Growth of the Independent Pharmacist:

We have been speaking to more and more pharmacist that are tiered of being a staff or relief pharmacist and wanting to start their own pharmacy.

Many of our staff and relief pharmacist’s clients have learned how to manage and operate the pharmacy but are being forced out due to industry consolidation or low wages.

The other challenge next to consolidation is that there has been a flood of new pharmacists into the market due to international pharmacists coming in and the addition of pharmacy schools.

This has place many staff and relief pharmacists in both a hard and unique position.

When I mean hard, unfortunately, not all pharmacists want to own their own pharmacy and will still find it difficult to secure a solid wage and some will be forced out due to consolidation.

This means that they will have to find work with various government organizations or companies that require a pharmacy designation.

Others that have some entrepreneurial spirit will want to start exploring buying groups and various banners out there. This is where we can help.

Next Steps:

This post is not going to discuss the various banners/buying groups out there but will discuss the several ways to attain funding.

We understand that if you sign with some of the main banners out there that they have some great marketing deals but do tend to lock you up for 10 + years depending on the banner. This is an easy way to gain funding but remember nothing comes for free.

Yes, you will have the access to capital up front and for some, this may be the only feasible option depending on your financial situation. Do be careful and review the terms of the banner agreement and always have your accountant, lawyer or advisor review.

Before You Get Your Loan:

- Before any funding options are looked at. Get incorporated with a normal corporation (not a professional corporation as it limits your abilities to add non-pharmacist shareholders)

- If married, can add your spouse as a 49% growth shareholder – allows for the capital gains exemption in the future (Potentially $250K of tax savings in the future)

In terms of the details of the structure, speak with a lawyer, accountant or someone on our team. We are always more than willing to help.

Main Funding Options:

Big 6 Banks:

The easiest funding option is to go to one of our main banks (BMO, RBC or Scotia) and use their medical professional program.

Some buying of the buying groups and banners out there like UPG, Whole Health and API have programs with the various banks that make attaining funding easier.

Most will need 25% down and the balance will be funded through a Term 5 or Term 7 Corporate loan.

The rate will also be Prime + something and we typically see Prime + 1% to Prime + 2.00% if the pharmacist has a strong financial situation or higher if they are going for 100% financing with someone like Canadian Western bank typically.

Rate Change alert… Our friend at the Bank of Canada on target to continue to raise rates and this means that the interest payments will continue to rise. The Prime Rate stand now at 3.45%

This means that unless you are using a home equity line (HELOC) @ Prime then your Interest rates is typically – 4.45% to 5.45%.

Case Study:

Case Study:

For example, here is a client situation we encountered that already opened his pharmacy, but we said we could help improve his cash flow.

Pharmacist Bob just opened up a small pharmacy with an independent banner.

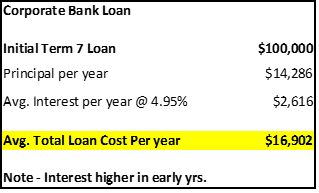

- Loan of $100,000 with the professional lending

- Interest rate he negotiated was Prime + 1.5% – 95% (Not bad – can do better)

- Term – was for 7 years

This means each year he must pay principal payments of $14,286 (not including the interest). See table below:

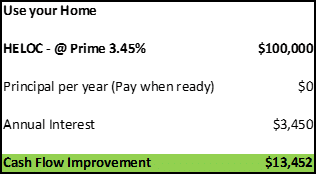

We were lucky that Bob is an older pharmacist and has his home partially paid off so we could consider the Be your Own Banker route. This means that you pay down the principal when cash flow is good not the bank telling you.

Some of you are thinking, well I don’t want my home on the line… Most banks require a personal guarantee, this means your home is on the line anyways so may as well setup the loan to save you cash flow.

Like dentist pharmacy bankruptcy rates are very low, yes you are taking a new journey if you are new as an owner but if you have the right team of professionals in place, they can help coach you.

The Big Picture:

When starting a pharmacy, cash flow is king and extending the financing terms as long as you can the better, especially when the loan is deductible to the corporation.

Let the loan pay for itself. A lot of people can get tied up by paying down their loan quickly because the hate debt but then reduce the true cash flow that the pharmacy will need for growth (marketing, expansions, new software/technology).

In the example above, we saved Bob over ~$13,500 in extra cash flow per year. Some may not think this is a big amount but when starting up and the Marketing funds come in monthly it goes a long way.

The best way is to become your own banker. What do we mean by this again? A lot of institutions want you to take a corporate term loan for 5 or 7 years and pay it back over time.

If there is room on your mortgage, we can help and go to the bank and create a home equity line of credit. This line of credit is tax deductible to your corporation (same as the term loan interest). But you decide when you want to pay the loan back.

Summary:

Remember, the loan is tax deductible so there is no rush to pay it off. Your mortgage is not so the strategy can be pay your home first, business last.

If you need help with loan financing, speaking with your advisor is a great start. Don’t automatically just go to the bank.

Also, be mindful, yes, the larger banners give you bigger up from marketing allowance but they always make their money. You can do this. It is a big step to be on your own, no one will pay you a wage but remember, you can still do relief work on weekends.

Always speak with your professional team and you will need one to help get things going.

Adam Tenaschuk

CIM, MBA | Partner

Adam is a founding partner of Pharma Tax and focuses on providing tax planning strategies to health care professionals. His goal is to provide simplicity and convenience to clients by coordinating all areas of personal wealth management so that his clients don’t have to. This means working with external professionals on: investments, insurance, business planning, retirement planning, and estate planning.

- How Do I Fund My New Pharmacy?Let Us Show You How! - January 18, 2018

- Are You Drowning In Accounting & Professional Advisory Fees? - November 28, 2017

- Your Advisor Vs. The New Robo Advisor – What’s Better? Is it for you? - November 13, 2017