Happy New Year!!

From the team at Pharma Tax, we wish you nothing but success in 2020.

Our goal is to help you save taxes this year and every year going forward.

Why?

Pharmacists pay a lot of taxes.

On average, your tax rate is about 43% so about half of what you make goes to tax.

So why not try to pay less of it?

Here are tax changes that come into effect for 2020 as well as tax saving tips to act on NOW to pay less tax this year and every year going forward.

The longer you procrastinate, the more in tax that you’ll overpay this year.

Tax Filing Deadline

The 2019 tax filing deadline is April 30th, 2020.

There are a slew of tax changes that have come into effect over the last few years.

If no one has sat down with you to perform a thorough analysis of:

- Legal entity structuring

- Maximizing deductions

- Cash flow strategies

- Pharmacy specific strategies

- Structuring insurance

- Structuring retirement

- Preserving your net worth

- Liberal tax changes 2017-2020

Then I can guarantee that you’ve been overpaying in taxes.

Schedule a time to chat with us to see how much tax you could be saving.

Basic Personal Amount Increases

In 2020, the first $13,229 of income that you earn is tax free.

This is up from $12,298 in 2019 and will continue to increase each year until it reaches $15,000 in 2023.

If your spouse does not work, you can claim his or her basic personal amount as well so that the first $26,458 of income that you earn is tax free.

However, the benefit does get reduced for those earning more than $150,473 and is reduced to zero for those earning over $214,368.

Tax Bracket Increases

Canada Pension Plan (CPP) premiums have gone up (because Canadians are VERY bad at saving) but Employment Insurance (EI) contributions have gone down.

For 2020, the maximums for employees are:

CPP employee contribution = $2,898 (up from $2,748)

EI employee contribution = $856 (down from $860)

If you own a pharmacy with staff, then your employer portions are:

CPP employer contribution = $2,898

EI employer contribution = $1,198

Federal and provincial tax brackets have increased in 2020 to keep up with inflation.

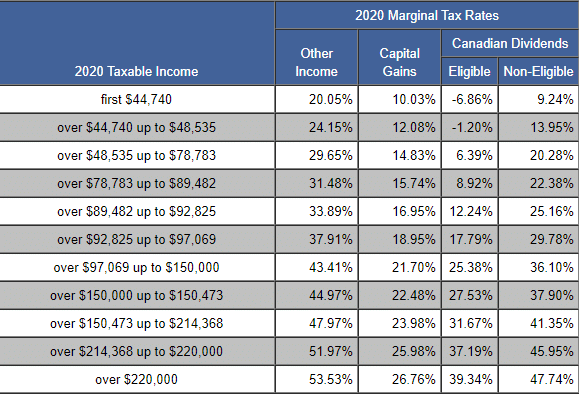

Pharmacists on average make around $100K to $150K per year, which means you’re in the 43.41% tax bracket for 2020.

Think You're Paying Too Much In Taxes?

Schedule a free call to see and start paying less taxes.

OHIP Ends Out-of-Country Travel Insurance

Starting 2020, Ontarians are now left without built in, out-of-country health insurance.

OHIP previously covered out-of-country inpatient services up to $400 per day for higher levels of intensive care and $50 per day for emergency outpatient and doctor services.

OHIP cited high administrative costs to process the roughly $9 million in annual claim payments.

For staff pharmacists, it’s likely that your group benefits have some sort of travel insurance built in.

For relief and pharmacy owners, if you don’t have group benefits then I recommend setting up a Health Spending Account.

For the one we use, you can add the Travel & Major Medical Insurance option which gives you:

- $1 million of coverage per person per claim

- Unlimited trips per year, up to 45 days each

- Medical expenses are guaranteed

- Transportation home or to a different medical facility

- Referrals to physicians, pharmacists, and medical facilities

- No deductible

- Available to age 70

Included in this option is $125,000 of catastrophic coverage if you are hit with an unexpected accident, disease, or illness here at home or abroad.

So it’s a slam dunk.

Many credit cards also offer travel insurance but be sure to check the fine-print.Usually over the first 7 to 14 days of a trip are covered and only up until age 55.

Home Buyers Plan Changes

In 2019, the Home Buyers Plan was increased to $35,000 up from $25,000.

This remains for 2020 and means you can withdraw up to $35,000 tax free from your RRSP to purchase or build your first home.

Beginning in 2020, however, extends this definition to those who have experienced breakdown in marriage or common law partnership.

If this breakdown happens in the year of making a withdrawal or happened in any of the last 4 years, then you are allowed to use the Home Buyers Plan again even if this isn’t your first home. Conditions apply.

Canada Training Benefit

This is a refundable tax credit to help with professional development costs in 2020.

As a worker, you’ll be eligible to receive $250 annually as a tax credit but you must meet the following criteria:

- File a tax return for 2020

- Be between 26 and 65 years old

- Be Canadian resident

- Have earnings between $10,000 and no more than $150,000

Tax Breaks For Parents

The Liberals have promised the following tax breaks for parents.

Maternity or parental benefits received through EI will be tax free beginning 2020.

The Canada Child Benefit is slated for an increase as well. The tax free benefit will increase for new parents with kids under one years old. This increase could mean as much as $1,000 more for some parents.

Tax Breaks for Seniors

Liberals have promised to increase Old Age Security (OAS) for seniors over 65 earning less than $77,580.

This change will start July 2020 and will mean an increase of about $729 per year.

Digital Subscriptions Refund

Starting 2020, you can claim up to $500 in costs paid towards eligible digital subscriptions, for a maximum tax credit of $75 per year.

This is meant to promote and support Canadian journalism however the criteria has yet to be set.

Also, certain journalism organizations that operate as not-for-profits will be allowed to register to receive donations from Canadians.

You and/or your pharmacy donating money can apply for these tax savings.

Claiming Cannabis as a Medical Expense

Since cannabis is legal in Canada, the government will be amending the Income Tax Act so that you can claim a medical expense tax deduction for any cannabis products that you buy as a patient after October 16, 2018.

What are you waiting for?

Schedule your free call to see how much tax you could be saving.

Tax Free Savings Account Contributions

The annual contribution limit was increased in 2019 to $6,000 per year, up from $5,500.

For 2020, the contribution limit will remain at $6,000 per year.

If you have never contributed to a TFSA before, and you’ve been eligible to contribute since 2009, you can contribute $69,500 in total this year.

Track Mileage Driven For Business

For pharmacy owners and reliefs, take a picture of your odometer to record the “starting point” of 2020.

Then track the following each time you make a trip for business:

- Destination to & from

- Number of KM’s driven for the trip

- Date

- Purpose of drive

Track all of your car expenses for the year:

- Monthly lease/finance

- Car Insurance

- Maintenance

- Gas

Whatever the percentage is that you drove for business, you can then take that percentage of all the car expenses as a tax deduction.

This can save you about $2K to $5K in taxes every single year on average.

This is very manual process, thankfully there are apps you can download to track all of this for you automatically and save you time.

- Quickbooks Self Employed (promo code 50% off for 12 months)

- Mile IQ (use promo code for 20% off forever: RARD890A)

You can easily download the car log easily from the app to provide to your accountant and to the CRA if you get audited.

Pharmacy owners and reliefs are notoriously bad at tracking mileage because no one has ever taught you how to record this properly.

This may sound familiar:

Accountant: how many KM’s did you drive last year for business?

You: Not sure, just put down 50%

One pharmacist came to us after she had to pay back $10K in back taxes and penalties for not having a car log.

Another pharmacist came to us after she was audited and had to “make up” a car log for the last 3 years she was with her old accountant.

Between running her pharmacy and being a full time mom, she wishes that no one ever go through that experience.

Aren't Tracking Your Mileage?

Schedule a call and we will set you up.

How To Reduce Your Corporate Taxes

Many independent pharmacies report a net profit of $30K to $200K+ annually, which means you have to pay about $3K to $25K+ in corporate tax.

Rather than giving that to the CRA, re-invest that in your yourself and your business.

Here are 5 ways to do that:

- Invest in yourself (mentorship)

- Invest in your services (professional development & new clinical services)

- Invest in growing script count (marketing & advertising)

- Invest in protecting your pharmacy (estate planning)

- Invest for retirement

Every year, drug prices keep going down so you’re getting less and less per script; what are you doing to offset that hit to profitability?

Many owners aren’t doing anything and are suffering quietly as a result.

There are only so many expenses that you can cut.

However, revenue is unlimited.

So why not shift your mindset to investing in activities that grow revenue?

With pharmacy, for every $1 invested you can get $2.50 return on investment.

Saving For Retirement

How much do you need for retirement?

Are you taking the steps every year to reach your retirement goal?

If you’re a staff pharmacist at Rexall or Walmart, you should be maximizing your pension contribution so that you get matched.

Typically, if you contribute 6% to your pension you will get matched 3%.

If you’re at Shoppers Drug Mart, you should contribute $2,500 to get matched your $2,500 in your group RRSP.

That’s free money!

If you’re a relief, consider paying yourself a bonus and instead, contributing that to your RRSP.

If you’re a pharmacy owner, you should strongly consider starting an Individual Pension Plan instead of an RRSP.

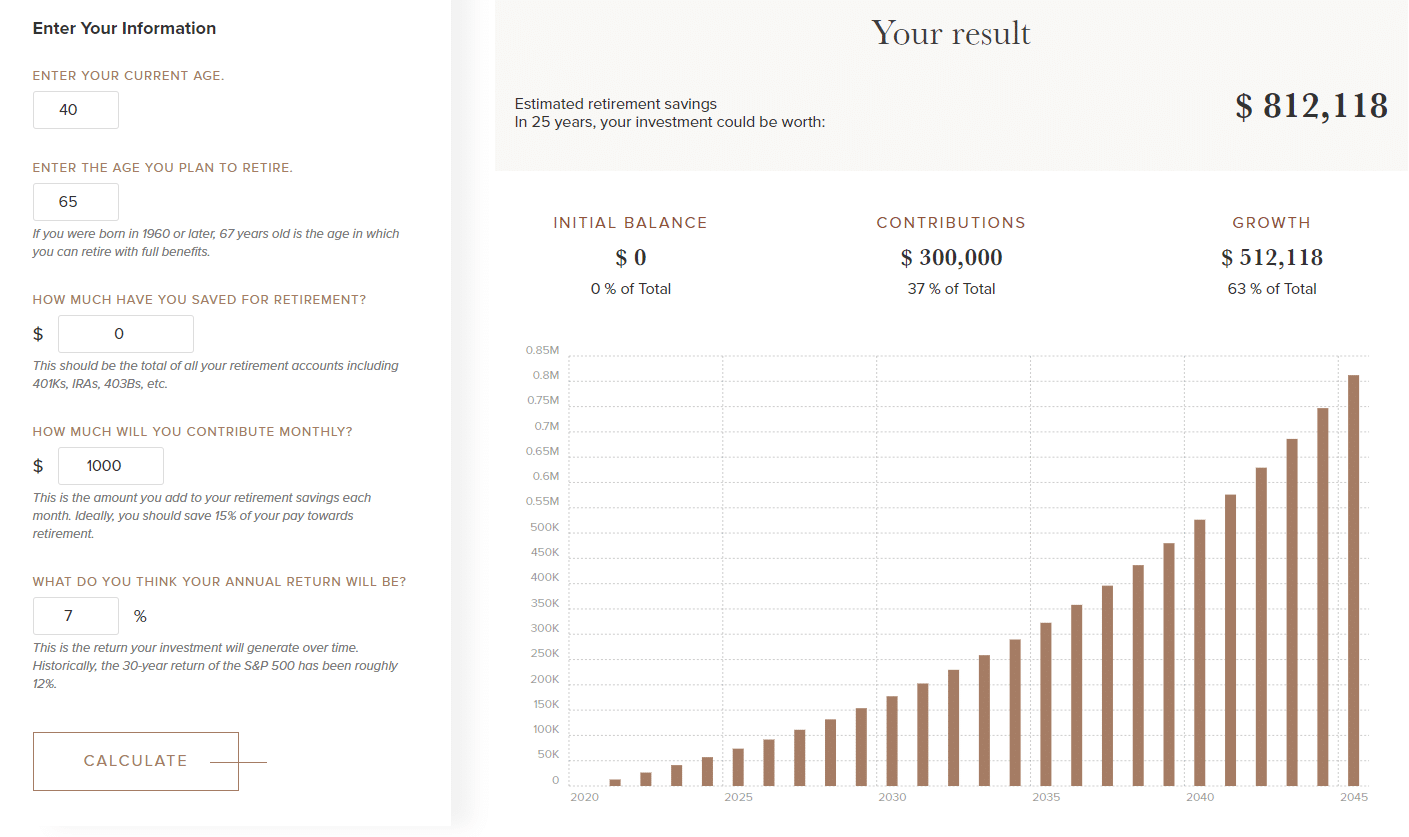

Even if you have $0 today at age 40, consider what $1,000 per month contribution until age 65 could mean for you.

The sooner you start, the more you will have because of magic of compounding!

Aren't Saving For Retirement?

Schedule a call and we will help you with cash flow strategies.

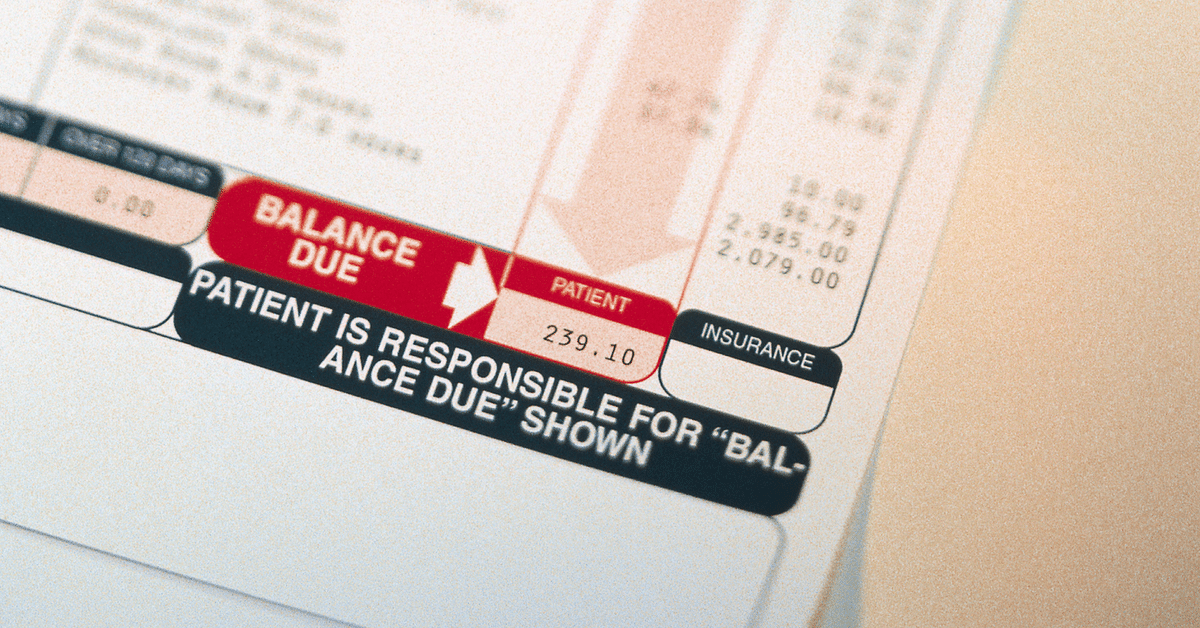

Have Your Corporation Fund Medical Expenses

If you’re a pharmacy owner or relief pharmacist, you shouldn’t be paying for medical expenses with personal after-tax dollars.

You can setup a Health Spending Account and have your corporation fund your medical expenses.

This strategy can save you $372 to $2,739+ in taxes every single year.

Don't have a Health Spending Account?

Schedule a call and we will set you up with one.

Conclusion

What will you be doing in 2020 to pay less in taxes?

The reality is, many pharmacists think they are getting tax planning from their accountant…

…but really, all they are doing is preparing your tax returns.

Years go by and most pharmacists have no idea that they’re overpaying in taxes by $9K to $26K on average every single year.

Now you know the tax changes that are in effect for 2020.

Question is, will you do something about minimizing your taxes in 2020?

I’m happy to chat with you to see what strategies you may be missing out on.

Happy New Year!!!

Ricardo Ardiles

About the Author

Ricardo helps pharmacists like you pay less tax, grow your pharmacy, and grow your wealth.

Prior to starting Pharma Tax, Ricardo worked at another accounting & wealth management firm focused on dentists. Pharmacists were coming on as referrals and all said the same thing: what you guys are doing for dentists, we need that specialist for pharmacy. Hence, Pharma Tax was born.

Follow Pharma Tax on Social Media

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020