Like with any business, having a strong, steady cash flow is integral to running things efficiently. The same goes for pharmacies.

If your pharmacy is struggling with its cash flow, you might be seeing the effects in other areas of your business. Cash flow problems can be disastrous for businesses, so it's important to be actively managing your accounting and financial statements in order to avoid any big problems.

4 Strategies For Improving Cash Flow

If your pharmacy cash flow is struggling, you will need to adopt some strategies that can help rejuvenate your pharmacy business. Here are 5 strategies that can be implemented to improve your pharmacy's cash flow.

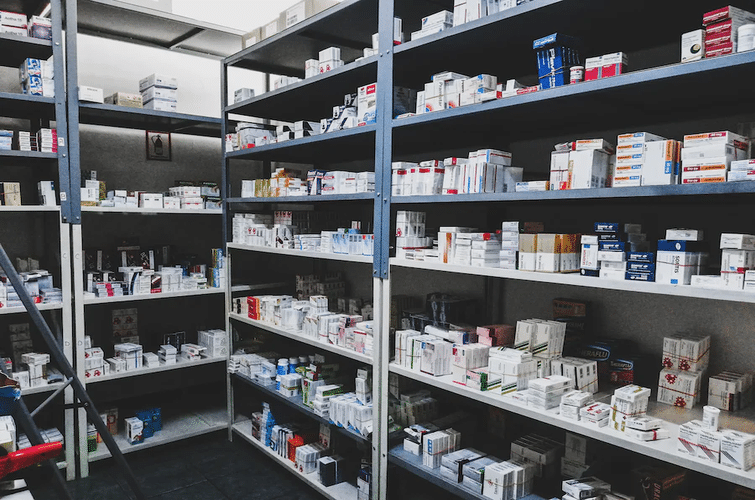

Inventory Management

One of the most crucial steps you can take to improve cash flow is through inventory management. While inventory is a driving force for cash flow and profitability, it can also be a huge expense if the products aren't turning over.

Inventory turnover is a ratio that measures how many times you sold and replaced your inventory during a given period.

A good ratio to have for an efficient pharmacy is 12-13 times per year, meaning you are selling your entire inventory and replacing it about 12 to 13 times every year.

Understanding your store's product movements can help you make decisions that can save you a significant amount of money. Look at your customers' spending habits. As much as inventory levels and spending habits can be constantly changing, paying attention to your catalogue and the types of products that aren't selling on a regular basis can help you manage your catalogue of products more efficiently.

Inventory Management Systems

For many pharmacy owners, an inventory management system can be a huge asset and can have many benefits. For many pharmacies, McKesson integrates directly into your inventory management system to allow automatic ordering, prescription organization, and inventory support.

This kind of system can help you avoid having too much cash tied up in products that aren't selling or spending money on overhead costs that are needed to store these products.

There are many stores out there who do not integrate their inventory management system with their main supplier(s). For these stores, it is very likely you are spending more time and money on labour costs than necessary by ordering and managing inventory manually.

Product Expansion

When you walk into a grocery store with a list of items you need to grab, you often end up grabbing one or two more things that you see while in the store. This same habit can occur in pharmacies which can increase your sales and improve your cash flow.

While, as we've just seen, product management is key to improving cash flow, product expansion can be an effective way to increase your pharmacy's profits.

Instead of your patients only coming in for prescriptions and over the counter products, provide different pharmacy adjacent products that they can pick up at the same time.

Think about the needs of your patients, and what they ask you when they visit your store. This will let you assess the demand for particular products.

For example, the majority of patients at many pharmacies are seniors who also need home healthcare products such as canes, blood pressure machines, compression socks, etc.

Be intentional with the products you offer in the front end, and the profit margins that make it worth your time.

Many of our top clients only offer front shop products with 30% or more profit margins.

Managing Expenses

Taking a look at your expenses on a monthly basis can have a huge impact on your store’s overall profit. Unfortunately, most owners do not talk to their accountant until after the year end, so they run their stores blindfolded when it comes to managing revenues and expenses.

Paying for subscriptions that you don’t use anymore? Cancel them.

An efficient pharmacy has overhead of approximately 20% to 25% of overall revenue. Your overhead expenses include your day-to-day expenses to run your pharmacy outside of inventory, such as rent, staff, marketing, accounting, utilities, and more.

If you’re outside this benchmark, you may be spending too much at your store and there may be an opportunity to cut some of the fat.

Staff is one of the highest expenses in any pharmacy. Looking at metrics such as scripts per labour hour can let you know if you have too much staff. While this metric will vary depending on size of store, the average is about 6-7 scripts filled every hour.

Strong Accounting Practices

Sometimes, the accounting aspects of your pharmacy can be the biggest challenge that independent pharmacies have to overcome.

To increase cash flow, it is essential to stay on top of your numbers. Investing in a great bookkeeper can help you keep your books in good order, being updated on a monthly or quarterly basis, at a minimum.

Investing in a great accountant can help you better understand the financial aspects of your store and where it is headed, such as revenue growth by department, gross profit margins, prescription versus front shop products, accounts receivable, payroll, and minimizing taxes.

Accountants in many ways are like pharmacists - they are capable of doing much more than just filing tax returns (or in a pharmacist’s case, dispensing medication). The true power of accountants is in the value-added services such as providing advice and strategies that will help you grow the profitability of your store and minimize taxes.

Especially if you are having trouble increasing the cash flow of your store, a great accountant will work with you to create a budget and set targets for revenue, expenses, and profit. As you meet throughout the year, together you can compare the budget with your actual results and assess the good, the bad, and the ugly.

A great accountant should act as your Chief Financial Officer for your business by helping you set targets and holding you accountable to do the activities to reach these targets. They will help you track key metrics, helping you understand what the numbers are telling you, and create a plan of action to take your business to the next level.

PharmaTax

Are you a pharmacy owner looking for a team of professional accountants to help you with your business? The team at PharmaTax has experience working with independent pharmacy owners looking to improve their pharmacy's cash flow and overall business transactions. With a variety of services available for pharmacists, we are confident that we can help you reach your financial goals!

- With The New Capital Gains Tax Changes for 2024, What are the Best Places to Tax Shelter My Money? - November 1, 2024

- Business Overhead Insurance: What it is & Why You Need It - October 18, 2024

- How Long Do I Need to Keep Receipts? - October 5, 2024