Keeping Your Hard Earned Dollars In The Family

With the new tax changes being implemented by our Liberal Government, we need to explore new avenues to defer or even eliminate tax so we can retire comfortably and then pass along the rest tax free to our loved ones.

We are lucky that the insurance companies have lobbied hard and continue to lobby to save Canadians tax! Our country is made out of Banks, Insurance Companies and Resource Companies and it’s good to see that if they make money we can save tax.

Like many pharmacists, you’ve worked hard and saved for retirement. The hours spent helping your patients and growing your net worth for your family.

Those that are incorporated and owned your own pharmacy or franchise find that you’ve got far more set aside than you and your spouse require. Your thoughts now turn to maximizing your estate for your children and grandchildren.

It’s also possible that your estate could face significant tax burdens which may cause your family to sell valuable assets like the family cottage. Through implementing the Corporate Estate Bond strategy that follows, you can preserve and maximize these assets earmarked for future generations and provides funds for taxes at death.

If your corporation or holding company holds estate bound retained earnings, and you would like to prevent the erosion of asset value as a result of significant taxes, the Corporate Estate Bond strategy is worth considering.

How does the Corporate Estate Bond work?

Your corporation purchases a life insurance policy on your life, or on a joint basis with you and your spouse, and is the beneficiary of the policy.

The corporation deposits funds into the policy in excess of what is needed to pay the policy charges, creating cash value.

This cash value accumulates on a tax-deferred basis and is invested in various fixed income and equity investments, increasing the proceeds payable under the policy.

When you die, if you had a single life policy, your corporation receives the proceeds of the policy, tax free or on the second death if you have a Joint-Last-To-Die policy with your spouse.

The corporation also receives a credit to its capital dividend account (CDA account) for a portion of the proceeds. Dividends can then be paid—tax free—to your estate out of the capital dividend account.

This is an area the new government is trying to attack for non-insurance products such as: Mutual Funds, Stocks, Bonds, ETF’s and Cash held in the corporation.

How the Capital Dividend Account (CDA) works:

The CDA is a notional tax account that includes, among other things, a portion of life insurance proceeds (calculated through a specific formula).

When there is a credit balance in the corporation’s CDA, the corporation can declare that a taxable dividend be treated as a capital dividend. In turn, the capital dividend is received by the shareholder tax-free.

The Liberals have still yet to attack this area for permanent insurance policies and we feel that the insurance companies will lobby hard for this to stay as is.

Case Study of An Existing Pharmacist Client:

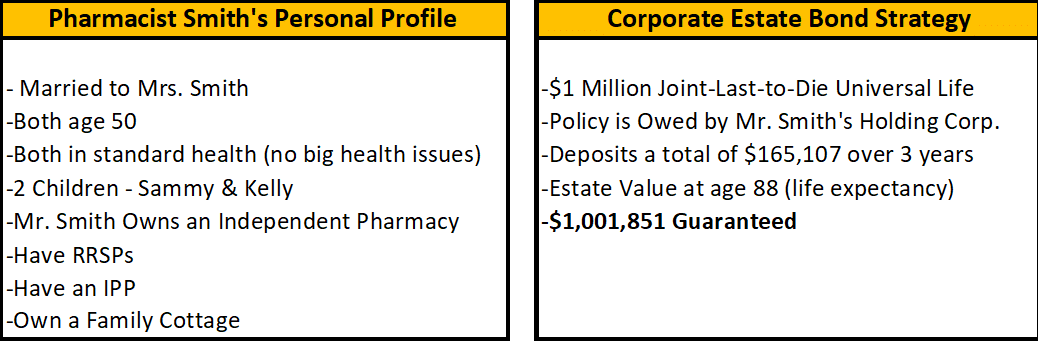

To illustrate a typical scenario that may be similar to yours, we will look at the case of Pharmacist Smith (name has been hidden for confidentiality purposes).

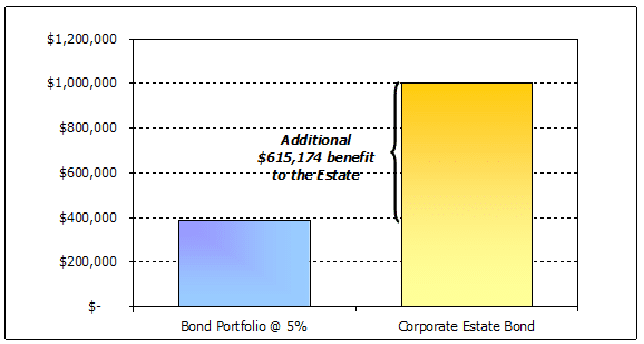

Let’s compare the Corporate Estate Bond $1,001,851 guarantee to the alternatives:

- Bond Portfolio returning 5% (hard to find) would be worth $386,677 at age 88, after-tax for same amount of deposits

- A pre-tax guaranteed rate of return equal to 9.2% would be required to achieve the same $1,001,851 provided by the Corporate Estate Bond strategy

- Provides a $615,174 difference after-tax to the estate

Mr. Smith is married to Mrs. Smith who are both age 50 and in good health. They have two children, and would like to maximize the estate value that they leave to them.

Mr. Smith has been very successful with his pharmacy over the years and has allowed him and Mrs. Smith to purchase a family cottage as well as maximize their RRSP’s/IPP (Individual Pension Plan).

Also, Mr. Smith’s corporation has been able to build up significant amount of retained earnings initially taxed at the low small business corporate rates.

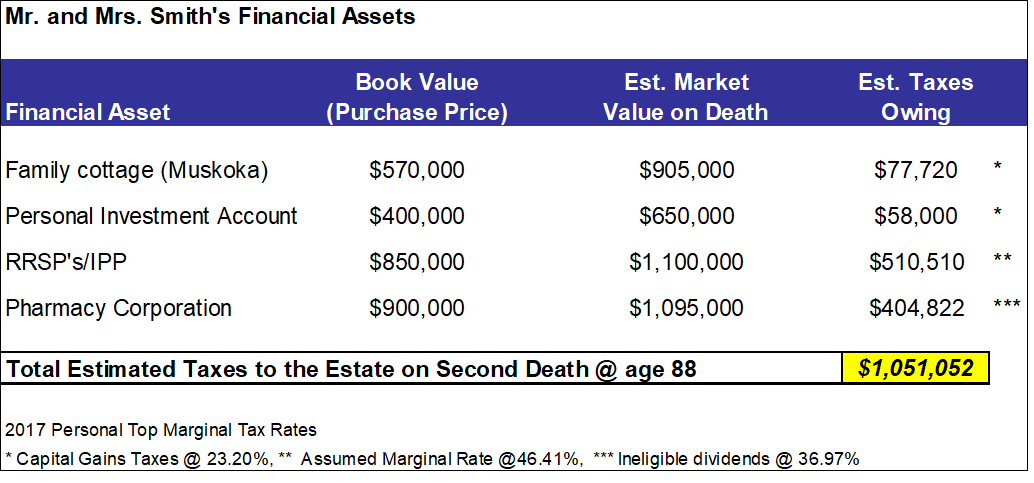

The couple is concerned how much tax will have to be paid on their passing and about keeping the cottage in the family for their children and future grandchildren.

However, they know that with the growth in the value of the cottage, RRSP’s/IPP, and retained earnings in the corporation, assets may need to be liquidated to cover the tax bill upon their deaths.

Estimated Big Picture:

Through the Corporate Estate Bond Strategy, Mr. Smith’s Corporation purchases a Joint-Last-To Die Universal Life policy and accumulates cash value by depositing funds into the policy above and beyond what is needed to cover the life insurance cost.

These excess funds grow tax-free within the Universal Life policy, and can help create some impressive guaranteed Estate Values that rival saving money the traditional way (an investment portfolio).

Upon the last passing, the proceeds from the Universal Life policy are paid into the corporation, and in turn, paid out to the shareholders (their children) by way of a Capital Dividend.

Mr. Smith’s children can now use these funds to defray the taxes on their inheritance of the cottage and RRSP’s, keeping what’s important, in the family.

Key Main Benefits to you:

- Tax exempt growth

- Funded with partially taxed retained earnings

- Guaranteed minimum rates of return

- Access to the cash value of your policy at any time

- Hedge against inflation and deflation

- Maximizes your estate and provides a tax-free lump sum of capital out your Corporation to your beneficiaries.

Main Risks:

- The insurance carrier goes bankrupt and no other carrier steps in.

- Ontario raises the 2% premium tax.

- MTAR is retroactively redefined by CRA.

Summary:

The Corporate Estate Bond provides many advantages to pharmacists as it is a viable alternative to traditional taxable investments.

It can protect your family against a liquidity event such as a family cottage and maximize the estate.

- How Do I Fund My New Pharmacy?Let Us Show You How! - January 18, 2018

- Are You Drowning In Accounting & Professional Advisory Fees? - November 28, 2017

- Your Advisor Vs. The New Robo Advisor – What’s Better? Is it for you? - November 13, 2017

Hi there. Thanks a lot! Great article.