Do you know what disability coverage you currently have?

Many staff pharmacists are covered under a group disability plan but don’t have a clue about what exactly they’re covered for.

Or maybe you’re a pharmacy owner, in which most cases you’re responsible for setting up your own coverage.

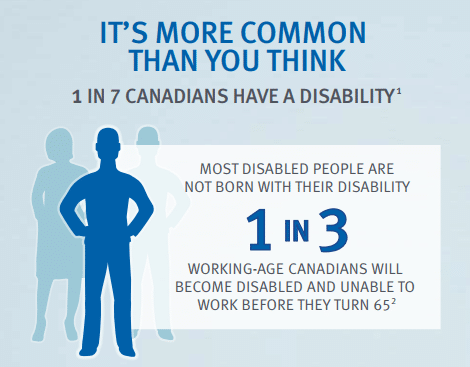

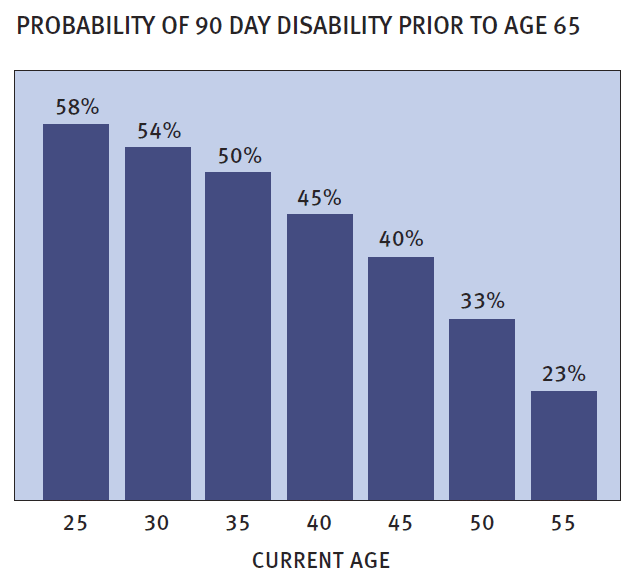

Did you know? Approximately 1 in 3 Canadians will become disabled and unable to work before they turn 65.

If you don’t have coverage at all, here are 3 reasons why every pharmacist should get coverage before it’s too late.

In this article, we explain how disability insurance works and, if you currently have coverage, how to know if you are properly covered.

Definition of Disability

There are two terms to define disability: total and partial.

Total Disability means that you are:

- Unable to perform the important duties of your occupation

- Not engaged in any other occupation; and

- Receiving appropriate physician’s care

Partial Disability means that you can work a bit but not everyday. You are:

- Not totally disabled

- Are not engaged in your occupation or any other occupation; and

- Unable to earn more than 80% of your earnings because of sickness/injury

- Receiving appropriate physician’s care

Your Occupation

How your disability policy defines “your occupation” is extremely important.

Your occupation doesn’t necessarily have to mean your specific job in order for benefits to be paid.

“Own occupation” is an option (called a rider in the insurance world) that may or may not be part of your coverage.

For pharmacists, “own occupation” means your job as a pharmacist; if you cannot work as a pharmacist, then disability payments will kick in.

However, if your disability coverage does not include this “own occupation” rider and the insurance company feels you are able to work in any another job where you can earn at least 60% of what you make as a pharmacist, then guess what? No benefits will be paid.

If you currently have coverage, double check to see if this “own occupation” rider is included.

If it’s not, it’s time to seek a 2nd opinion.

Amount of Coverage

Typically, the monthly benefit amount is 60%-70% of your gross earnings.

But wait, why not 100%?

The percentages try to estimate take how much you receive after-tax on your paycheque.

You will always receive a little less because if you were to receive your full pay while on disability, no one would be motivated to get back to work!

So if you already have coverage, check to see what your benefit amount is.

For example, if the benefit amount in your policy pays 60% of gross earnings, this is how much you can expect to receive.

(Your Gross Annual Income / 12 months) * 0.60 = your monthly benefit amount.

Compare this number to what you get paid every month and if the number is significantly less, it’s time to top up your coverage.

Many group disability plans cap the benefit amount you can receive, so if you have a group plan, check to see if there are any limits to the monthly benefit amount.

For example, group disability coverage with the OPA sets a limit of $8,000 per month.

If you’re a staff pharmacist under this plan, this limit is more than enough and you don’t need to worry.

But for pharmacy owners who earn more than $230,000 a year, you are under-insured and need to top-up your coverage with an individual plan.

Benefit Period

This is how long you are entitled to receive disability benefits. This can range from 2 years, 5 years, or to age 65, depending on your policy.

If you currently have coverage, check how long you are covered for.

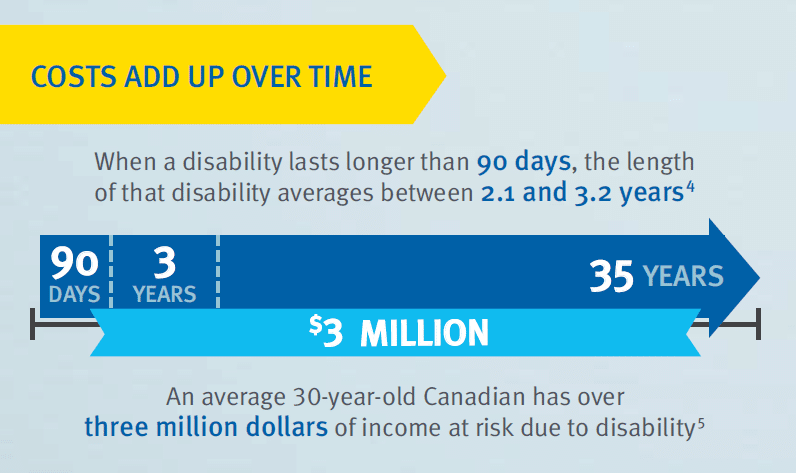

With 1 in 3 people in Canada suffering a disability longer than 90 days before age 65, the average length of that disability lasts between 2.1 and 3.2 years.

So if your coverage is only for 2 years, what will you do for income after benefits stop?

Many individual plans, as well the OPA Disability plan, pays benefits until age 65.

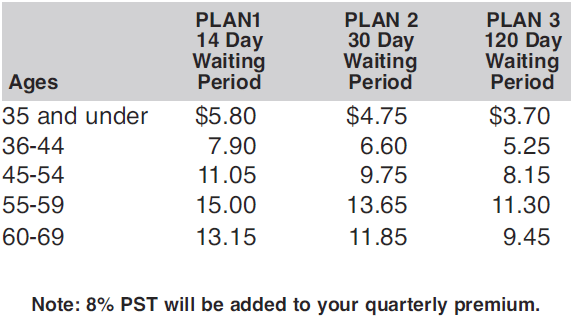

Elimination Period

Also called “waiting period,” this is the time period you have to wait before receiving payments.

This is set to so that people do not take advantage of the system and fake disability to get immediate payment.

Elimination periods are typically: 30, 60, 90, 120, 180, 365, and 730 days

With group plans, this is already selected for you and there is nothing you can do about it.

With an individual plan, the longer the elimination period you select, the cheaper your premium will be.

It’s a good idea to have an emergency fund of 3 to 6 months of expenses just in case to cover the time period between when you stop working and when disability payments start.

Occupational Class

Insurance companies group people into risk classes, depending on what type of job you do.

The riskier the job, the lower occupational class you are; which means higher probability of disability, so higher premiums. And vice-versa.

Pharmacists typically fall under one of two occupational classes: 4A and 4S.

4S is the highest class anyone can get and 4A is the second highest, meaning that pharmacists pay the cheapest rates for disability coverage of any job out there.

If you are part of a group plan, the insurance company has already been chosen by your association/employer and you have no control over what classification you are given.

But typically, if you have been working as a pharmacist for 3+ years and are making $100,000 or more, you can qualify for 4S occupational class. If not, then you are likely considered 4A and will pay a little bit more than your 4S peers.

If you don’t have coverage, it’s best to have your insurance advisor shop around for you to get you the best rate.

Premiums

Pharmacists with group disability coverage or through the OPA disability plan, then your premiums are banded into age intervals.

This means that everyone, regardless of health, is charged the same premium. The OPA disability plan, however, gives a 5% discount for non-smoking status.

Definitely not the best deal in town.

Here is an example a group plan with banded premiums:

Problem is, many employers make group disability coverage mandatory, so there is nothing you can do about the extremely expensive premiums when you’re age 50 or older.

If you have the option to opt-out, definitely consider an individual plan that is much cheaper in the long run.

Same goes with the OPA disability plan. You will pay much cheaper rates over the long run with an individual plan compared to the OPA plan.

Considerations for Pharmacy Owners

For pharmacy owners, either you will get the OPA disability plan or an individual plan.

Here are three optional riders that are important to consider:

Future Income Option

This rider gives you the ability to increase your coverage as your compensation increases without having to prove your current health status.

This is an important rider to add on because

Cost of Living Benefit

This rider will increase your benefit amount by the level of inflation, so that you don’t lose purchasing power over the years.

However, if you purchase the future income option rider, you don’t need this COLA rider.

Save yourself the cost.

Return of Premium

This rider will refund approximately 50% of your premiums every 8 years if there are no disability claims made.

Student Discounts

Students who are in their last year of pharmacy school or have graduated within the last 12 months can get a discount of 25% for life!

And you don’t even have to be employed yet.

With an individual plan at select insurance companies, students and recent grads can get $3,000 monthly benefit disability coverage with no income verification.

Any riders that you include are eligible for the discount too.

So throw in a “own occupation” and “future income option” at 25% off for life. This guarantees you for additional coverage in the future at a discount.

Conclusion

If you don’t have disability coverage, don’t wait any longer. The younger and healthier you are, the cheaper your premium will be.

For those with coverage, either through a group plan or individual policy, have a look to see if you are adequately covered. There may be gaps that you did not know about.

And typically with group plans, you are given a thick book of insurance policy terms and definitions that no one ever reads anyway.

If you would like a second opinion about your current insurance policies, feel free to contact us or schedule a free consultation.

Adam Tenaschuk

CIM, MBA | Partner

- How Do I Fund My New Pharmacy?Let Us Show You How! - January 18, 2018

- Are You Drowning In Accounting & Professional Advisory Fees? - November 28, 2017

- Your Advisor Vs. The New Robo Advisor – What’s Better? Is it for you? - November 13, 2017