Should you invest inside your pharmacy corporation?

On October 18, 2017, Federal Finance Minister Bill Morneau announced tax changes to passive investments held inside private corporations.

Many business owners use surplus cash to create investment portfolios within their corporation. This means opening an investment account in the name of your corporation, depositing this surplus cash, and investing into securities such as:

- Stocks

- Bonds

- Mutual funds

- Exchange Traded Funds

- Hedge Funds

These investments are called “passive investments” because they aren’t used to help you generate revenue at your pharmacy.

Many business owners use passive investments to fund their future retirement, and rightly so.

As a Pharmacy owner, it is important to understand how investment income is taxed inside your pharmacy corporation and how these tax changes will impact the investment choices you make.

As a result, the question many are asking is: should I still invest inside my corporation?

Here we explain the answer.

How is Investment Income Taxed Inside Your Pharmacy Corporation?

There is a significant difference in the way that investment income is taxed compared to active business income inside your corporation.

Recall that for active business income under $500,000, the small business tax rate of 15% in Ontario (as of 2017) applies.

See related: Small business tax rate will change as of January 1, 2018

However, investment income is not eligible for the small business deduction and instead is taxed a higher corporate tax rates.

But why?

Because you aren’t using these passive investments to generate revenue at your pharmacy. These investments are mainly used to save for retirement or other purposes besides re-investing into your pharmacy.

As a result, any interest income, dividend income, or capital gains that you earn on your investments inside your corporation are taxed at higher rates to make the after-tax amounts comparable to if you had taken that money out of your corporation and invested it personally.

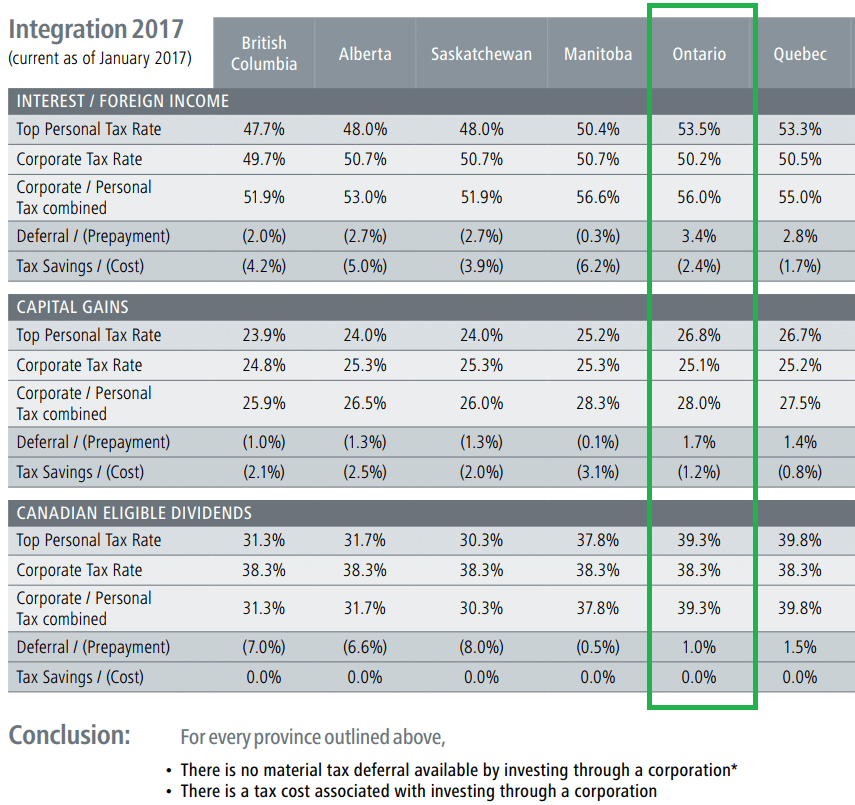

This is called “tax integration” and the tax rates are different depending on the source of investment income: interest income, dividend income, and capital gains.

Source: Mackenzie Investments: Income in a Corporation 2017

There are a lot of numbers in that chart – just know that tax integration has equalized the tax differences between investing personally vs investing corporately.

If you are going to invest inside your corporation, don’t invest into products that pay interest income, such as government bonds, because those are taxed at higher rates.

The combined corporate/personal tax rate in Ontario is approximately:

- 56% for interest income

- 39% for Canadian eligible dividends

- 28% for capital gains

Thus, it is much more tax-efficient to have Canadian equities that pay dividends and/or grow in value over time (called a capital gain) because there are tax credits that reduce the rate of tax paid on these types of investments.

What Happens When I Liquidate the Investments Inside my Corporation?

Assume you’re ready to withdraw your investments, how do you get your money? There are a few steps:

- Liquidate some or all of your investment portfolio

- Pay corporate tax on the proceeds

- Pay yourself a salary or dividend using the after-tax proceeds

- Pay personal tax on the amount that you receive

The government has equalized the tax rates such that you would have earned the same amount if you had invested that money personally vs inside your corporation.

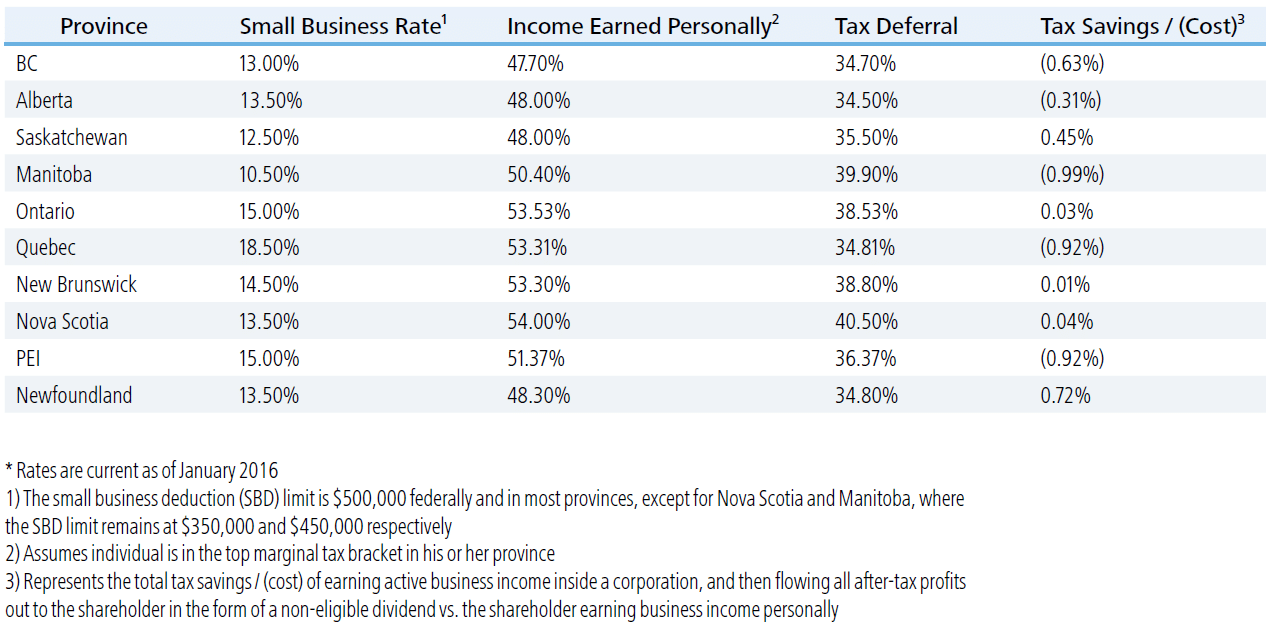

This is called “tax integration” and the following table shows tax savings/(cost) of investing inside your corporation vs investing personally.

Source: Mackenzie Investments – Tax & Estate Planning for Business Owners Part II

What do these numbers tell us?

By investing inside your corporation, you can pay a lower small business tax rate initially and defer paying a higher tax rate until you sell/withdraw the investments.

By investing personally, you are subject to a higher personal marginal tax rate initially but pay a lower tax later when you sell/withdraw the investments.

What’s the conclusion?

Due to tax integration, there is no material difference in investing inside your corporation compared to investing personally.

So What is The Government Complaining About?

There is a “perceived benefit” to the tax deferral that we described above.

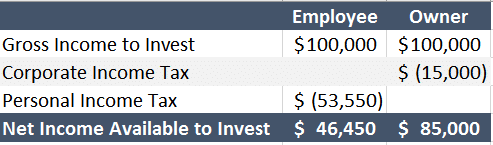

Finance states that there is no tax provision to align the after-tax cash flow available to fund corporate investments with the after-tax cash flow to fund personal investments.

Here’s what we mean:

Because of the small business tax rate, corporations have more after-tax dollars to start their investment portfolio vs if you start the investment portfolio personally.

But as we saw above, due to tax integration, when you eventually withdraw the money from your corporation, you will wind up with approximately the same after-tax amount as you would personally.

Nonetheless, the Government wants to eliminate this perceived benefit.

What Tax Change Was Announced?

The Government announced measures to limit tax deferral opportunities on passive investments held by private corporations:

- A $50,000 threshold would be set for annual passive investment income earned in a Canadian small business

- Grandfathering of all past (existing) investments and income earned from those investments;

- Incentives will be introduced to encourage investment in innovation by venture capital and angel investors.

The date as to when these changes come into effect are still unknown but the good news is that any corporate investments made before this date will be “grandfathered” and not subject to the new rules.

We don’t know how the Government plans on tracking this new threshold but will be announced in Budget 2018. Good luck with that!

How are You Affected?

If you invest inside your pharmacy corporation, you need to carefully plan future investments.

For example, assuming a nominal rate of return of 5%, the new tax rules would permit $1 million in new corporate investments to be exempt from the new punitive tax regime.

Threshold of annual passive income

%

Assuming nominal rate of return

Threshold for New Corporate Investments

If you surpass this $1 million threshold, you risk having more than $50,000 in annual passive income inside your corporation and will be subject to higher tax rates.

What these rates will be have yet to be announced but will be next year.

And remember, existing corporate investments will be grandfathered.

What are Tax Planning Strategies as Alternatives?

This all depends what your annual surplus cash flow is. Nonetheless, there are tax planning strategies for everyone.

The first step would be to fund new corporate investments, up to but no more than this new $1 Million threshold. This gives flexibility for pharmacy owners should you have a poor year and need to liquidate some investments to make up for any shortfall.

There are also ways to invest tax-sheltered inside your corporation, much like an RRSP.

An Individual Pension Plan (IPP) is one way to do this, where deposits are made by your corporation to your own pension plan and grow on a tax-sheltered basis. You can save up to 65% more inside an IPP vs a personal RRSP.

See related: How to Save $1 million in 10 years using an Individual Pension Plan

Another way to invest on a tax-sheltered basis inside your corporation is by using life insurance.

Permanent insurance products, such as Whole Life or Universal Life insurance have an investment component to the insurance policy. Investments inside the policy grow tax sheltered and can provide an income stream for you at retirement and a tax-free benefit to your family at death.

All deposits made to the policy are done via your corporation, which can save you thousands of tax compared to paying for these policies personally.

See related: How to Save $1.6 million More Using Life Insurance vs Investing Inside Your Corporation

Additional Benefits of Investing Using Your Corporation

There are several additional “soft” benefits of investing inside your pharmacy corporation, including:

Control Dividend Payments

You can control the timing and amount of investment income you receive from a corporation compared to income from personal ownership of investments.

As a shareholder, you will only pay personal tax when the corporation pays taxable dividends to you. By choosing when you receive dividends, you can control your personal income tax liability, tax installment requirements, and government clawbacks on income tested benefits, such as Old Age Security or the Guaranteed Income Supplement.

In some cases, you may even reduce your personal tax liability to $0 tax if you choose to have the corporation pay dividends to you in years when you have no other sources of income.

Reduce Probate Fees

If you live in a province with high probate fees, most notably British Columbia and Ontario, holding investment assets in your pharmacy corporation may reduce or eliminate probate or estate administration fees on those assets.

Whereas if you hold investments personally, probate fees will be levied based on the value of the investment assets, before they are distributed to heirs. The ability to avoid fees generally arises because shares in a private company can be passed to beneficiaries by way of a secondary will that may not require probate.

See related: How to Save $30,000 in Probate Fees

Cover Shortfalls in Poor Years

Some years are better than others and for some pharmacy owners, disaster may strike where profits aren’t enough to cover your annual compensation or other costs.

By keeping surplus cash flow from prior years inside your corporation, you can use this as a cushion for years of poor performance.

Conclusion

The Government has announced tax changes that will affect how you invest inside your pharmacy corporation.

While the date has not yet been announced, there will now be a limit of $50,000 of annual passive investment income inside your corporation.

If you surpass this amount, you will be subject to higher tax rates.

There are three valid tax planning strategies to deal with this tax change:

- Deposit up to $1 million of new corporate investments; then,

- Maximize your Individual Pension Plan (IPP), where you can save 65% more than an RRSP

- Maximize your Insurance Retirement Program (IRP), where can create a more tax-efficient income stream compared to passive investments inside your corporation

These are all valid tax planning strategies and should be planned in advanced, not last minute when it’s time to file your tax returns, like what happens to most Canadians.

If you’re accountant is not providing proactive tax planning strategies, then maybe it’s time to seek a second opinion.

Are you investing inside of your pharmacy corporation?

Ricardo Ardiles

CIM | Partner

Ricardo is a founding partner of Pharma Tax and focuses on providing tax planning strategies to health care professionals. His goal is to provide simplicity and convenience to clients by coordinating all areas of personal wealth management so that his clients don’t have to. This means working with external professionals on: investments, insurance, business planning, retirement planning, and estate planning.

- 2021 Budget Breakdown for Pharmacy Owners - April 29, 2021

- How This Pharmacy Owner Is Now Saving $22,209 In Taxes & Interest This Year - April 9, 2021

- Does Your Pharmacy Qualify For the Canada Rent Subsidy? - November 22, 2020

I like the helpful info you provide in your articles. I will bookmark your site and check again here often. I’m quite sure I’ll learn many new stuff right here! Good luck for the next!

Good job on this article! I really like how you presented your facts and how you made it interesting and easy to understand. Thank you.

I am definitely bookmarking this website and sharing it with my acquaintances. You will be getting plenty of visitors to your website from me!

I must admit that your post is really interesting. I have spent a lot of my spare time reading your content. Thank you a lot!