An estimated 73% of Canadians will not have their final wishes be taken into consideration at death and/or distribution of their assets will be handled solely by generic government guidelines.

Why? Because they lack estate planning.

We have all heard the saying, or various iterations of it, that “in this world nothing can be said to be certain, except death and taxes.”

There are many who attribute this quote to the great Benjamin Franklin, as it appears in a letter that he wrote in 1789.

Much has changed in our society since his time, and the human species has evolved and developed many great technologies to help enrich our lives.

But despite all the advancements of the 21st century, and while there are ways to delay or put off acknowledging the inevitability of the things Mr. Franklin referred to, the fact remains that eventually everyone will have to pay taxes and everyone will die… and we have to pay taxes even after our deaths.

So, what do you do when you can’t avoid doing something you don’t want to do?

You develop a plan that will work to diminish as much of the negative ramifications as possible.

Here are 5 tips for making sure pharmacy owners like yourself are prepared for the expected end of their careers, or unexpected scenarios where you pass on while still operating your pharmacy.

Tip 1: Outline Your Pharmacy’s Business Plan and/or Life-cycle

How many store fronts do you want to own?

What rate of growth do you want to achieve, if any?

How old do you want to be when you retire?

Regardless of the specific answers to these questions, at the end of the day, you can’t get to where you are going if you don’t have a map to get there.

While some strategies and opportunities may change numerous times over the course of a career, it is important to develop at least a basic vision of how you want to start and, more significantly, how you want to finish.

There are two extremely important questions that you will need to ask yourself:

1) What will happen to my pharmacy when I retire?

Most people spend the majority of time focusing on running their pharmacy’s daily operations and maximizing profits so they can make a living, but few owners give consideration to the fact that it is up to them to make sure the business is in a position to continue operations without them.

After all, pharmacy owners have an obligation to ensure that any employees who are part of the business will still have a job, and loyal customers can continue to get help from a location that they know and trust.

In other words, your pharmacy doesn’t just magically continue to exist after you step away from your career.

Possible plans for secession can include:

- Selling to another local pharmacy owner or large corporation;

- Grooming a successor from within the existing staff; or

- Handing off operations to an offspring or other family member

2) What will happen to my pharmacy if I die without a Will and before I retire?

In Ontario, if you die without a Will it is called an intestacy.

If you are like most people who are survived by family after they pass on, then the Succession Law Reform Act determines that your estate and assets will be divided to those family members based on a standard procedure and set of rules.

However, if you do not have a family, or more importantly, if you would not want the entirety of your estate going to certain family members or have certain family members control your estate, then preparing a Will and Powers of Attorney is crucial to creating certainty in outlining your last wishes.

Also, even if you verbally ask someone to be your executor, without a legal Will that person will need to go through the process of applying to the relevant court in order to be appointed as the Estate Trustee.

Picture this, you have worked hard to build your pharmacy business from the ground up.

You have acquired and/or developed a quality staff and established a solid reputation in the community.

Everything is going great, your tireless efforts have paid off, and you are providing your family with a comfortable life…. but then tragedy strikes, resulting in your unexpected passing.

Now, not only does your family have to deal with losing a loved one, but they have also been forced into Probate to try and determine how your estate and assets are to be handled, and to top it all off they are now forced to run your business all at the same time.

Perhaps none of them have experience or any interest in taking over a pharmacy operation.

Perhaps you have had a falling out with certain family members and have no confidence or desire in them to be able to take over your legacy.

After all, you have gotten into the pharmacy business to help people, right?

It would be a shame to see those intentions and efforts fall by the wayside because you failed to plan ahead.

The bottom line is, don’t ask “what happens if I die without a Will?” … don’t even take the chance!

Tip 2: Structure Your Business Properly (is incorporation right for you?)

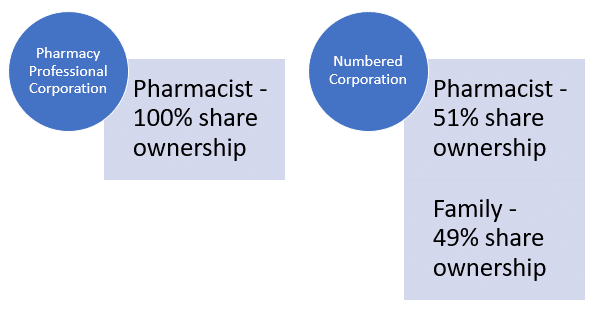

How you structure your business will have a great impact on how you structure your Wills and which estate planning strategies you can take advantage of. Organizational characteristics to consider will be:

- Remain as a sole proprietorship or incorporate as a private company

- Keep pharmacy and retail departments separate

- Establish both an operating company and holding company

- Number of shareholders (if incorporated)

There will likely be three main determining factors that will influence how you structure your business:

1) Results of Government Corporate Tax Restructuring

There was plenty of talk throughout the summer and fall of 2017 about the federal government’s proposed closing of “tax loopholes” that focus on private corporations and tax planning strategies.

On October 16, 2017, and after a debatable length of time spent considering their ultimate course of action, the Liberal government announced a few changes to certain tax rules, including:

i) A decrease in the federal small business tax rate from 10.5% in 2017 to 9% by 2019:

This is, obviously, a good thing which will hopefully encourage greater entrepreneurship in the Canadian market. This will also allow pharmacy owners to initially retain more earnings. We say initially because there are different things you can do with those earnings that will have different tax implications

ii) There will be no changes to the Capital Gains exemption

This means that, if you have established your pharmacy as a true family business and it is your intention that your children (or another family member) will take it over, there will be no impact on the transfer process as was initially anticipated; and,

See related: How the Latest Tax Changes Will Affect Your Pharmacy Corporation Effective January 1, 2018

iii) Income splitting will come to an end

This was probably the most talked about aspect of the proposed changes and the one that was met with the greatest concern.

Basically, the government will no longer allow family members in a lower tax bracket to receive income that would have normally gone to the owner from the private corporation.

Family members will only be able to receive income if they actually work for the pharmacy, and they will also now be required to pass a new “reasonableness test”.

Essentially, this test will be used to compare the family member’s job responsibilities to how much income they are receiving from the corporation to make sure they are reasonably compensated (ie. not being overpaid).

Family members will also be able to receive corporate dividends as a shareholder, but must prove that they have made an appropriate capital contribution.

For some, the opportunity to income split was a significant determining factor in their decision to incorporate, so this rule change will have great impact on how estate plans are structured.

2) Pharmacy’s Net Income vs Your Cost of Living

Despite the government’s push to close “tax loopholes” such as income splitting with family members, there are still other factors to consider with thinking about your business structure.

Your overall net income is a significant one, especially as it compares to your own personal cost of living.

If your pharmacy is very successful and is showing considerable enough profit that you can meet or exceed the amount needed for you to live comfortably, then incorporating might be the right way to go to take advantage of the government’s renewed commitment to lowering corporate tax rates.

Now, there is a caveat to this, which is the government’s decision to cap the annual amount that you will be able to passively invest inside the corporation at $50,000.

Naturally, this has ruffled a lot of feathers as it will force those who have the ability to retain above that figure to move it out and into other accounts.

Of course, if you aren’t bringing in a significantly greater amount of income than what you need to live and invest on, then keeping your pharmacy as a sole proprietorship may be your best play.

3) Family composition

Prior to the recent corporate tax change announcement, discussions of family composition would have resulted in a conversation about income splitting and deferring income to a spouse or adult children.

Instead, family composition will play a role in your business’ structure based on whether you want to make it a family pharmacy from a secession or, in this case succession, strategy.

If you have family members who actively participate in the running of the pharmacy and have expressed the desire to take over for you one day, then waiting until retirement may be too late, especially in the case of unexpected death before a proper transition is completed.

Corporate structures can be adjusted as family members enter into, or leave, the business to help avoid operational problems during unexpected events.

Tip 3: Primary and Secondary Wills

Also known as personal and corporate Wills, having two separate Wills allows you to identify which assets belong to you, and which ones belong to the pharmacy.

Having only one Will results in all assets affiliated with you being pooled together, regardless of whether they are associated with and are used solely for the business, which in turn means that Probate fees, or estate administration tax, will be charged on the entirety of your estate.

This also means that your estate trustee (formerly known as the “executor”) will have to go through Probate for absolutely everything in order to make sure all items are distributed properly.

Using a secondary Will to assign specific assets to your pharmacy will help to reduce or avoid Probate for those properties and make the transition of operations significantly smoother.

It will also reduce the amount of tax paid out of your estate during the Probate process as they are calculated as a percentage on the total value of assets contained only in the primary Will.

See related: 6 Ways to Reduce Probate Fees and Save $30,000 Before It’s Too Late

Tip 4: Limited or Specific Powers of Attorney

Powers of Attorney are different from Wills.

A legal Will provides direction as to your wishes and intentions after death, while Powers of Attorney are brought into effect when you are still alive, should anything happen that results in your incapacitation or inability to make personal, financial, or business decisions.

As with preparing specific Wills to keep personal and corporate assets separate, establishing limited or specific Powers of Attorney can also help to keep things neat, tidy, and organized during unfortunate situations.

For example, perhaps you have a business partner or employee who you have tremendous confidence in to run the pharmacy in your absence on a daily basis for short or long-term periods of time.

However, you would not feel comfortable with that person making the decision to take you off of life support.

Likewise, a spouse or adult child may make the most sense to handle your personal affairs and finances, but they have no involvement or knowledge in pharmacy operations so it would be a mistake having them oversee business decisions.

It is important to remember that in naming someone as a Power of Attorney you are granting them the ability to make decisions on your behalf in whichever areas you have identified.

Unlike a Will where you legally outline your desires, the person who holds your Power of Attorney has some flexibility to operate as they see fit.

This means that great consideration should be given to who you ask to fill this role and there should be a mutual understanding as to how certain situations and decisions should be approached.

Tip 5: Estate Freezes or Trusts

Before we begin to highlight some of the characteristics of an estate freeze, it is important to acknowledge that this is perhaps one of the most complicated strategies of tax and estate planning.

While we will do our best to illustrate the most important things to consider, if you think initiating an estate freeze and setting up trusts will be beneficial to you, a tax, legal, and/or estate planning specialist should be engaged to ensure that all possible details are accounted for and the proper process is followed from start to finish.

An estate freeze is a strategy that is commonly used in situations where a business owner is getting close to retirement, has a clear plan of who will be taking over operations, and is fortunate enough to already have a solid financial portfolio in place to accommodate or maintain a lifestyle they have become accustomed too.

Simplified, it consists of the primary owner of a pharmacy making a change to the type of shares s/he holds for the purpose of locking in, or “freezing”, the current value of the private corporation.

This is done by exchanging his/her common growth shares for preferred shares that have a fixed value equal to the fair market value at the time of the freeze.

The intended successor(s) will then acquire new common shares, which will be associated with the future growth of the corporation from the time of the freeze.

Benefits

- Allows the primary owner to start to prepare for exiting the pharmacy while still maintaining control of the business until they are ready to officially retire

- Reduces the future capital gains charged to the transferor’s heir(s) at time of his/her death because only the preferred shares will be part of the estate

- Defers the amount of income tax paid on capital gains until the time that the transferor’s shares are actually or deemed to be disposed, by death or otherwise

- Provides an opportunity to transfer ownership to the next generation (if family) or allow key employees to be included in the future of the business, thus building goodwill, loyalty, dedication, and a smoother succession process

- Can provide a source of income by receiving a payout of dividends on the frozen shares

Considerations to setting up an estate freeze

- Life expectancy of the current primary owner

- Life expectancy of the business

- Future income needs and lifestyle

- Impact of estimated inflation

- Clearly identified successor(s) and/or succession plan

- Ability of successors to manage and preserve business growth and development as well as directly-controlled wealth

- Ability of the company to fund orderly payments to the retiree as required/necessary to fund retirement

Wills must be prepared or revised to ensure the objectives of the freeze are achieved when the transferor dies

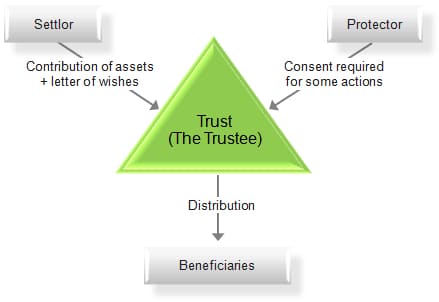

Trust accounts

A trust account, or multiple accounts, is/are a particularly useful tool in an estate freeze, especially when dealing with a family pharmacy where the intention is to pass it on to the next generation.

The key feature of a family trust is the power of the trustees (usually the parents, who control the family pharmacy) to appoint the capital and income of the trust to one or more specified beneficiaries, or exclude others.

When the trust is established for the purpose of holding company shares, it will allow trustees to decide who among their children will receive them, provided the children are grown up and demonstrate an interest and ability to operate the pharmacy.

Trusts can also be used to distribute share proceeds, should the parent(s) decide that the pharmacy is to be wound down or sold to an outside party.

Another useful aspect of a properly constructed family trust is the opportunity to take advantage of more than one family members’ capital gains exemption eligibility.

When shares of a corporation are held in trust and then sold, as long as the account(s) is/are set up properly, the trustees will be able to allocate capital gains to multiple beneficiaries.

In turn, they can each use their own respective capital gains exemptions to protect their allotment.

Conclusion

A survey executed by Google Consumer Surveys as recent as 2016 indicated that approximately 62 percent of Canadians are not in possession of a Last Will and Testament.

This is an astonishing number, especially combined with a figure from the same survey showing that almost 12 percent of Canadians have a Will that is outdated.

This means that at the time of death, an estimated 73 percent of Canadians will not have their final wishes be taken into consideration and/or distribution of their assets will be handled solely by generic government guidelines.

By making sure you have a properly prepared and up-to-date Will, you can insure that your final wishes can be executed without confusion.

Losing a family member can be hard enough without the added stress of trying to guess at how they wanted things to be left and to whom.

It is imperative to engage your tax and legal advisors and use their estate planning and administrative services to allow your loved ones to focus on what is most important, dealing with an emotional loss.

Experienced professionals should be able to explain the ins and outs of building a Will, have the knowledge to make suggestions, build and execute estate freezes, and setup trust funds for loved ones to make sure assets are distributed properly.

Ryan Carson

BKin, LL.B | Lawyer

Ryan Carson, BKin, LL.B., practices Real Estate Law, Corporate & Business Law, Wills & Estate Administration, and Intellectual Property Law. Ryan is a registered trademark agent.

Ryan’s goal is to help you in various legal aspects of your Pharmacy, including but not limited to: drafting shareholder agreements, assisting in the sale and purchase of your Pharmacy, and drafting Wills and Powers of Attorney.

Website: http://www.breenlaw.ca/

- What happens if you die without a personal Will? - February 2, 2018

- Matters of Life and Death: 5 Estate Planning Tips for Pharmacy Owners - October 25, 2017

- Consider a Career as a Locum Pharmacist - July 24, 2017