Did you know that at death, most people pay a tax called probate fee?

No one wants to think about death but you want to leave everything you own to your family, don’t you?

With proper tax planning, you can make sure that your family gets every dollar possible.

In this article, we are going to discuss probate in Ontario and 6 tips on how to reduce probate fees, including what you need to action TODAY.

Probate differs in each province, so if you are reading this outside of Ontario, please seek professional advice.

What is probate?

Probate is a process that confirms that your Primary Will is valid and is your last true testament. Here is the process your executor will follow upon your death:

- Apply to Ontario courts by completing these application forms

- Calculate the value of your Estate (explained below)

- Pay a probate fee based on the value of your Estate (explained below)

- If approved, the courts issue a “Certificate of Appointment of Estate Trustee With a Will” confirming that your executor has the authority to start distributing your assets

What if you die without a Primary Will?

This is called intestacy and your family will have to follow this application process.

The courts will then appoint an executor by determining who has the right to distribute your Estate.

How much are probate fees?

Probate fees are based on the value of your Estate.

In Ontario, 0.5% is charged on the first $50,000, then 1.5% of the remaining value.

Your Estate includes everything that you own that:

- Does not have a named beneficiary; and

- Do not own jointly with rights of survivorship

For Pharmacists, your Estate could potentially look like this (but not limited to):

- Bank accounts

- Jewelry, Art, etc.

- Automobiles, Motorcycles, etc.

- Non-registered investment accounts

- Pharmacy business that you own

- Real estate (home, cottage, investment properties, etc.)

- Registered accounts (RRSP, RRIF, TFSA, etc.) with “Estate” listed as beneficiary

- Life insurance proceeds with “Estate” listed as beneficiary

Less:

- Pharmacy under a Secondary Will

- Mortgage balance(s) on real estate

- Registered accounts (RRSP, RRIF, TFSA, etc.) with named beneficiary

- Life insurance proceeds with named beneficiary

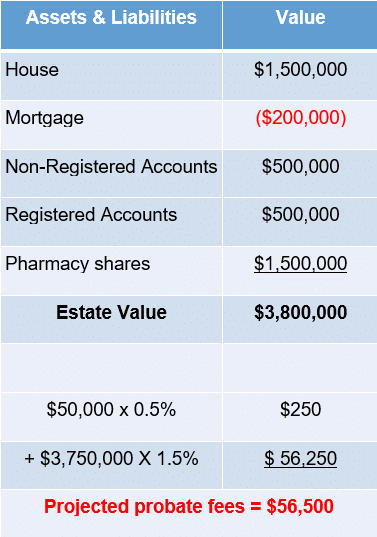

Example of Pharmacist

Pharmacist, “David,” was 50 years old and lived in Toronto when he died in March of this year from a sudden heart attack.

He was divorced and left behind one daughter, Sophia, who is 19 years old and lives with her mother.

When we first met David 4 years ago, his situation was as follows:

- Primary Will with his ex-wife listed as executor

- Home with a mortgage balance outstanding

- A non-registered investment account in his name only

- Registered accounts (RRSP & TFSA) with no beneficiary designated

- His Pharmacy that is incorporated and is the sole shareholder

- No Secondary Will for the Pharmacy corporation

This is what his Estate value looked like:

6 Tips on How to Reduce Probate Fees

If you follow these steps, assets will fall outside of your Estate value, meaning your family will pay less in probate fees.

The goal here is to distribute as much of your Estate as possible to your family.

1. Designate Beneficiaries

By designating a named beneficiary (spouse, children, charities – anything other than “Estate”) on registered accounts (RRSP, TFSA, Pension, etc.) and insurance policies, these assets go directly to the named beneficiary and are not included in your Estate.

This is something Pharmacists of any age should act on IMMEDIATELY.

2. Joint ownership

Hold assets jointly with rights of survivorship; if you die, these assets will go directly to the surviving joint owner and fall outside of your Estate.

In most situations, spouses should hold Non-Registered accounts jointly.

3. Gift assets before death

You can give away as many assets as possible to family before death, which reduces that value of your Estate.

There are many ways this can be done with careful tax planning, see tip #5 as an example.

4. Establish multiple Wills

If you are incorporated, get a Secondary Will. This way, your Pharmacy corporation falls outside of your Estate and is administered according to the Secondary Will.

5. Establish trusts

If assets are held in a trust, they fall outside of your Estate and are dealt with through the trust agreement established. These types of trusts are called inter-vivos trusts because they are created while you are still alive.

Do not confuse these trusts with testamentary trusts as those are created upon death via instructions in your Primary and Secondary Wills.

6. Convert unsecured lines of credit into secured

Lines of credit where no assets are pledged as collateral cannot be used to reduce the value of your estate.

It is very easy to get a home equity line of credit, which uses your home as collateral – not only will it help reduce reduce the value of your Estate but the interest rate is lower compared to unsecured lines of credits.

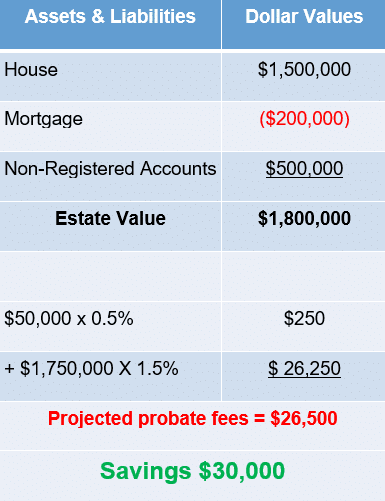

How David Saved $30,000 in Probate Fees

By implementing as many of the above tips as we could, David was able to save $30,000 in probate fees – money that went to his daughter instead of the tax man.

These were the changes made:

- Named Sophia as beneficiary of his Registered Accounts

- Established a Secondary Will for this Pharmacy corporation

- Updated the Primary Will to appoint David’s brother as Executor

Since David was still working, the use of an inter-vivos trust was not an option because David planned on using his money to fund his retirement.

However, a testamentary trust provision was inserted into David’s Primary Will and Secondary Will so that, at death, the proceeds of these assets be placed in a testamentary trust for Sophia and professionally managed.

This ensured David’s ex-wife cannot misappropriate the assets that are intended to provide for Sophia.

Here is what his Estate value was after making these changes:

Conclusion

No one wants to think about death but everyone wants to leave as much as possible to their family. With proper planning, this can be achieved.

Do you have any questions about probate and ways to reduce probate fees?

Adam Tenaschuk

CIM, MBA | Partner

Adam is a founding partner of Pharma Tax and focuses on providing tax planning strategies to health care professionals. His goal is to provide simplicity and convenience to clients by coordinating all areas of personal wealth management so that his clients don’t have to. This means working with external professionals on: investments, insurance, business planning, retirement planning, and estate planning.

- How Do I Fund My New Pharmacy?Let Us Show You How! - January 18, 2018

- Are You Drowning In Accounting & Professional Advisory Fees? - November 28, 2017

- Your Advisor Vs. The New Robo Advisor – What’s Better? Is it for you? - November 13, 2017

Trackbacks/Pingbacks