What is something that can be “here today, gone tomorrow” or “up today, down tomorrow?”

Hint: it is your most valuable asset to making a living. Without it, you wouldn’t be to enjoy all the things that make your lifestyle possible.

Yet, many of us take this for granted.

Have you guessed it yet?

It is your health. It’s not something you think about, but your health is essential in your career.

Without it, your ability to earn an income, run your pharmacy, and enjoy time with family can be severely jeopardized.

Don’t think this will happen to you?

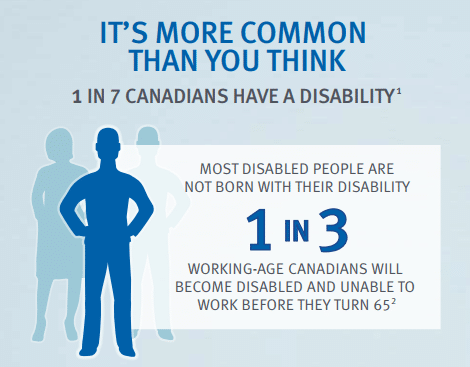

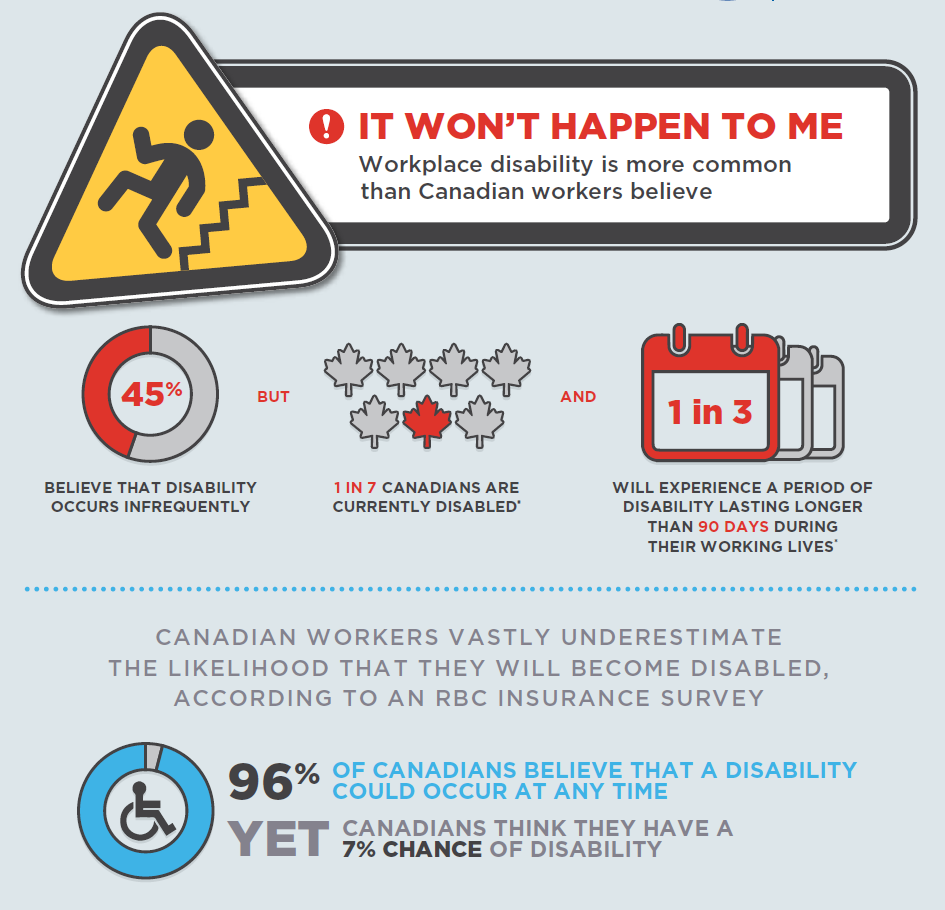

According to RBC Insurance, 1 in 3 Canadians will suffer from a disability of 90 days or more at some point during their working years.

Still not convinced that this might happen to you?

Here are 3 reasons why every pharmacist should have disability insurance.

1 in 7 Canadians are Currently Disabled

Many of us think we are superman and that disability will never happen to us.

It’s a lot more common than you think, have a look.

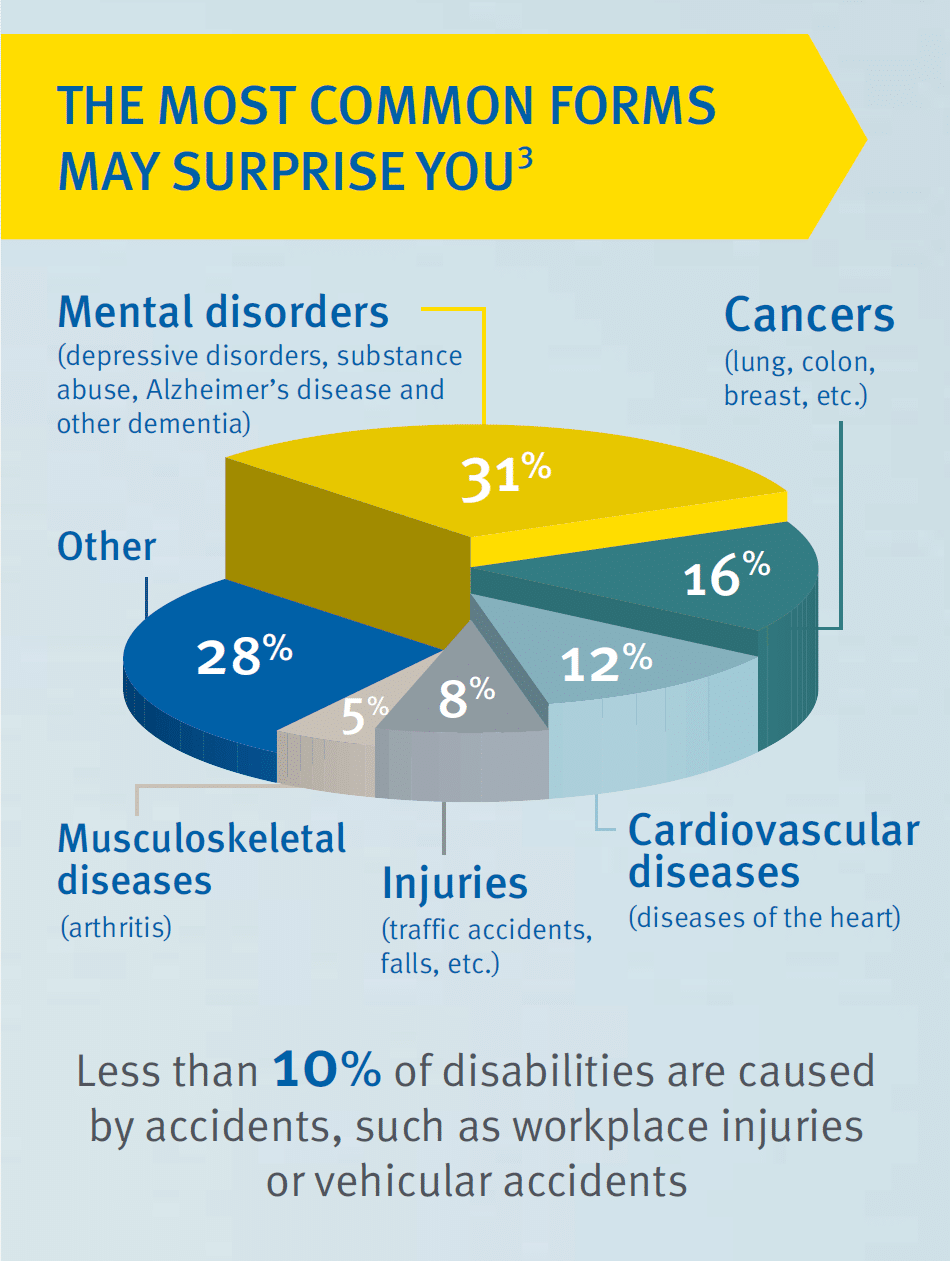

Most people think that disability is caused by a physical accident, such as workplace injuries or car accidents.

But less than 10% of disability cases are caused by accidents.

Mental illness, cancer, cardiovascular diseases, and musculoskeletal diseases cause more disabilities than accidents.

In fact, these are 6 times more likely to be the cause of disability than an accident.

Here are some common examples, according to Manulife Insurance:

- 1/2 million Canadians are unable to work due to mental health issues in any given week, such as workplace stress

- 80% of adults experience back pain at some point in their lives, enough not to be able to work

- 58% of Canadians with arthritis are under the age of 65, enough not to be able to work

Workplace disability is much more common than Canadians believe.

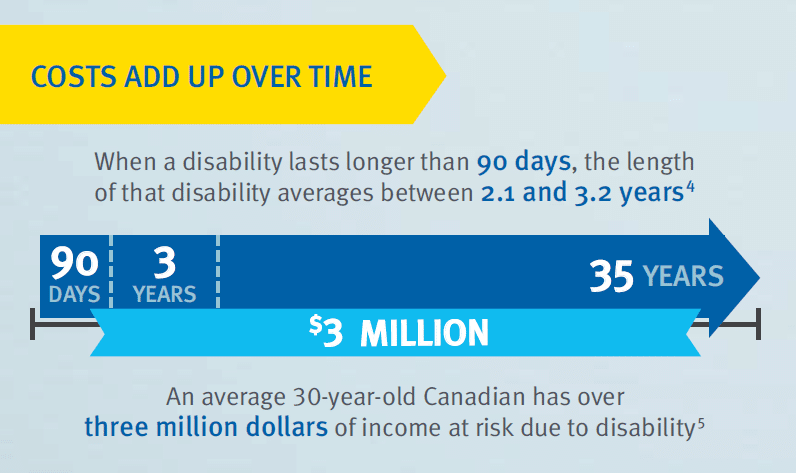

Costs Add Up Over Time

Consider how much money you could lose if you couldn’t earn an income because of a disability that lasted until you were age 65.

No one wants to lose their ability to earn income, this is a cost no one thinks about.

In addition to your regular costs of living, you must also cover medical expenses and other bills related to your disability.

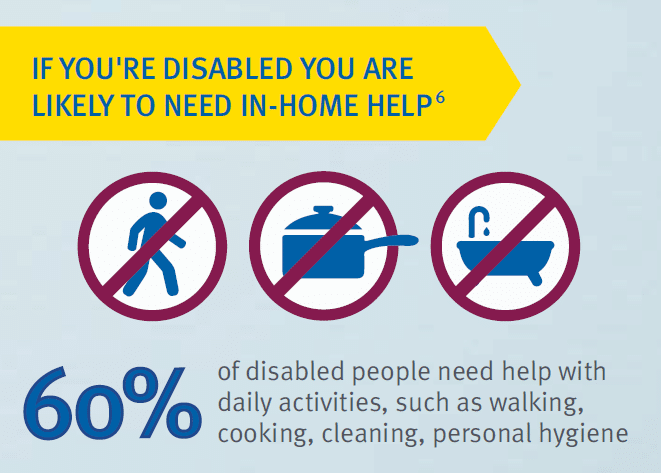

If your disability is such that you need help with daily activities, unfortunately you cannot rely on your spouse or family to take care of you everyday; at some point, they need to return to work as well.

It’s a dangerous situation. Especially when there’s less money coming in and more going out.

Canadians Are Not Financially or Emotionally Prepared

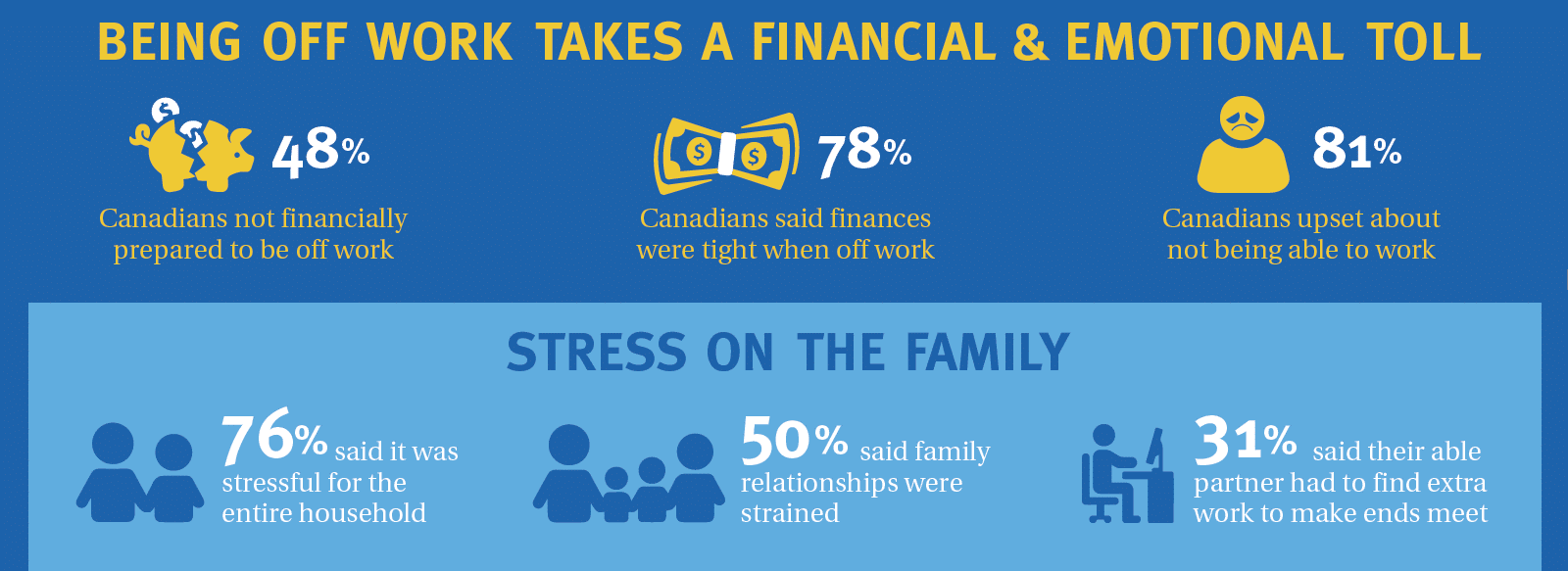

Being off work due to a disability can take a huge toll financially and emotionally.

Disability is often a scenario we don’t plan for, so many aren’t prepared when the time comes.

Are you prepared if such a situation arose?

76% of people surveyed by RBC insurance said that there would be serious financial implications for their family, such as going into debt or having their retirement plans impacted.

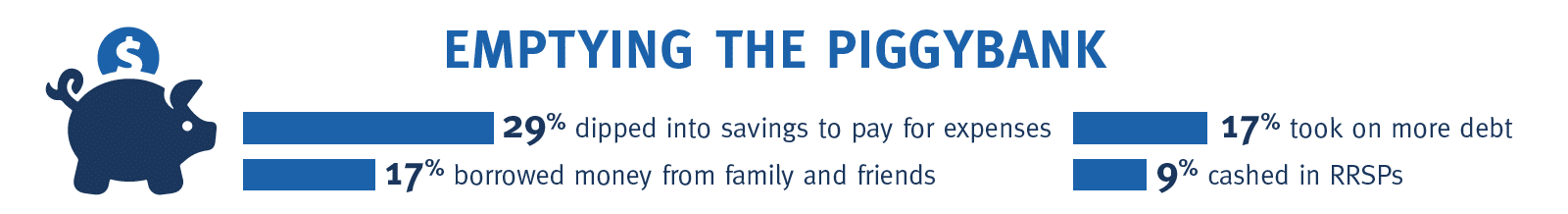

How do people manage to pay for the extra costs while on disability?

Yet, only 27% of Canadian workers have had a family discussion about how disability would financially impact them.

Coverage for Staff Pharmacists

Group disability plans are offered to many staff and hospital pharmacists.

Participation may or may not be mandatory, depending if you have coverage elsewhere.

If you are a member of the Ontario Pharmacists Association, they offer a group plan as well.

The reality is, many group plans have coverage limits, and many pharmacists discover once it’s too late that their coverage was not enough to replace all of their income.

In Part 2 of this series, we will describe what you need to know to ensure you have proper and sufficient coverage.

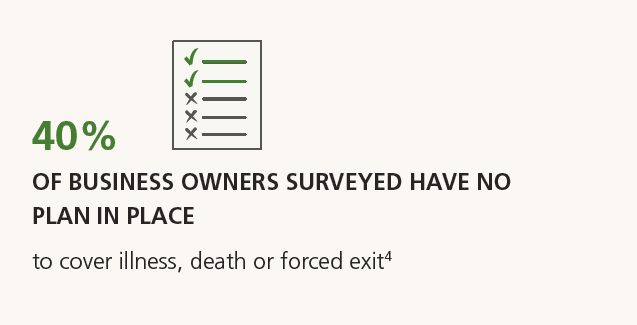

Coverage for Pharmacy Owners

If you’re a pharmacy owner, it is important to protect both yourself and your pharmacy. You risk losing your pharmacy without proper protection.

Yet, according to Manulife, 40% of business owners in Canada have no disability insurance plan in place.

Don’t wait until it’s too late to get proper coverage.

Conclusion

Most people recognize the need to home insurance, car insurance, and other types of property insurance. Things that can be replaced.

But many overlook the need for disability insurance, which provides a source of income should you become ill or injured and can’t work.

Your health cannot be replaced.

And with 51% of Canadians believing that they would find themselves in financial difficulty if their pay was delayed by even a week, the risk of financial and emotional stress is very real.

In Part 2 of this series, we will touch on what to look for when selecting disability coverage, including group plans for staff pharmacists and coverage for pharmacy owners.

Want to learn more? Subscribe to our newsletter or contact us for a free consultation.

Adam Tenaschuk

CIM, MBA | Partner

Adam is a founding partner of Pharma Tax and focuses on providing tax planning strategies to health care professionals. His goal is to provide simplicity and convenience to clients by coordinating all areas of personal wealth management so that his clients don’t have to. This means working with external professionals on: investments, insurance, business planning, retirement planning, and estate planning.

- How Do I Fund My New Pharmacy?Let Us Show You How! - January 18, 2018

- Are You Drowning In Accounting & Professional Advisory Fees? - November 28, 2017

- Your Advisor Vs. The New Robo Advisor – What’s Better? Is it for you? - November 13, 2017

Trackbacks/Pingbacks