There are a few things to consider before the end of the year if you want to save money on your 2019 tax bill.

Here are 18 year end tax planning tips that can help you save money.

Prior to implementing any strategy, you should consult with tax and legal advisors to ensure it is right for you.

Delay training costs until 2020

There is a new refundable $250 Canada Training Credit (CTC) that starts next year to help cover the costs of training.

You can save up to $250 on your personal taxes but there are some criteria to meet in order to be eligible:

- You must be a resident of Canada

- Be between 25 and 65 years old

- Have 2019 employment income between $10,000 and $147,667

Did You Move This Year To Be Closer To Work?

You can write off your moving expenses if you moved for work, to run a business, or to be a full-time student and were not reimbursed.

To qualify, your new home must be at least 40 KMs away.

Eligible moving expenses include (but not limited to):

- Packing/Hauling

- Movers

- In-transit storage

- Insurance

- Travel expenses (vehicle, meals, overnight accommodation for up to 15 days)

- Ancillary fees such as cost to update your drivers license, legal documents, cost to cancel your old lease, utility hook-ups

- Mortgage interest

- Property taxes

- Home insurance premiums

- Cost of utilities

Costs associated with selling your old home are also tax deductible, including:

- Advertising

- Notary or legal fees

- Real estate commissions

- Mortgage penalty (if any)

Similarily, costs associated with purchasing your new home:

- Land transfer tax

- Title fees to your new home

Any of these cost incurred by December 31st are tax deductions.

With many pharmacists in the 43% tax bracket, $50,000 of valid moving expenses can potentially save you $21,500 in taxes.

Be sure to keep your receipts for these transactions.

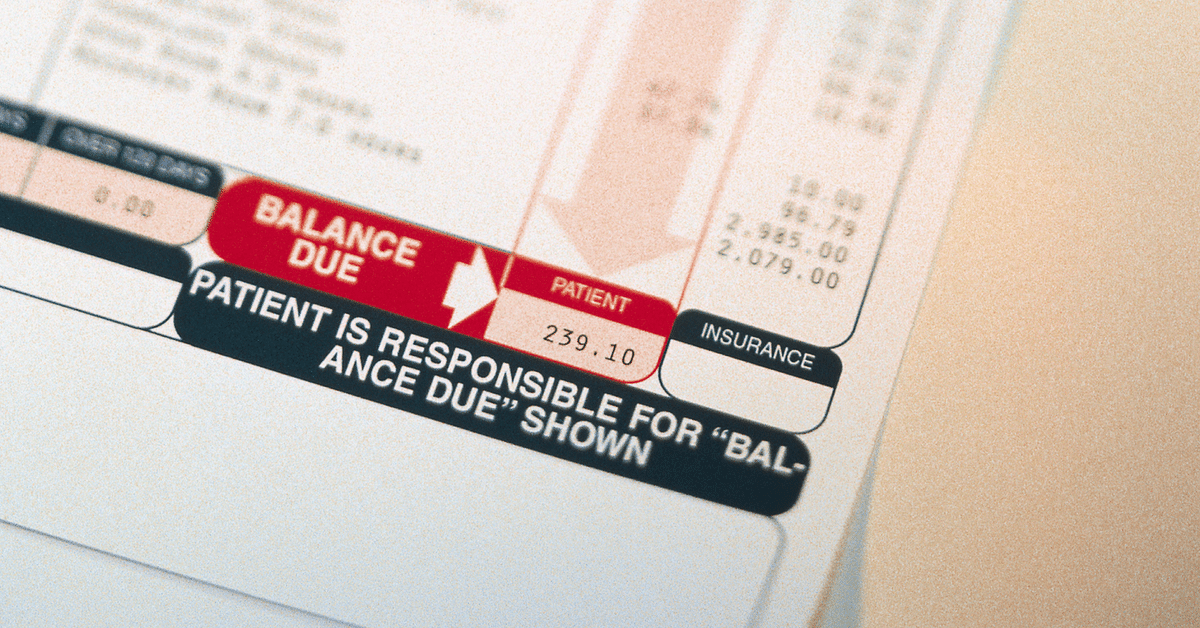

Pay Family Medical Expenses

Many pharmacists have group benefit plans but still find themselves paying out of pocket for medical expenses due to limitations of benefit plans.

For medical expenses paid for personally, a tax credit can be claimed when total medical expenses exceed the lower of 3% of your net income or $2,352 in 2019.

Be sure to include any premiums that you paid for those group benefits and weren’t reimbursed.

Forgot to claim medical expenses in 2018? You can choose to claim 2018 medical expenses as long as you only include expenses within any 12 month period that ends in 2019.

Make sure you keep the appropriate documentation/receipts.

If you’re a pharmacy owner and are paying for medical expenses personally, stop right now and read this article about Health Spending Accounts.

Done right, your corporation can pay the medical expenses for you and your family, saving you thousands.

Split Investment Income With Family Members

Many pharmacists are in a higher tax bracket than their family members.

It might be beneficial to have some investment income taxed in the hands of family members (spouse, common-law partner, or children) who are in lower tax brackets.

To do this, you can lend funds to family members at the CRA’s prescribed rate which is 2% until at least March 31, 2020.

Interest must be paid annually by January 30th to avoid attribution rules.

The lower income family member can then invest the loaned funds and pay less tax on any dividends, income, and/or capital gains that the investments yield.

For example, if you have a family member in Ontario who has $0 income, he or she can receive about $52,000 of eligible dividends in 2019 without paying any tax.

Split Pharmacy Income With Family Members

Many pharmacy owners are in a higher tax bracket than their family members.

It might be beneficial to pay dividends from your pharmacy to family members (spouse, common-law partner, or children) who are in lower tax brackets.

Despite the new income splitting rules that came out in 2018, pharmacy is still eligible to split income with family members if your corporation shares are structured a certain way.

For example, if you have a family member in Ontario who has $0 income, you can pay him or her around $30,000 in non-eligible dividends without paying any tax.

This dividend should be declared and paid by December 31, 2019.

Split Investment Income From Corporate Investments

For pharmacy owners who have passive investments inside your corporation, you can potentially split investment income without having to issue a prescribed rate loan like mentioned above.

If your corporation is structured properly, the dividends, income, and/or capital gains can be paid to the lower income family members.

For example, if you have a family member in Ontario who has $0 income, you can pay him or her around $30,000 in non-eligible dividends without paying any tax.

This dividend should be declared and paid by December 31, 2019.

Missing out on these strategies?

Schedule a free phone consultation and start saving tax.

Did You Buy Your First Home This Year?

If you bought a home (condo, house, or townhouse) this year and this is your first one, don’t forget to claim a number of tax credits on your tax return.

The First-Time Home Buyers’ Tax credit can save you $750 in taxes.

There is also a land transfer tax rebate for first time buyers in Ontario, British Columbia, and PEI.

The amount depends on province but in Toronto, for example, one our clients got a rebate of $8,475.

If you bought a new build or substantially renovate an existing home, you could also qualify for a GST/HST rebate.

However, this rebate can only be claimed if the purchase price is $450,000 or less which means that most homes in Canada aren’t eligible.

Delay Home Buyers Plan withdrawal

Are you looking to purchase your first home? It might make sense to wait until 2020.

For first time home buyers, you can withdraw up to $35,000 tax free from your RRSP.

This is new for 2019, up from $25,000.

If you are moving in with your spouse or common law spouse, he or she can withdraw $35,000 tax free as well.

Together, you’ll have $70,000 tax free to use towards down payment of your home.

If you aren’t taking advantage of this, you can contribute to your RRSP but you’ll have to wait 91 days before you withdraw it under the Home Buyers Plan.

You do have to pay this back to your RRSPs beginning the 3rd year after you purchase your home.

So if you purchase in 2019, repayments start in 2022.

But if you wait one month until January, you can delay repayment for an extra year until 2023.

Make RRSP contributions

You have until March 2, 2020 to make RRSP contributions in order to pay less in taxes when you file your 2019 personal tax return.

Your 2019 RRSP deduction limit is 18% of earned income in 2018, up to a maximum of $26,500, less any pension adjustment plus any previous unused RRSP contribution room and pension adjustment reversal.

Many pharmacists are in the 43% tax bracket, so for every $1 you contribute to your RRSP, you reduce your taxes by $0.43.

So a $10,000 RRSP contribution could save you $4,300 in taxes.

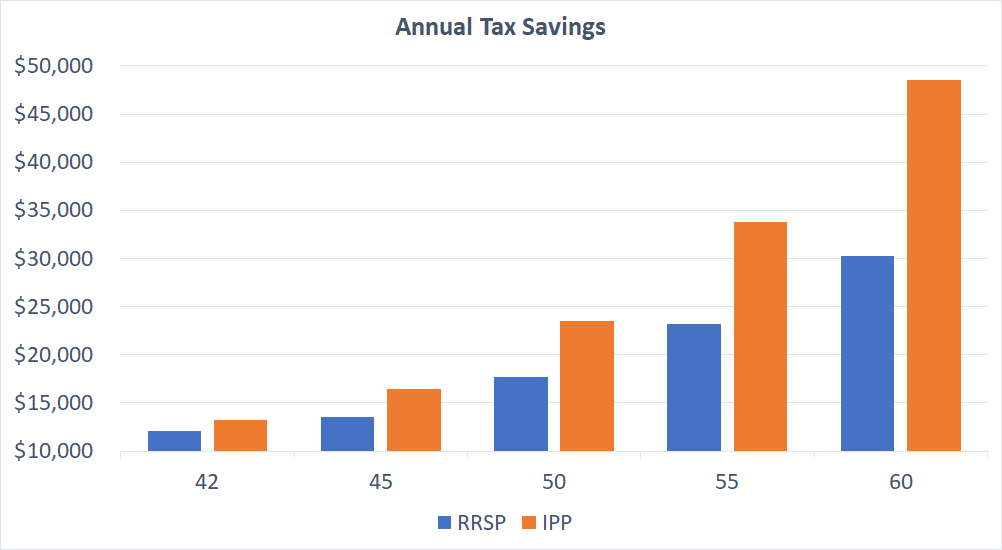

Make IPP contributions

For pharmacy owners who are over 40 years old and receive $100,000+ in salary, you shouldn’t be using RRSPs.

Instead, you can have your corporation start your own pension plan, which is customized to you and gives you the power to save up to 65% more for retirement than a personal RRSP.

Contributions are 2019 tax deductions to your corporation if made by December 31st.

Maximize your deductions to pay lower corporate taxes and defer personal taxes.

Make TFSA Contributions

The TFSA annual contribution limit increased to $6,000 in 2019.

If you haven’t previously contribute to a TFSA before, you can contribute up to $63,500 in 2019.

This limit assumes that you were at least 18 years old and resident of Canada since 2009.

If not, then double check your TFSA contribution limit by logging into CRA My Account.

Need To Withdraw From Your TFSA?

If you withdraw funds from your Tax Free Savings Account (TFSA) in 2019, you can contribute that amount back to your TFSA in 2020 or later.

So if you’re considering withdrawing from your TFSA in 2020, consider withdrawing the funds by December 31, 2019.

Let’s say you are considering withdrawing $10,000 in 2020; if you withdraw that amount by December 31, 2019, you can re-contribute $10,000 in 2020 instead of having to wait until 2021.

Remember that growth inside a TFSA is tax free, so try to maximize your TFSA contributions as much as you can.

Missing out on these strategies?

Schedule a free phone consultation and start saving tax.

Make RESP Contributions

Registered education savings plans (RESP) can help you save for your child’s post-secondary education in a tax efficient way.

The government provides a grant equal to 20% of the first $2,500 of contributions, which is $500 per year.

Contributions should be made by December 31st, 2019.

What if you can’t contribute?

Contribution room carries forward, so if you cannot contribute this year or if you haven’t contributed in previous years, you can play catch-up by contributing up to $5,000 to receive $1,000 in government grant.

If your child turned 15 this year and you have yet to setup an RESP, you need to contribute at least $2,000 by December 31st in order to receive government grant in future years.

Take RESP Withdrawals for Students in School

Did your child attend post secondary school in 2019? If so, consider withdrawing from the RESP before December 31st.

Education Assistance Payments (EAP) are withdrawals of government grants and investment growth which are taxable in the name of your student child.

It is very likely that he or she has sufficient personal tax credits such that he or she doesn’t have to pay any tax.

You don’t need to justify withdrawals so you should withdraw as much as you can tax free by December 31st.

Make Charitable Donations

Both the federal and provincial government offer donation tax credits which, depending on province, can result in tax savings of around 50% of the value of your gift in 2019.

Make your donations by December 31st to get a tax receipt for 2019.

Make RDSP Contributions

The registered disability savings plan (RDSP) helps families save for the long-term financial security of individuals with disabilities.

Similar to an RESP, your contributions are matched by government grants and the funds grow tax efficiently.

The government matches 100% of your contribution, up to a certain limit depending on your family income.

Even if you are in the highest tax bracket, you will still receive $1,000 in government grants if you contribute $1,000 by December 31st.

If you’re in a lower tax bracket, you will get even more government grants.

Do You Have Unprofitable Investments?

If you have investments with losses in a Non-Registered account, you could sell those investments to offset gains on other investments.

However, this transaction must be initiated by December 27th for the trade to settle this year.

There are two things to keep in mind:

The investment merits should trump any tax considerations, so careful consideration with your advisor or accountant should be made.

Also, be aware of the superficial loss rule, which denies a loss if you repurchase investments within 30 days before or after the original sale.

Gains on your investments?

If you have investments with gains in a Non-Registered account that you are looking to sell or withdraw, it might make sense to wait until January to sell.

If you sell now, then the tax on the gain would be due on your tax return deadline April 30, 2020.

If you wait until January to sell, then you won’t have to pay tax on that gain until April 30, 2021.

This strategy depends on your marginal tax rate and careful consideration should be taken before timing capital gains.

Conclusion

As 2019 comes to a close, what strategies will you use to help you pay less tax?

Today, we’ve touched on 18 ways and there are plenty more strategies available to you.

Most pharmacists overpay in taxes every single year and have no idea for two mains reasons:

- Many pharmacists “think” they get tax planning advice from their accountant but really all that gets done is their tax return

- Many try to do this on their own to save on costs but still end up overpaying taxes because they don’t know all the strategies out there

We help pharmacists pay less in taxes every year.

With client results ranging from $3,780 to $46,625 in tax savings every single year, how do you know that you’re not overpaying tax?

Schedule a free phone consultation to see what strategies you could be missing out on.

Ricardo Ardiles

About the Author

Ricardo helps pharmacists pay less tax, start/grow your pharmacy, and build your wealth.

Prior to starting Pharma Tax, Ricardo worked at another accounting & wealth management firm focused on dentists. Pharmacists were coming on as referrals and all said the same thing: what you guys are doing for dentists, we need that specialist for pharmacy. Hence, Pharma Tax was born.

Follow Pharma Tax on Social Media

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020