Ontario Finance Minister, Charles Sousa, announced Tuesday afternoon that the provincial portion of the small business tax rate will decrease, effective January 1, 2018.

With an eye on next spring's election, this announcement is very convenient, don't you think?

The Liberals are spinning this announcement as a way to "ease" the transition to the new minimum wage of $14 per hour that also comes into effect on January 1, up from the current $11.60.

This tax rate change affects pharmacy owners and locums/reliefs operating under a pharmacy corporation.

Here is how it affects you.

More...

Small Business Tax Rates Explained

Let's first define these terms:

- Active business income = revenue from your pharmacy - expenses incurred to generate that revenue

- Corporate tax rate = federal tax rate + provincial tax rate

- CCPC = Canadian controlled private corporation, any corporation in Canada that is privately owned by a Canadian resident(s) and not listed on a stock exchange

The small business tax rate applies to the first $500,000 of active business income of your CCPC, such as your pharmacy corporation.

Currently,

- Federal tax rate = 10.5%

- Ontario tax rate = 4.5%

- Total corporate tax rate = 15%

Anything higher than $500,000 of active business income is not considered small business anymore and is subject to higher corporate tax rates.

The provincial portion is different in each province but we will only focus here on Ontario.

Ontario to Cut Provincial Tax Rate to 3.5%

The Ontario provincial portion of the small business tax rate is currently 4.5%.

Effective January 1, 2018, that rate will decrease to 3.5%.

Federal Liberals to Cut Federal Tax Rate to 10%

The federal portion of the small business tax rate is currently 10.5%.

In October, the Federal Liberals announced that they would decrease the Federal portion of the small business tax rate effective January 1, 2018.

How the New Tax Rules will Increase Your Tax Bill by Thousands of Dollars starting January 1, 2018

How Do I Benefit from This Rate Reduction?

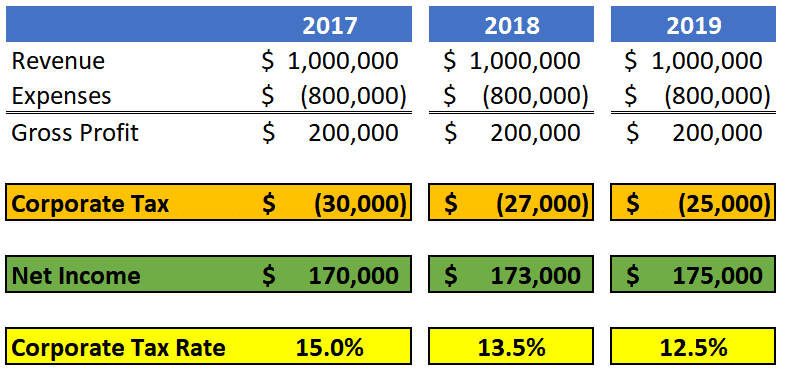

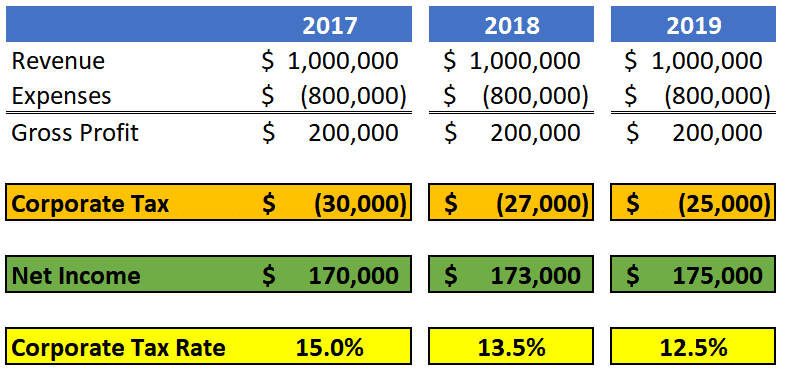

Here's an example of a pharmacy grossing $1 million in annual revenue.

As you can see, the rate reduction isn't anything spectacular.

In 2018, a pharmacy of this size can expect to pay approximately $3,000 less in corporate tax, rising to $5,000 in 2019.

But that's nothing in comparison to the tax changes announced in October along with tax changes on investing inside your corporation that will force many to pay tens of thousands more in tax every year.

Business owners across the country are furious!

Conclusion

Both the Federal and Ontario Liberals have announced that they will decrease their respective tax rates for small businesses, effective January 1, 2018.

Given the fury of business owners across Canada at the other tax changes and minimum wage increase that will also come into effect on January 1, this is being taken more as a political move given the elections next year.

Regardless of how you perceive this announcement, it should soften the increased tax burden many of us will face next year.

Ricardo Ardiles

CIM | Partner

Ricardo is a founding partner of Pharma Tax and focuses on providing tax planning strategies to health care professionals. His goal is to provide simplicity and convenience to clients by coordinating all areas of personal wealth management so that his clients don’t have to. This means working with external professionals on: investments, insurance, business planning, retirement planning, and estate planning.

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020