Tax increases on passive investments inside your corporation are on their way.

So how will you, a pharmacy owner, save within your corporation without paying 70% tax?

An individual pension plan (IPP) remains one way to do so.

And this strategy is not affected by these upcoming tax changes. But what exactly is an individual pension plan?

Most likely you’ve heard of group pension plans that staff and hospital pharmacists get from their employers.

See related: Pension Plans for Staff and Hospital Pharmacists

Think of a group pension plan as an off-the-rack suit.

Sure, it looks great and fits OK but doesn’t quite have the snug feel that a bespoke suit has.

And that is exactly what an IPP is: a bespoke pension plan, customized to you, the pharmacy owner.

What is an Individual Pension Plan (IPP)?

Considered the Cadillac of pension plans in Canada, an IPP is a defined benefit (DB) pension plan that allows business owners to save for retirement.

See related: What is a defined benefit (DB) pension plan?

- It works like an RRSP where your investments grow tax-sheltered

- Annual contribution limits are higher than an RRSP

- Greater accumulation – up to 65% more than an RRSP by retirement

- It sets how much retirement income you will receive, which is guaranteed and payable for life

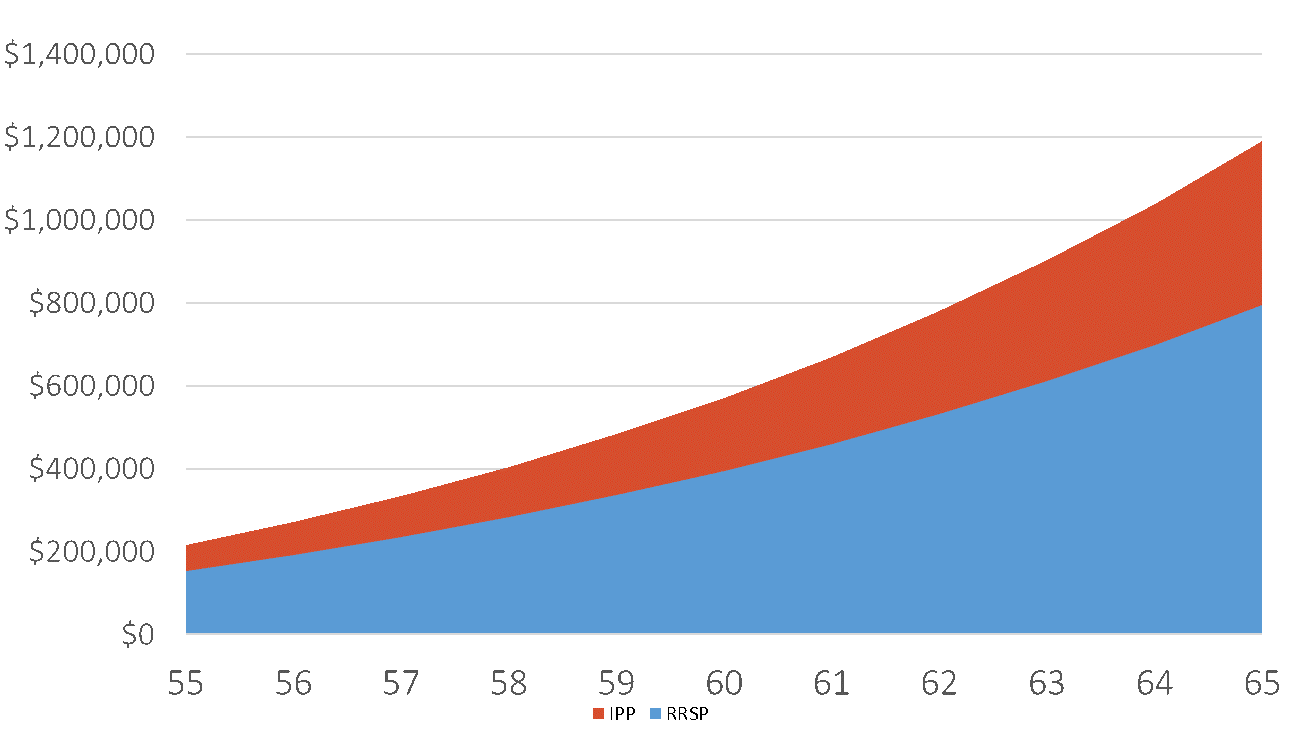

Here is an example of a Pharmacist earning $140,000 who started an IPP at age 40. The older you are, the more contribution room available in an IPP vs RRSP.

But why do IPPs have higher contribution limits?

Because IPPs promise a certain amount of income at retirement while RRSPs do not.

The older you are, the less time there is to meet this obligation, resulting in higher contributions limits.

Over the long run, you can accumulate up to 65% more in an IPP vs an RRSP.

What are the benefits of an Individual Pension Plan (IPP)?

An IPP is one of the best tax planning tools that Pharmacy owners can leverage because it is an excellent way to save for your retirement and the contributions are large tax-deductions for your company.

- IPPs are 100% creditor proof

- All contributions and costs associated to the pension plan are tax-deductions for your company

- Minimum rate of return of an IPP is 7.5% per year

- If the return is less than 7.5%, your company can make additional tax-deductible contributions

Here is an example of a Pharmacist who decided to stop contributing to his RRSP and instead started an IPP at age 55.

By age 65, the IPP grew to $1,300,000; had he decided not to start an IPP, his RRSP would have grown to $800,000.

RRSP vs IPP Values at Retirement

This Pharmacist was able to accumulate $500,000, or 62%, more by saving inside an IPP instead of an RRSP!

Which one would you prefer to live from…$1,300,000 or $800,000?

Opportunity to Transfer Wealth to Family Members

IPPs are a great vehicle to transfer wealth to family members at retirement or upon death.

Just like an RRSP, upon your death, the IPP would transfer to your spouse on a tax-free, rollover basis.

If your Pharmacy continues after you retire, the family member(s) taking over the business can be added as member(s) of the IPP.

If your Pharmacy continues after you retire, the family member(s) taking over the business can be added as member(s) of the IPP.

Or if family members don’t have any interest taking over the business, you can add them to the IPP if they are on your payroll.

By leaving the IPP open, any assets not used to provide benefits to you will remain inside the IPP and can be transferred to your children without triggering tax.

This means that upon death of you and your spouse, the remaining IPP assets can be transferred to your children, who are members of the IPP, without triggering tax.

You cannot get that with an RRSP, which triggers a tax liability to the estate upon death of the second spouse.

Are you a good candidate for an IPP?

An IPP is specifically designed for Pharmacy owners and locums who:

- Are age 40 and over

- Practice under their own corporation

- Earn $100,000+ in T4 income (salary)

Incorporated Pharmacists who pay themselves dividends are not immediately eligible because dividend income does not generate RRSP contribution room, which is what you need to contribute to an IPP.

If this is you, don’t get upset because with proper tax planning, Pharmacists can optimize their earnings through a combination of salary and dividends so that in one year, you can start contributing to an IPP and skyrocket your retirement savings.

Learn More about Individual Pension Plans

With the Federal Budget changes from 2016, there are Pharmacy owners who are struggling to qualify for the small business tax rate and are now paying more tax as a result.

IPPs are a great way to not only skyrocket your retirement savings but also help lower your business income to the Small Business Deduction (SBD) limit of $500,000.

And with the latest tax changes set for 2017, pharmacy owners will be looking for ways to invest inside their corporation without getting hit with a 70% tax rate.

To learn more about how an IPP can be customized to meet your needs, contact us for a free consultation and start paying less tax today.

Ricardo Ardiles

CIM | Partner

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020

Trackbacks/Pingbacks