pharma Tax®; investment solutions are provided by IA Securities®; insurance products are provided by PPI®.

Pharma Tax® is a trademark of Intelligent Wealth Inc. IA Securities® is a division of Industrial Alliance Securities Inc. IA Securities, a member of the Canadian Investor Protection Fund (CIPF) and the Investment Industry Regulatory Organization of Canada (IIROC). IA Securities is a trade name and business name under which Industrial Alliance Securities Inc. operates. PPI® is a trademark of PPI Management Inc.,doing business as PPI and PPI Advisory. Read Savings Disclaimer, Terms & Conditions, as well as Privacy Policy here.

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020