Are you paying too much in Accounting & Professional Advisor Fees?

Do you feel that you are paying too much for accounting and professional fees? Is your accountant proactive? What does that even mean? Does your financial advisor or lawyer communicate with each other to make sure you have the right corporate structure in place to save your family tax?

What many pharmacists don’t know is that sometimes they are not getting the right financial advice and unfortunately paying too much in fees.

This will not only penalize you in terms of money in fees but also cost you thousands in taxes over time. All your professionals for one thing need to speak with each other and if they are not you have to make them.

The challenge is to get them on the same page.

Accounting:

Many accountants we have seen over time do an excellent job taking your information at the end of your year-end and preparing your corporate tax return as well as filing your HST return but are they providing you proactive accounting advice?

What does proactive accounting mean?

Basically, when you meet your accountant does he or she look at your overall big picture? Do they look at your corporate and personal needs, spending and debts?

Do they implement a plan to pay off your mortgage sooner or personal debts sooner (student debts or lines of credit)? Or do they just meet you once or twice a year and file your personal and corporate tax returns?

This is what proactive accounting means. It means looking at all the pieces of your pharmacy business and personal needs and building a roadmap that looks at addressing your goals.

These goals could be paying your debts faster, saving for your children’s education, protecting your family if a life occurring event happens, saving for retirement or buying/selling your pharmacy.

Accounting Fees:

Over our years of experience, most accountants work of an hourly billing rate that could amount to costing you thousands of dollars more vs. fixed cost accountants. We have seen that costs can range for one corporation and holding company from $2,250 to over $8,000 per year and do not include bookkeeping.

A true cost should be around $4,000 to $4,500 per year for the structure above (Pharmacy Corp and Holding Company + Personal returns for the family).

For a Pharmacy Corporation and personal returns, they should range from $1,500 to $3,500 but true cost being around the $2,500 mark. Are there cheaper firms out there than this, yes but remember you typically get what you pay for.

If you are paying more than this, I would hope that the accountant is working for the fees that he or she is charging vs. just the name at the firm.

Other Professionals:

In terms of your other professionals such as your financial advisor and lawyers they also need to earn their fees.

A lot of the time we find that the lawyers just take the instructions from the accountant and are basically implementers. May lawyers have templated articles of incorporation but yet charge an exorbitant amount of money for incorporating the pharmacist and don’t even think if it’s the right structure for you.

Also, we find that the financial advisor is not in the loop nor understands much about the accounting and legal side, which they should.

Financial Advisor Costs:

Many pharmacists will either get referred to a financial advisor (from a friend of professional) or work with one that has been referred by the bank. Sometimes this means working with someone from RBC DS Securities or TD Waterhouse as an example.

One thing you should always ask your advisor is how they get compensated for the work they do. Don’t use an advisor that uses commission structures called Deferred Sales Charge and Low Lowed Deferred Sales Charges.

This structure pays the advisor 5% to 3% typically upfront and you are locked into a fund company’s product for 3 to7 years.

True Example:

We have one client that is locked in Primerica’s product and cannot move to another advisor now without taking the penalty fee as their products are proprietary. This client either must wait the fee out as it comes down by 10% each year or take the hit in penalty fees.

Basically, you are paying back the commission that was paid to the advisor as in this example Primerica paid the advisor a lump some so needs time to recoup these costs through investment fees.

For example, the charge on a $100,000 “DSC’ed” fund will be around $5,000 or so in the early years and gradually comes down over the 7 years.

Use an advisor that is fully transparent and charges a Fee for Service cost. This means that you are never locked in and he or she is not bias to a fund company.

These advisors can also reduce your cost as you grow with them (again this cost is always negotiable so try to reduce your fee with them). They try to state that their fees are set via the bank or investment dealer but most are independent advisors and if they want your business can fight for it!

They typically charge is around 0.7% to 1.25% depending on the size of the account for the advisor cost. Also remember that you have to add the cost of the investment products that typically can run 0.03% to 1.5%.

Vanguard states that in 2016 the average Management Expense Ratio or MER for both Advisor Compensation and Cost to run the fund is around 2.23% or for a million dollar account $22,300 per year in fees. Is that advisor working for these fees and looking at your big picture?

Advisors should not only get paid for managing your investments (but many do), they should get paid to liaise with your other professionals to make sure everything you have (RRSPs, Individual Pension Plans, Insurance) fits with your goals and objectives.

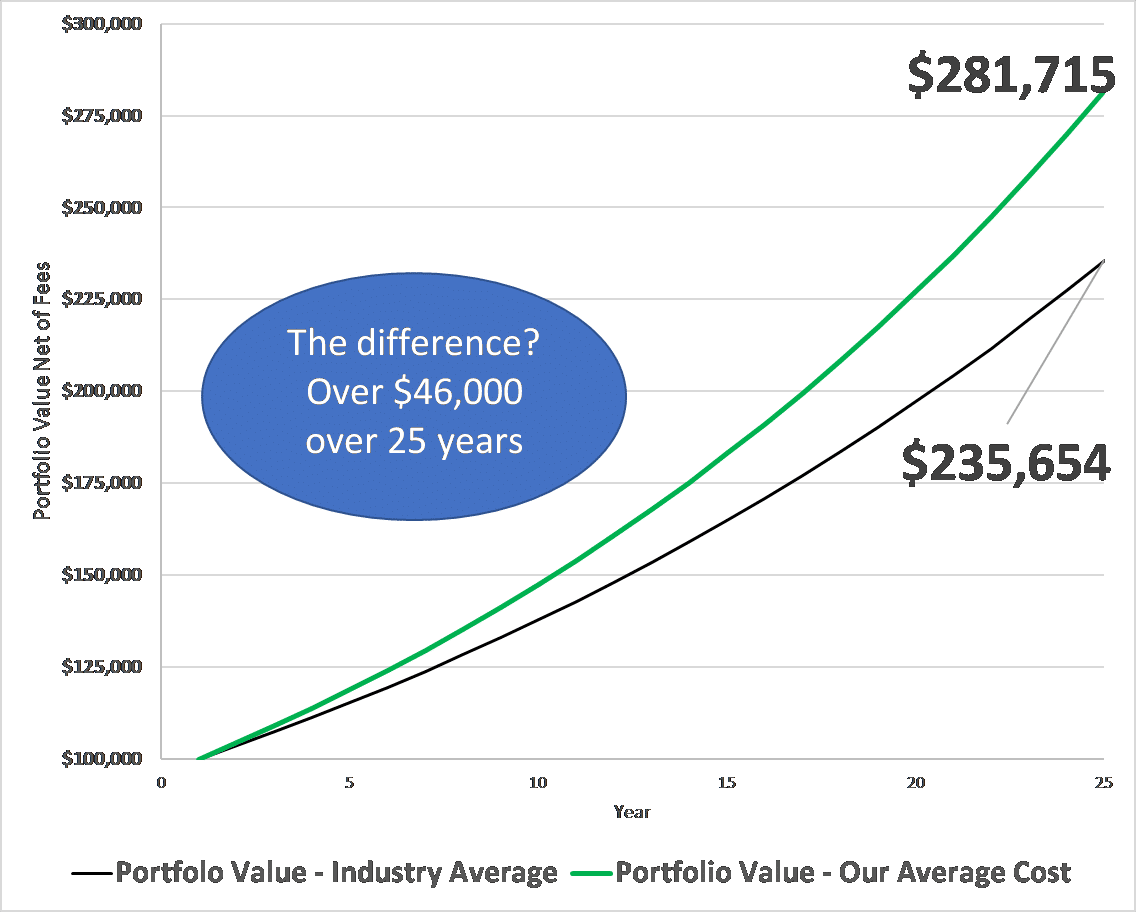

Here is an example of a $100,000 account using the 2.23% MER compared to a fee based account with a combined MER for 1.5%. Using a 6% growth rate and no additional funding, over 25 years the pharmacist could have save over $46,000. Now imagine if you we adding to this and your account was double or triple this amount.

Case Study:

We met a pharmacist client that was recently let go from Loblaws and started his own pharmacy independent. Prior to meeting us he met with another accountant for an intro meeting and got charged $600 +HST.

The accountant charged him for the initial meeting and then installment payments before he agreed to become a client even…

After the meeting he went to see a lawyer that also charged him a large fee to incorporate but did not consider adding his spouse that is a pharmacist as well as the 49% shareholder.

This would allow them to take advantage of the Capital Gain Exemption in the future. The other good news is that she is a pharmacist as well so if the government tries to take this away as they tried to in the last discussion papers that it would be harder as she will be eventually active in the business.

The issue:

Now the Articles will need to be amended and a potential freeze of his shares for the current value may need to be done in order to add his spouse. This will then cost the client even more because a new lawyer will have to undo the wrong work that was done.

The lawyer did not think and just did the templated work he was using to doing. The lawyer also charged over $2500 for the legal work + the college fees.

Conclusion:

Therefore, it is very important to make sure your professionals know your big picture and implement things correctly. Make sure you just don’t go to randomly referred professionals and work for a firm that works for you.

Firms that do a majority of the work under one roof are typically better as you will save on fees and have all the proper parties speaking to each other.

Big picture, keep more of what you earn, save tax and grow your net worth faster.

Adam Tenaschuk

CIM, MBA | Partner

Adam is a founding partner of Pharma Tax and focuses on providing tax planning strategies to health care professionals. His goal is to provide simplicity and convenience to clients by coordinating all areas of personal wealth management so that his clients don’t have to. This means working with external professionals on: investments, insurance, business planning, retirement planning, and estate planning.

- How Do I Fund My New Pharmacy?Let Us Show You How! - January 18, 2018

- Are You Drowning In Accounting & Professional Advisory Fees? - November 28, 2017

- Your Advisor Vs. The New Robo Advisor – What’s Better? Is it for you? - November 13, 2017