Back on July 18th, the department of finance, a.k.a Bill Morneau, proposed new tax measures that impact Canadian-controlled private corporations (CCPCs).

After months of consultations, and backlash from business owners around our country, today there was an announcement on what changes have been approved.

Pharmacy owners and reliefs/locums with pharmacy corporations around Canada are impacted by these changes.

Are you prepared? Many aren’t.

Here are the changes that will come into effect January 1, 2018.

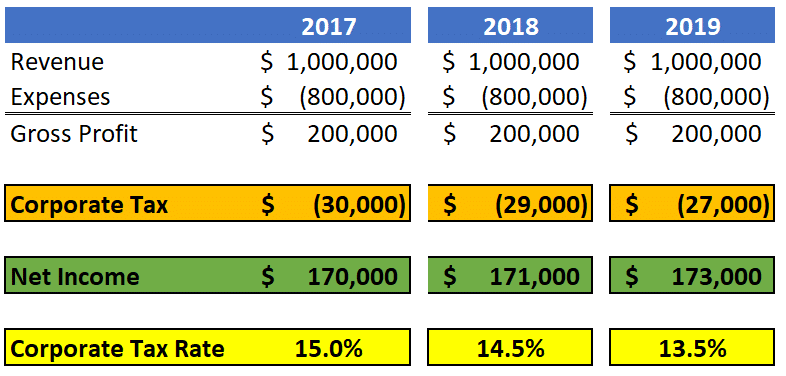

Decrease in Federal Small Business Tax Rate to 10%

Small business owners across the country are furious with the proposed tax changes and, in our opinion, the prime minister only made this announcement to “soften” the blow.

In their first budget, the Liberals reduced the corporate federal tax rate to 10.5% – a campaign promise to continue what was started by Stephen Harper and the conservatives.

Starting January 1, 2018, the corporate federal tax rate will decrease to 10%.

And January 1, 2019, this rate will decrease to 9%.

No change was made to the Ontario provincial corporate tax rate of 4.5%.

It applies to the first $500,000 of active corporate income, and the government says lowering the rate will provide entrepreneurs with up to an additional $7,500 per year.

Here’s how your pharmacy is impacted:

Other provinces have different provincial tax rate.

Capital Gains Exemption Remains

Many pharmacy owners have had spouses on as shareholder for years, which would have been disastrous if this proposed tax change had been approved.

There were many concerns about the potential impact on inter-generational transfers of family businesses that the government actually listened to.

No Mention About Passive Investment Income

While no comment was made today, this change remains pending further review.

The government did acknowledge the concerns raised during the consultation process and now seems to have a better appreciation for the way in which passive investments within a private corporation are used, particularly by small and medium-sized businesses.

For example: many business owners invest inside their corporation as a retirement tool since other savings vehicles, such as RRSPs and RRIFs, are not sufficiently flexible and adaptable to address business volatility.

See related: How to Save $1 million in 10 Years By Creating Your Own Pension Plan

Income Sprinkling Will End For Most…But Not for Pharmacy

Income sprinkling will end starting January 1, 2018 for service based businesses and those operating under a professional corporation.

The government wants to end this practice for family members who are paid dividends but have not contributed any capital or do not work in the business.

But what is income sprinkling?

Income sprinkling, better known as income splitting, allows someone in your family who is in a lower tax bracket to receive income that otherwise would have been paid to you, the pharmacist.

The goal of income splitting is to reduce the combined tax liability of your family.

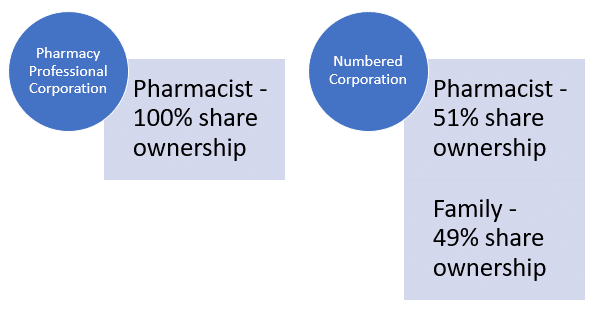

Currently, Ontario allows pharmacy owners and locums to practice under your own corporation in one of two ways:

Most pharmacy owners elect to use a numbered corporation, so these new income splitting rules do not affect you.

Why?

Because pharmacy is considered a retail business, not a service based business, in the eyes of the CRA.

By adding a family member as a shareholder to your numbered corporation, you are entitled to pay him or her a dividend.

For example, you can pay an unlimited amount of dividends to your spouse and s/he doesn’t have to work at the pharmacy at all, as long as s/he owns 10% or more of the voting common shares.

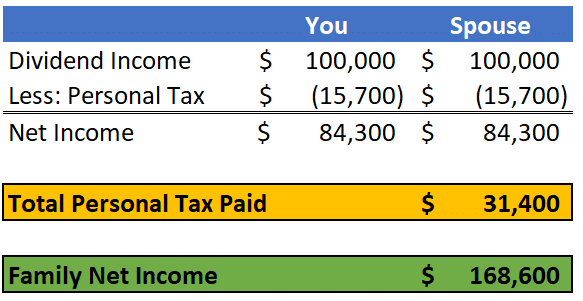

Example of the Benefit of Income Splitting

- You, the pharmacist, 51% common shares

- Your spouse, 49% common shares

Your pharmacy earns $200,000 in net income and now you need to figure out how much in dividends to pay yourself and your spouse.

The strategy of income splitting is to equalize the incomes of you and your spouse.

Assume your spouse earns no other income. So in this example we take the $200,000 leftover in your corporation and pay each other a $100,000 dividend.

Let’s calculate family net income with income splitting.

Each of you pay approximately $15,700 in tax for total personal tax paid of $31,400.

Family net income that you get to take home is $168,600.

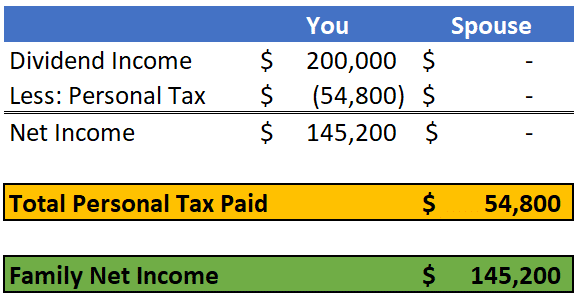

Example of No Income Splitting

Most pharmacy owners have no idea about income splitting.

So here is a very common scenario that we see.

Continuing from the above example, let’s assume you pay yourself, the pharmacy owner, the full $200,000 as a dividend.

The tax burden increases: paying $54,800 of tax on $200,000 of dividend income.

With income splitting, you can save $54,800 – $31,400 = $23,400 in personal tax.

But My Spouse/Family Work at my Pharmacy, What Now?

If you pay your spouse or family member a salary because s/he works at your pharmacy, a “reasonableness test” for salary is applied.

This test isn’t anything new and has been around for a long time.

This test is used to determine if the amount that s/he is paid is reasonable compared to the responsibilities given.

Say you pay your spouse a $200,000 salary for doing administration work and nothing else, for example.

Your spouse would likely fail the reasonableness test because what admin person in Canada gets paid an income of $200,000 per year?

You would have to justify other responsibilities for that level of salary.

The total compensation must be reasonable compared to the level of responsibility in the pharmacy.

How Can I Income Split Going Forward?

You can continue splitting income going forward if one of two conditions are met:

Hours Worked

- Works at the pharmacy 20 hours or more per week on average during this calendar year or any of the last 5 calendar years

Share Ownership

- Owns 10% or more of the voting common shares of your corporation

What if you don’t meet any of these two rules? Then any dividends paid are subject to a new “reasonableness test” for dividends:

Functions performed

- For an adult age 18-24, the individual is actively engaged on a regular, continuous and substantial basis in the activities of the business; and

- For an adult age 25 or older, the individual is involved in the activities of the business (e.g., contributed labour that could have otherwise been remunerated by way of salary or wages)

- Translation: your spouse or family member has to work in your pharmacy; and the compensation must reflect what other Canadians are receiving for similar responsibilities

Capital Contribution

- For an adult specified individual age 18-24, the amount exceeds a legislatively-prescribed maximum allowable return on the assets contributed by the individual in support of the business; and

- For an adult specified individual age 25 or older, the individual has contributed assets, or assumed risk, in support of the business.

- Translation: your spouse or family member should have an investment in your pharmacy, which means s/he participates in the growth and risks of your pharmacy

But What Will Happen if I Continue to Sprinkle Income?

Let’s assume your spouse or family member doesn’t own 10% or more of the voting common shares of your corporation and doesn’t work 20+ hours per week.

There are two likely scenarios here:

- Your spouse or family member doesn’t work at the pharmacy nor has any capital contribution to the pharmacy

- You pay your spouse or family member more than what is “reasonable” for his or her level of responsibility

And for whatever miraculous reason, the CRA finds out you’ve been doing so when you shouldn’t be.

The income that you pay that spouse or family member would be subject to a tax called “TOSI” or tax on split income.

This means that whatever you pay your family member will be subject to the highest marginal tax rate, which is approximately 53.53% in Ontario.

You will be penalized by having to pay more in tax than you should.

Why is the Government Targeting Income Sprinkling?

“Let me be clear: all Canadians must pay their fair share of taxes,” Mr. Morneau said in a prepared speech to the House of Commons.

Translation: the Government wants to level the playing field of business owners vs employees.

Let’s be clear about something first. Income splitting is NOT a tax loophole nor it is any form of tax avoidance.

Income splitting is a valid tax planning strategy that has been around for decades and was introduced as an incentive for people to start their own business.

By starting your own business, you hire other Canadians, pay them a salary, which in turns helps the economy with jobs and spending.

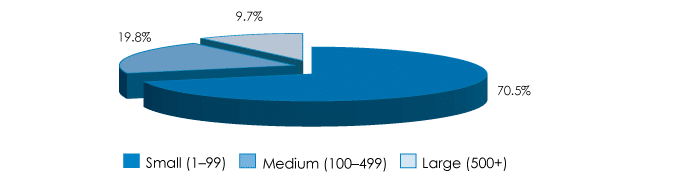

Did you know? According to Statistics Canada, approximately 90% of Canadians who work the private sector are employed by small and medium sized businesses.

But who took the risk to employ these Canadians in the first place? Business owners like you did.

Who took the risk to start up your own pharmacy? You did.

Who took the risk of losing your investment and go bankrupt? You did.

Who pours their blood, sweat, and tears everyday? You do.

Because, well, there aren’t that many people who can do what you do.

And you continue taking these risks everyday that your pharmacy is in business.

Yet, as a business owner, you’re called greedy, a tax cheat, and overpaid.

You’re not in this for the money, you love your job.

You provide vital patient care to thousands of Canadians.

And yet, you’re exempt from the employment standards act.

No maximum number of work hours, no overtime, no minimum wage, no breaks. It’s hard enough for you to sit down and eat lunch.

How many employees in Canada take those risks? I didn’t think so…

Conclusion

Today, our government let us know what tax changes will be implemented on January 1, 2018.

These tax changes will make it harder than ever for business owners, including pharmacies, to earn a living.

Profit margins are already being squeezed due to the prices of generics going down every year.

Some serious tax planning needs to be done. If you aren’t prepared, time is ticking.

Which means your accountant should be arranging for a meeting very soon.

If not, it’s time to start asking questions and seeking a 2nd opinion.

Our guarantee to you is simple: if we can’t help you pay less tax, you don’t pay.

Ricardo Ardiles

CIM | Partner

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020

Trackbacks/Pingbacks